$110.7 billion in salaries, $46 billion in taxes, and $182.2 billion in procurement—Elon Musk creates the "American Dream"

Elon Musk's business empire contributes significantly to employment and tax revenue in the United States.

The Contribution of Musk's Business Empire to U.S. Employment and Tax Revenue.

Written by: Larry Goldberg

Translated by: AididiaoJP, Foresight News

Few people realize that Elon Musk not only made himself wealthy, but is also a major force in job creation, tax payments, and economic stimulation. Over the past five years (2021-2025), through his companies including Tesla, SpaceX, xAI, The Boring Company, and Neuralink, Musk has injected hundreds of billions of dollars into the pockets of Americans. This is not just an abstract Wall Street figure, but real money circulating in communities everywhere—from factory floors in Texas to engineering centers in California. Let’s break down the concrete data and see how Musk’s enterprises are energizing the U.S. economy.

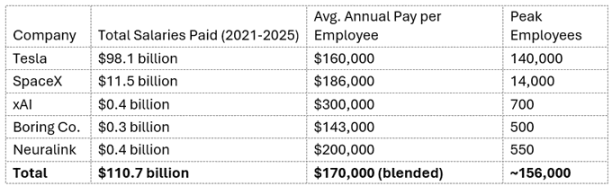

Employment and Income

In the past five years, Musk’s companies have paid a total of $110.7 billion in salaries, enough for every resident of Los Angeles to receive $27,000. These incomes support the lives of more than 200,000 employees, from welders building the electric Cybertruck to software engineers designing rockets for Mars. It’s not just senior management who benefit—Tesla’s average annual salary is about $160,000, enough for employees to settle down, send their children to school, and drive the prosperity of local industries such as catering.

These incomes continue to generate ripple effects: employees spend money on daily necessities, housing, vacations, and more. According to the economic multiplier effect, every $1 can generate $1.5 to $2 in economic value.

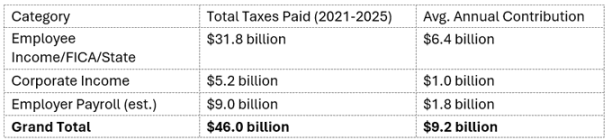

Tax Contributions

Musk’s business empire has made significant contributions in terms of taxes. Just the personal income tax and payroll tax paid by employees reached $31.8 billion, supporting education, infrastructure, and social security systems. This amount is equivalent to fully funding NASA’s budget twice. At the corporate level, despite enjoying tax incentives related to green technology and R&D, these companies still paid $5.2 billion in corporate income tax. Adding about $9 billion in employer payroll taxes, it is clear that Musk’s companies are fulfilling their tax obligations rather than evading them.

If every billionaire’s company contributed like this, public finances would be much more abundant.

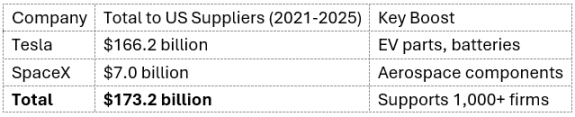

Supply Chain

Musk not only focuses on his own enterprises, but also spreads wealth across the U.S. through the supply chain. Tesla alone has purchased $166 billion worth of batteries, chips, and steel from U.S. suppliers, strongly supporting manufacturing in Michigan and Nevada. SpaceX, adhering to the “Made in America” principle, contributed $7 billion in procurement, mainly purchasing rocket-grade alloys and avionics from domestic suppliers. Adding xAI, the total procurement amount reaches $173 billion, benefiting thousands of small and medium-sized enterprises, not only creating a large number of indirect jobs but also strengthening the resilience of the U.S. supply chain against global risks.

In addition, xAI has invested about $9 billion in building data centers and plans to invest another $40 billion to $60 billion in the “Colossus 2” project over the next two years.

Overall Impact: A $338 Billion Economic Engine

In summary: $110.7 billion in salaries + $46 billion in taxes + $182.2 billion in supplier spending = $338 billion injected into the U.S. economy since 2021. With the expansion of projects such as fully autonomous Robotaxi, humanoid robot Optimus, and supercomputer Colossus, these expenditures are expected to grow significantly in the short term, potentially exceeding $300 billion annually. Considering the economic multiplier effect, this is equivalent to installing a “turbocharger” for U.S. GDP. Where does Musk’s influence lie? He creates high-paying jobs, funds public services, and rebuilds industrial strength—proving that bold innovation ultimately benefits ordinary Americans.

Although critics question the risks, the data does not lie: Musk’s companies are true economic boosters, turning science fiction into reality. As xAI and Neuralink develop, their impact will only expand. In an era of stagnant wage growth and industrial outflow, Elon Musk has proven that American innovation is still shaping the future—and funding it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | ZCash shielded pool assets reach 23% of total supply, network usage surges

The potential end of the U.S. government shutdown means the SEC and CFTC will resume crypto regulatory work. The SEC may prioritize support for tokenization businesses, while the CFTC plans to promote spot crypto trading. The Hello 402 contract has been exposed to risks of unlimited issuance and centralized manipulation. The probability of a Fed rate cut in December is 69.6%. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

The Federal Reserve pours cold water, December rate cut expectations plummet!

San Francisco Federal Reserve President Daly, who has consistently supported interest rate cuts, also sent a cautious signal on Thursday. Market expectations have quickly reversed, with short-term interest rate futures now showing only a 55% probability of a Fed rate cut in December...

Has sector rotation in the crypto market really failed?

With BTC maturing first, ETH lagging behind, and SOL still needing time, where are we in the cycle?

Prospects of Ethereum Protocol Technical Upgrade (1): The Merge

This article will interpret the first part of the roadmap (The Merge), explore what technical design improvements can still be made to PoS (Proof of Stake), and discuss ways to implement these improvements.