Breaking Down Circle's Q3 Financial Report: Net Profit Reaches $214 Million, While Stock Price Drops Over 70% from Its Peak

Overall, Circle's Q3 revenue and net profit both saw significant growth, with USDC's scale and trading volume reaching new highs. Arc and the payment network are advancing on dual fronts, but short-term stock price pressure reflects the market's sensitivity to costs, unlocking events, and competition.

Author: Zhou, ChainCatcher

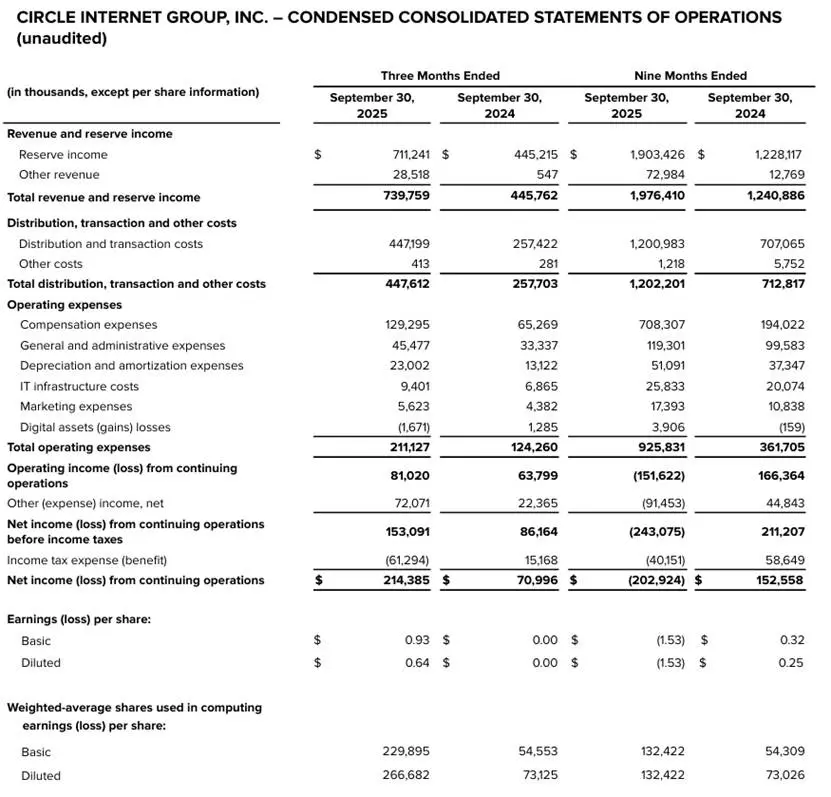

Circle released its Q3 2025 financial report on November 12, reporting total revenue of $740 million, a year-on-year increase of 66%; net profit reached $214 million, up 202% year-on-year.

Previously, institutions had expected revenue of $700 million and EBITDA of $31 million, so the financial results significantly exceeded expectations. However, due to the company updating its full-year expense guidance and raising its 2025 operating expense forecast to between $495 million and $510 million, this change has triggered market concerns about its cost control and future profitability, resulting in CRCL shares closing down about 12.21% on the day at $86.3, with a total market capitalization of about $20 billion.

Since completing its IPO at a price of $31 in June 2025, Circle's stock price has experienced significant volatility, dropping from a high of $298.99 to the current $86.3, with its total market value shrinking by more than 70%.

In addition, according to regulatory filings, the lock-up period for company executives and internal shareholders may end as early as this Friday. Typically, the lock-up period after an IPO is 180 days and should have ended in early December. This means that a large number of shares held by insiders may soon enter the market, creating potential selling pressure.

Financial Report Breakdown: Reserve Income Up 60% YoY, Operating Expense Guidance Raised

Breaking down the financial report by business segment, Circle's main source of income is reserve earnings, i.e., returns from investing USDC reserve funds in short-term government bonds and other assets. Therefore, the growth of USDC circulation directly determines the revenue ceiling. By the end of Q3, the circulating USDC reached $73.7 billion, doubling year-on-year; reserve income reached $711 million, up 60% year-on-year and 12% quarter-on-quarter, mainly due to a 97% increase in the average balance of circulating USDC, though partially offset by a 96 basis point decline in reserve asset yields. Since short-term government bond yields are affected by interest rates, a continued rate cut in Q4 may weaken the elasticity of this interest income.

Nevertheless, Circle CFO Jeremy Fox-Geen refuted the view that falling interest rates are unfavorable for the company. He stated that lower rates bring stronger economic activity, more risk-taking, and increased investment, which in the short term is beneficial for the company's business.

The second part, other income, benefited from strong subscription and service revenue, pushing other income to $29 million, a more than tenfold year-on-year increase.

In addition, the company's new business initiatives may contribute to future performance growth. Among them:

- On October 28, Circle announced the launch of the Arc public testnet. Arc is a Layer-1 blockchain designed to help developers and enterprises leverage programmable financial infrastructure to bring more economic activity on-chain. The network has already attracted participation from over 100 companies, and Circle is also exploring the possibility of issuing a native token on the Arc Network.

- Circle Payment Network (CPN) enables cross-border payments via USDC/EURC, with 29 financial institutions already joining CPN, another 55 undergoing qualification review, and 500 more in preparation. Since its launch at the end of May this year, CPN's business activity has grown rapidly, and as of November 7, 2025, the annualized transaction volume based on the past 30 days of activity has reached $3.4 billion.

- Circle's tokenized money market fund USYC grew by more than 200% from June 30, 2025 to November 8, 2025, reaching about $1 billion.

These new business developments have injected momentum into Circle's revenue diversification, but also come with higher operating costs. The company has raised its full-year adjusted operating expense guidance to a range of $495 million to $510 million, increasing investment in platform development, capability building, and global partnerships.

On the cost side, the company's Q3 distribution and transaction costs reached $448 million, up 74% year-on-year and 10% quarter-on-quarter, mainly due to the increase in USDC circulating balance and the rise in average USDC holdings on the Coinbase platform, driving up distribution payments, and including other expenses related to strategic partnerships.

Stablecoin Track Faces Multi-Front Competition, New Business Initiatives Seek Breakthrough

In terms of competitive landscape, the total market capitalization of stablecoins has now surpassed $310 billion, with Tether occupying nearly 60% market share and a circulation of about $184 billion, holding a dominant position; Coinbase secures Circle's revenue through a 50% profit-sharing agreement and has expanded its derivatives business by acquiring Deribit; PayPal's PYUSD focuses on instant settlement scenarios, with merchant adoption up 300%.

In addition, the entry of traditional banks has become a major variable. JPMorgan has launched the JPMD token, Fiserv has issued FIUSD on Solana, and Mastercard has launched a stablecoin payment network. These players, leveraging low costs and established trust, are quickly capturing the enterprise market under the catalyst of the GENIUS Act.

It is worth noting that the company has long regarded compliance as a core competitive advantage, with 20% of employees engaged in compliance-related work. However, this compliance advantage now faces the risk of dilution. As global regulatory frameworks mature, compliance is shifting from a moat for a few players to an industry standard. With the implementation of regulations such as the EU's MiCA and the US GENIUS Act, traditional banks and payment giants are accelerating their entry, and licenses are no longer scarce.

Overall, Circle delivered a decent report card in Q3, with both revenue and net profit seeing substantial growth, USDC scale and transaction volume hitting new highs, and progress on both Arc and the payment network fronts. However, short-term stock price pressure reflects the market's sensitivity to costs, lock-up expirations, and competition. In addition, Circle must also face multiple risks from customer concentration, falling interest rates, and large institutions issuing their own stablecoins.

In the increasingly competitive stablecoin sector, the company's new business initiatives are not just a bonus, but a matter of survival. Otherwise, USDC will remain capped by high-yield deposit ceilings, with growth potential locked by the interest rate environment, and payment scenarios carved up by traditional banks and established players. From this perspective, Circle's transformation has entered deep waters.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

QNT jumps 12% as volume triples — Can Quant bulls defend THIS floor?

GRAM Ecosystem Joins EtherForge to Boost Web3 Gaming Across Chains

Everyone to get their own AI friend in five years, Microsoft executive says

Bitcoin’s Weekend Journey Sparks New Market Trends