Written by: Antonio Sco

Translated by: Luffy, Foresight News

Over the past two years, I have worked with more than 30 Pre-TGE projects and discovered three unexpected key reasons that have led most tokens to fail miserably during their TGE.

Those projects that raised millions of dollars keep making the same mistakes. I have summarized some patterns: failed projects never disclose their problems, only busy blaming others; successful projects also never share their secrets, wanting to take all the credit for themselves.

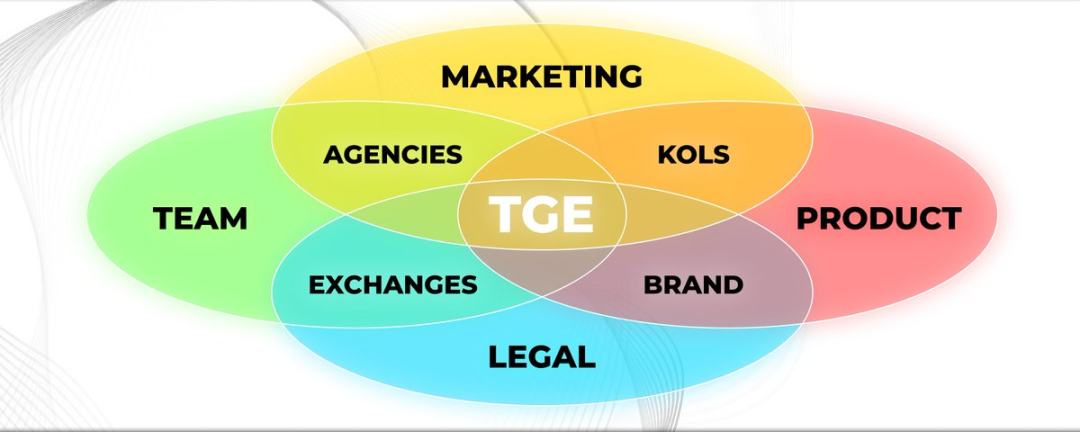

This leaves new founders confused, having no idea where to start. So, what are the core keys to a TGE? Without them, a TGE is doomed to fail, so founders must devote most of their time to these areas.

As the founder of a marketing company, I am reluctant to admit it, but the answer is not marketing. Marketing can amplify good fundamentals, but without a solid foundation, even the most glamorous marketing is just a castle in the air, easily toppled.

Here are three rarely mentioned core factors that can destroy a TGE project.

Market Makers

Choosing a market maker is essentially like playing Russian roulette:

-

Best case: both parties are aligned in incentives and share profits together;

-

Worst case: they scheme behind your back, causing years of your hard work to go to waste.

The problem of information asymmetry is terrifying—they only show you successful cases and never mention their failures.

So, how should you choose a market maker? 99.9% of the time, you should choose a market maker strongly recommended by a project party you trust or someone you have worked with directly.

Do not trust recommendations from strangers. They can get hefty referral fees from market makers and will recommend them vigorously even if they are unreliable.

An important reminder: if the project fails, you bear the consequences, not them.

Even if you have the best marketing, the most active community, and the top team, if the market maker crashes your token price by 50%, there’s nothing you can do to save it.

Tokenomics

The same goes for tokenomics. You and your team may not have studied 50 token models or seen their actual effects.

You absolutely cannot just copy the tokenomics of a successful project and assume it will work for you. Investors’ goals and appetites are always changing, so if you want to attract them to buy in, you must adjust accordingly.

Similarly, advisors will only show you their successful cases. You will never see the projects that went to zero.

One more thing: if your current tokenomics are destined to ruin your project, then change them decisively.

Don’t worry about:

-

Airdrop hunters getting angry;

-

People on social media complaining;

-

Seed round investors being dissatisfied.

If, according to the current token model, the token price crashes by 90% in a week, they’ll still be dissatisfied. The only difference is that you’ll go bankrupt within three months.

Obviously, the best solution is to avoid this situation from the very beginning, but as an old Roman proverb says: “Desperate times call for desperate measures.”

Exchange Listings

This is the point I want to emphasize the most. The problems with market makers and tokenomics only become apparent after the TGE, but working with exchanges is the most painful and dangerous thing before the TGE.

Why is it painful?

-

Communication is extremely difficult;

-

It’s hard to coordinate a unified schedule;

-

They often change their minds at the last minute, forcing you to postpone the TGE.

Why is it dangerous?

-

Predatory terms can drag your project down;

-

Many teams get scammed by fake representatives;

-

Spending millions of dollars on listings only to attract selling pressure and no buying interest.

The fastest way to solve this problem: know people inside the exchange and understand the baseline cost of listing to avoid being ripped off.

Due to information asymmetry, many teams waste hundreds of thousands of dollars in the initial negotiations.

Conclusion

Everyone is waiting for a better market environment to launch their TGE, but if you haven’t done these three things well, no matter how good the market is, your token won’t be able to gain a foothold. As a founder, you should focus your main energy on these three things, while supervising other team members to do their jobs well in their respective areas.