In this bull market, even those who stand still will be eliminated: only "capital rotation" can survive the entire cycle.

In the crypto market, most people are destined to lose money during a bull run—not because of bad luck, but because they don’t know how to move.

Still obsessed with airdrops, hoping for the next meme wave?

There’s only one way for people to truly survive this cycle: Rotation.

Capital is never stationary; it is always searching for the next narrative, the next hotspot, the next momentum.

Those who understand rotation go with the flow; those who don’t are crushed by the trend.

❶ Why do so many people lose money every cycle? Because they “don’t move”

Every cycle’s losers share one thing in common:

Asset allocation remains unchanged, always stubbornly sticking to the same sector.

But the reality is:

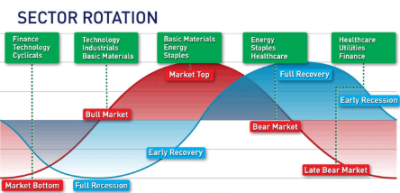

Capital moves through different stages

Sectors take turns performing

Stories keep shifting

From BTC → ETH → Alts → Meme,

From L1 → AI → GameFi → DeFi……

Only a rotation strategy can run through all stages from ignition to bubble to correction.

❷ What is “rotation”? Capital always follows momentum and narrative

The essence of rotation is moving funds to where momentum is strongest and sentiment is most concentrated.

Typical capital migration paths include:

BTC → ETH → Major Altcoins → Meme

Infrastructure → AI → GameFi → DeFi → New Narratives

Capital always follows the narrative, and your job is not to guess the future, but to read the direction of market sentiment.

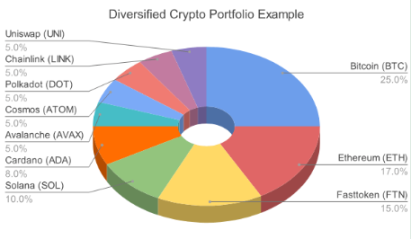

❸ The core structure of building a rotation portfolio: The three-layer model

A professional rotation portfolio consists of three layers:

1. Core Layer

BTC, ETH

Stable base position

Prevents systemic risk

Provides a “never dies” foundation for the portfolio

2. Growth Layer

Top altcoins with strong fundamentals

Capture medium-speed growth

Balance risk and reward

3. Speculative Layer

New narratives, trending sectors, meme

Small positions, high flexibility

Capture explosive gains when the market ignites

This three-layer structure allows you to:

Stay alive, ride the trend, and catch the breakout.

❹ The core of rotation is “triggered rebalancing”

Rebalancing is not done arbitrarily, but triggered based on conditions:

When an asset’s volatility exceeds X%

When an asset’s proportion deviates from the portfolio by Y%

This structure allows you to:

When a hotspot is overbought → automatically sell a portion

When an unpopular asset is excessively undervalued → automatically buy a bit

No need to guess the top or bottom,

With “structure,” you can achieve the counterintuitive but correct approach of buying low and selling high.

❺ Different market stages require different strategies

Within the rotation framework, strategies adjust with market rhythm:

When a sector is rising (trending period)

→ Use momentum strategies, go with the trend, don’t go against it.

When the market cools (sideways or correction period)

→ Use stable strategies: mean reversion, DCA, reduce high-risk positions.

This way you can:

Earn more in uptrends, lose less in downtrends.

❻ Use on-chain and derivatives indicators to improve rotation accuracy

Professional players never operate by gut feeling—they look at data:

Exchange netflow: inflow = preparing to sell; outflow = accumulation

Whale Transfers

Funding Rate: is sentiment overheated?

Open Interest

Combine with RSI and trading volume for confirmation,

You can spot reversals and sentiment turning points ahead of the market.

❼ The most effective model in uncertain markets: The Barbell Strategy

The so-called barbell strategy means putting funds at two extremes:

One end: Core assets (BTC, ETH)

Safe, risk-resistant

The other end: High-risk sectors (strong narratives or new hotspots)

High potential, high flexibility

When the market starts → move some from core to high risk

When the market overheats → move some from high risk back to core

Never go all-in on one side, and never go all-out.

❽ The key to successful rotation is not prediction, but disciplined execution

The most important rules include:

Write down your goals and maximum tolerable risk before entering

All operations follow the formula: Trigger → Signal → Position → Take Profit / Stop Loss

Record every rotation, review data not emotions

No execution, no rotation;

No discipline, no profit.

❾ What you should do right now

Build your three-layer structure: core, growth, speculative

Set rebalancing ranges (e.g., ±20%)

Monitor volatility and sector sentiment

Use on-chain dashboards to avoid emotional decisions

Use triggers to automate and systematize rotation

You don’t need to predict the market’s future, you just need to follow capital migration.

❿ The truth of this bull market: Capital likes to “move,” hates to “wait”

Every bull market weeds out those who don’t understand rotation.

This cycle, capital moves even faster, narratives are shorter, and hotspots are more intense.

Maintain structure, rotate smartly, take profits ruthlessly,

Only then can you survive between market frenzy and panic.

If you understand rotation, you stand with the market.

If you don’t, you stand against it.

Conclusion:

The core of the crypto market is not prediction, but adaptation.

You can’t control the market, but you can control how your assets flow at different stages.

Rotation strategies allow you to:

Catch trends during upswings

Preserve capital during corrections

Accumulate chips during sideways periods

Be in the right place when a new narrative starts

In this bull market, the biggest risk is not volatility, but stubborn inaction.

Maintain structure and discipline, and you can become one of the few who survive the cycle, rather than the majority who are eliminated.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Yala Faces Turmoil as Stability Falters Dramatically

In Brief Yala experienced a dramatic 52.9% decline, challenging its stability. Liquidity management emerged as a critical vulnerability in stablecoins. Investor skepticism deepened despite major fund support.

US Bitcoin ETFs Log $1.1B Weekly Outflows as BTC Slides Toward $95K

ECB Warns Rapid Stablecoin Growth Could Force Rethink of Eurozone Monetary Policy

Hong Kong Pilot Marks Breakthrough Moment for Regulated Fund Tokenization