"Whales" Accelerate Bitcoin Sell-Off, But Is It Really a Panic Signal?

Some "whale" wallets are showing regular selling patterns, which may be related to profit-taking rather than panic signals, but the market's ability to absorb these sales has weakened.

Original Title: "‘Whales’ Accelerate Bitcoin Sell-Off, But Is It Really a Panic Signal?"

Original Source: Golden Ten Data

Last week, bitcoin fell below the critical $100,000 mark, and the recent selling by "whales" (investors holding large amounts of cryptocurrency) and other long-term holders has become a significant driver of the recent price weakness.

Most blockchain analytics firms define "whales" as individuals or institutions holding 1,000 or more bitcoins. Although the identities of most "whales" remain unknown, tracking their cryptocurrency wallets through blockchain data can still provide clues about their activities.

Data shows that some "whales" have recently accelerated their pace of bitcoin selling. Some analysts say this phenomenon is worth watching but may not necessarily be a panic signal. They point out that the recent sell-off may reflect steady profit-taking rather than panic selling, a pattern consistent with previous bull market cycles.

Martin Leinweber, Head of Digital Asset Research and Strategy at MarketVector Indexes, said that such selling may reflect "planned asset allocation." "Some bitcoin investors bought in when the price was in single digits and have waited so long. Now there is finally enough liquidity to sell without completely disrupting the market," he told MarketWatch.

Although crypto bulls have recently complained about a lack of market liquidity, the ease of buying and selling bitcoin has improved significantly compared to a decade ago.

However, analysts at blockchain analytics firm CryptoQuant say what is concerning is that the recent whale sell-off coincides with deteriorating market sentiment and slowing buying, which could put further pressure on bitcoin prices. Dow Jones market data shows the largest cryptocurrency briefly approached $19,400 last Friday, the lowest level since May 6.

Comparison: Then and Now

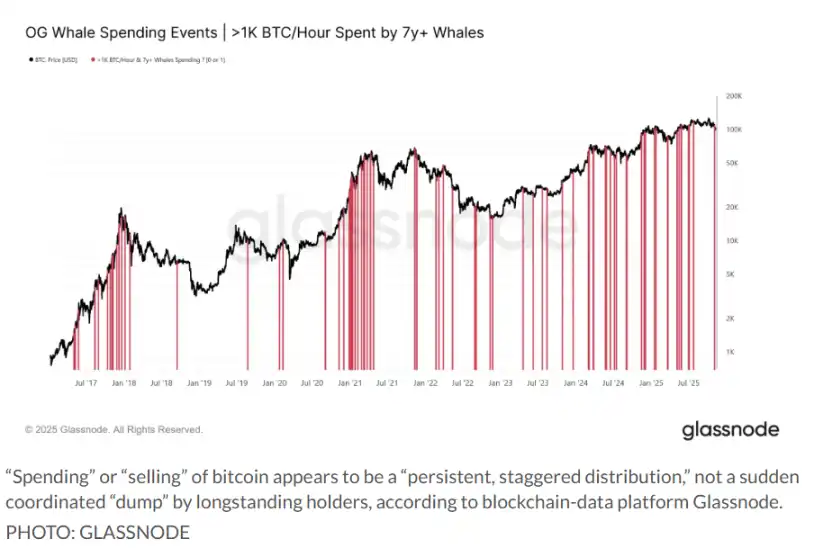

The selling of bitcoin by long-term and large holders is not unique to the current cycle. Analysts at blockchain data platform Glassnode wrote in a recent report that there are signs the recent sell-off is driven by profit-taking rather than panic.

Specifically, "whale" wallets that have held bitcoin for more than seven years and are selling more than 1,000 coins per hour have shown regular and steady selling behavior over a period of time (see chart below, data as of last Thursday, November 13).

The selling behavior of "whales" has shown regular and steady characteristics over a period of time

The Significance of the $100,000 Mark

Meanwhile, Cory Klippsten, CEO of bitcoin-focused financial services firm Swan Bitcoin and a long-term bitcoin investor, said that the large-scale selling by "whales" in recent months appears to be related to the $100,000 mark—a psychological threshold for profit-taking long regarded by many early adopters.

"Since I entered the space in 2017, many early holders I know have talked about the $100,000 figure," Klippsten told MarketWatch. "For some reason, people always say they’ll sell part of their holdings at this price level."

Glassnode data shows that since bitcoin broke through $100,000 for the first time in its history in December 2024, long-term holders have increased their selling activity.

Potential Warning Signals

However, CryptoQuant analysts wrote in a recent report that a changing factor is the market's ability to absorb the sell-off. When long-term holders sold bitcoin at the end of last year and the beginning of this year, other buyers stepped in to support the price, but this situation seems to have changed.

Fund flows into investment products can reflect weak demand—Dow Jones market data shows that as of last Thursday, bitcoin exchange-traded funds (ETFs) saw outflows of $311.3 million for the week, on track for a fifth consecutive week of outflows, the longest streak since the week ending March 14 (when there were also five consecutive weeks of outflows).

Over the past five weeks, bitcoin ETFs have seen a cumulative outflow of $2.6 billion, the largest five-week outflow since the week ending March 28 (when $3.3 billion flowed out).

Recent price action has also brought the $100,000 mark back into focus. At the time of writing, bitcoin is still trading below this level. Some technical analysts say that the market's failure to reclaim this key level could trigger more profit-taking.

To make matters worse, the overall macroeconomic environment is not favorable for risk assets. Joel Kruger, market strategist at LMAX Group, which operates forex and crypto exchanges, noted that this has led to some long positions being liquidated. "We believe the market had overly high expectations going into the fourth quarter, based on seasonal trend analysis—historically, this period has performed exceptionally well," Kruger wrote in a letter to MarketWatch.

Kruger pointed out that as investors lower their expectations for a Federal Reserve rate cut in December and weak labor market data raises economic concerns, overall risk assets, including bitcoin, are once again under pressure.

Saylor Still Accumulating

Nevertheless, one of the largest known bitcoin "whales" is still buying.

Michael Saylor, chairman of software company Strategy Inc. (now widely seen as a leveraged bitcoin investment vehicle), said on CNBC last Friday that the company has been "accelerating" its bitcoin purchases and will announce its buying activity on Monday morning.

As of last Friday, Strategy held more than 640,000 bitcoins, accounting for over 3% of the current 19.9 million circulating supply of the cryptocurrency. Strategy representatives did not immediately respond to requests for comment via email.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve officials send strong hawkish signals again, December rate cut in doubt

The crypto market has generally declined, with bitcoin and ethereum prices falling and altcoins experiencing significant drops. Hawkish signals from the Federal Reserve have affected market sentiment, and multiple project tokens are about to be unlocked. Early ethereum investors have made substantial profits, and expectations for a continued gold bull market persist. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being iteratively improved.

IOTA collaborates on the ADAPT project: Building the future of digital trade in Africa together

IOTA is collaborating with the World Economic Forum and the Tony Blair Institute for Global Change on the ADAPT project. ADAPT is a pan-African digital trade initiative led by the African Continental Free Trade Area. Through digital public infrastructure, ADAPT connects identity, data, and finance to enable trusted, efficient, and inclusive trade across Africa.