A $500,000 lesson: He made the right prediction but ended up in debt

The article discusses a trading incident on the prediction market Polymarket following the end of the U.S. government shutdown. Star trader YagsiTtocS lost $500,000 by ignoring market rules, while ordinary trader sargallot earned more than $100,000 by carefully reading the rules. The event highlights the importance of understanding market regulations. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

The hottest global topic last week was undoubtedly the "end of the US government shutdown." After all, global capital markets are watching the US, and when the government reopens, it signals potential policy changes.

On the largest prediction market, Polymarket, the market related to "when the government will reopen" saw a trading volume of over 100 millions USD, which shows the level of market attention. Interestingly, quite a few people predicted the outcome correctly but still lost money.

Let’s rewind to November 12. On this day, there was a stream of positive news: first, a White House press conference sent an optimistic signal, indicating that "there is a good chance the shutdown will end on Wednesday night (November 12)." Later that evening, President Trump officially signed the bill to end the shutdown, which was broadcast live on television.

This kind of ultimate certainty event, like other political events, immediately triggered a strong market reaction: on Polymarket, the price of the "shutdown ends on November 12" Yes shares soared, peaking at $0.97. In prediction market logic, this means the market consensus believed there was a 97% chance of the event happening. Since the maximum price is $1, or 100% probability, buying at $0.97 could only earn the last 3%, but this 3% was a guaranteed win with no risk, as the event was already confirmed.

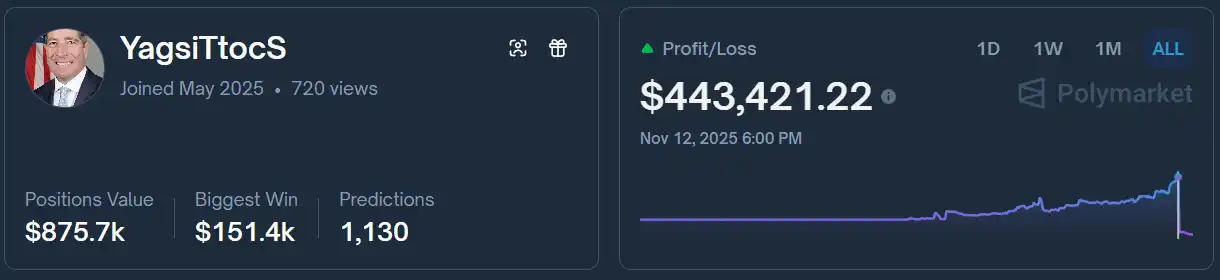

In this buying frenzy, the biggest spender was a trader named YagsiTtocS (formerly known as Halfapound). He is a star in Polymarket’s politics section, having participated in over 1,000 different markets from August to before November 12, with cumulative profits close to $400,000 and a steadily rising profit curve, almost never losing.

Looking at his previous trading logic, besides arbitrage, he is very skilled at quickly buying in large amounts when major, highly certain news events occur.

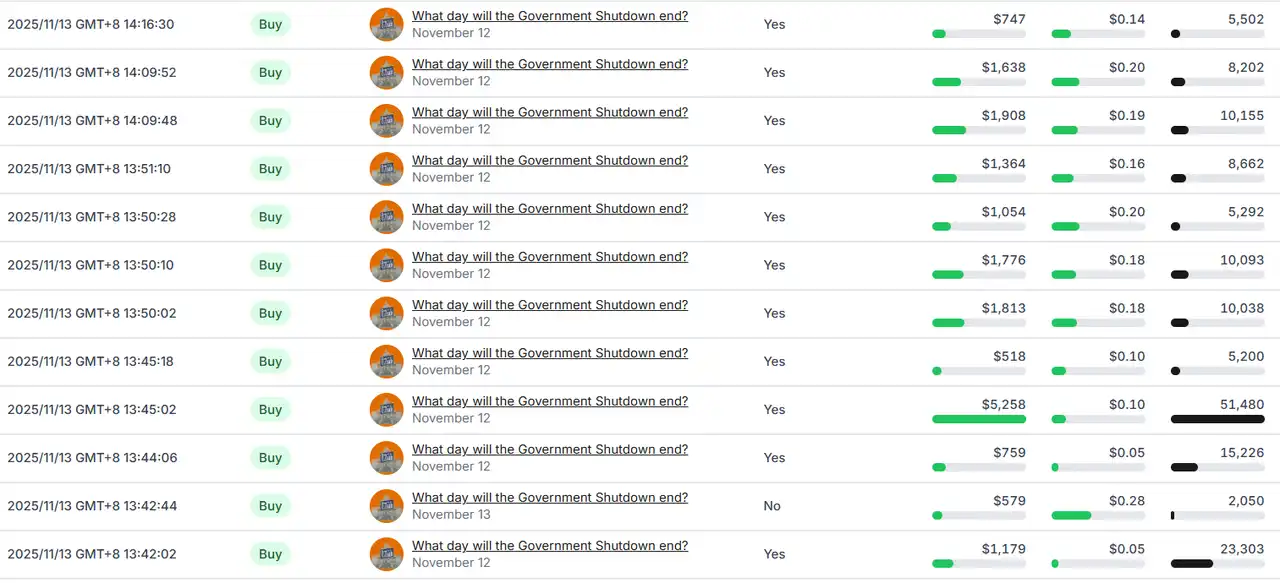

In YagsiTtocS’s view, the confirmation of the government reopening on the 12th perfectly fit his trading logic. So, at an average price of about $0.6, he invested over $500,000, heavily betting on Yes. After Trump signed the bill, the Yes price rose to $0.97. In his eyes, the bet was over, and all that was left was to wait for the system to automatically settle his profit. He even continued to buy at high prices at this point, believing this was no longer a risky subjective trade, but a "zero-risk, short-term high-yield investment."

Approaching Midnight: An Inexplicable Reversal

However, this is where the story takes a sharp turn.

After 10 p.m. (UTC+8) that night, after Trump signed the bill and all the news reported the shutdown was over, something strange happened in the market: the price of Yes began to fall instead of rise. This meant someone believed the market for the 12th would settle as No!

This left many people confused: the president had signed, the news had reported it, so why did some still think the shutdown would "not end" on the 12th?

The answer lies in the "market rules" that many traders tend to overlook.

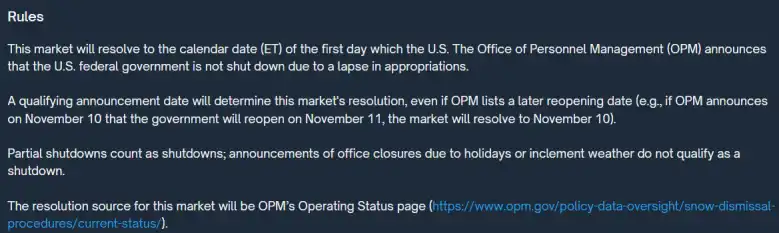

Each Polymarket market’s settlement does not rely on what we generally consider "facts," but on a single, pre-specified official information source. For the "when does the government shutdown end" market, the rules clearly state: the final arbiter is not the president’s signature, nor any news headline, but the US Office of Personnel Management (OPM) and the "government operating status" published on its official website.

The above image is from the Polymarket market execution rules: the date when the OPM website first announces "the federal government shutdown is over" (Eastern Time) is the standard. Specifically:

The date of the OPM announcement is used, not the actual return-to-work date (for example: if November 10 is announced as the return-to-work date for November 11, the market considers November 10 as the reopening date);

Partial shutdowns also count as shutdowns;

All status determinations are based on the OPM website’s operating status page (https://www.opm.gov/policy-data-oversight/snow-dismissal-procedures/current-status/)

In short: only when the OPM website says "the government is open" will the market have a settlement result; if it doesn’t say so, even if the president does, it’s invalid under Polymarket’s rules.

And due to delays in government processes, the OPM website did not update its status immediately after Trump signed the bill.

The Constraints of Rules and the Collapse of Emotion

At this point, no one was more anxious than YagsiTtocS. With only one hour left until midnight (UTC+8), his $500,000 was hanging by a thread on this rule.

When the date switched from the 12th to the 13th, the OPM website remained unchanged. At this point, the Yes price for the 12th on Polymarket had collapsed from $0.97 to below $0.05. But YagsiTtocS seemed unable to accept this reality: in the few hours after midnight on the 13th, he continued to buy the already doomed 12th Yes, at prices ranging from $0.05 to $0.3. This was no longer strategy, but "gambler-style" behavior driven by anger, unwillingness, and wishful thinking, trying to "average down" to fight against the cold rules, which only further increased his final losses.

After the final market settlement, YagsiTtocS lost over $500,000 in this market, making him the biggest loser in this round. This trade not only wiped out all his historical profits, but also pushed his total platform losses to over $150,000, dropping him from the top of the profit leaderboard to below one millionth place.

The Winner Who Understood the Rules

On the other side of this tragedy stood a trader named sargallot. Compared to the star aura of YagsiTtocS, he was previously unremarkable, with an average trade size of only about $200. As of before November 12, his total profit was less than $100. However, this seemingly ordinary trader became the biggest winner in this market by relying on a completely different trading method from YagsiTtocS, earning over $100,000.

The secret to sargallot’s success was simple: carefully reading the rules.

He realized that this market was not betting on "when the shutdown actually ends," but on "when the OPM website updates its status," and he anticipated the possibility of administrative delay. So, on the evening of the 12th, when everyone was celebrating the news and drove the price of No down to $0.07, he calmly bought in large quantities. When the OPM website failed to update after midnight on the 13th, at 00:02 (UTC+8), he sold out at $0.99, exchanging a tiny cost for an astonishing return.

One bet, two outcomes. The star trader lost everything despite "predicting correctly," while the unknown trader made a fortune by "understanding the rules." The $500,000 lesson may be the market’s most brutal and core takeaway.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SharpLink and Upexi: Each Has Its Own Advantages in DAT

Upexi and SharpLink have entered a field where the boundaries between corporate financing and cryptocurrency fund management are becoming increasingly blurred.

ETH falls into ‘buy zone,’ but volatility-averse traders take a wait-and-see approach

Bitcoin finally bounces, outpacing stocks ahead of Nvidia earnings: Will the BTC rally hold?

Bitcoin charts flag $75K bottom, but analysts predict 40% rally before 2025 ends