Key Notes

- Crypto options launched with 14 trading partners and crossed $1 billion in volume during Q3, while US spot trading began after NYDFS approval.

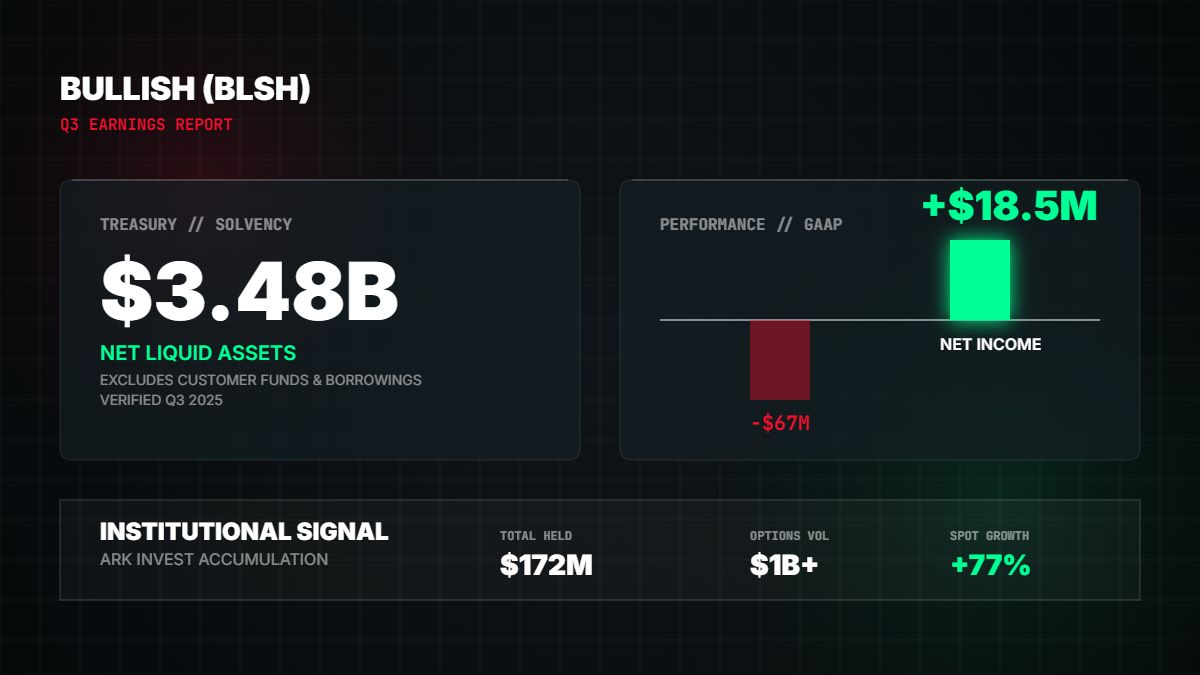

- Ark Invest has accumulated approximately $172 million in Bullish shares since the company's August public listing across multiple ETFs.

- The exchange ended Q3 with $3.48 billion in net liquid assets and projects Q4 subscription revenue between $47 million and $53 million.

Bullish reported net income of $18.5 million for the third quarter on Nov. 19, swinging to profitability from a loss in the prior year as the exchange expanded its product lines to include US spot trading and crypto options.

The company generated $76.5 million in adjusted revenue for the period ending Sept. 30. This compares to $44.6 million reported in Q3 2024, according to the earnings announcement .

Adjusted EBITDA rose to $28.6 million from $7.7 million in the prior-year period.

Our third quarter 2025 results are now available on the Bullish Investor Relations website.

Key highlights:

◾ Bullish posts record Adjusted Revenue, Adjusted EBITDA, and Adjusted Net Income for Q3’2025

◾ Bullish beats guided ranges on Subscription, Services, & Other (SS&O)… pic.twitter.com/st1y47Cu34— Bullish (@Bullish) November 19, 2025

Spot Trading and Options Volumes

Two major business lines launched during the quarter contributed to the results. Bullish debuted its crypto options offering with 14 trading partners. The new product surpassed $1 billion in volume within the quarter.

The company also commenced spot trading operations in the United States in September. This expansion followed regulatory approval from the New York State Department of Financial Services.

Spot trading volume in the current quarter (Q4) has risen 77% compared to the Q3 average.

Visualization of main data | Credit: Coinspeaker

Investor Sentiment

The earnings report follows a period of active accumulation by major investors. Ark Invest purchased nearly $10 million worth of Bullish shares across three exchange-traded funds shortly before the earnings release, according to the firm’s daily trade disclosures.

The asset manager has steadily increased its position in the exchange. Since Bullish’s public listing in August, Ark Invest has accumulated roughly $172 million in shares across its various funds.

Diversified Revenue Streams

Bullish reported growth in its non-transactional businesses. The Subscription, Services, and Other (SS&O) segment generated record revenue. New liquidity services partnerships drove this growth, more than doubling in Q3 compared to the second quarter.

The company issued guidance projecting SS&O revenue between $47 million and $53 million for the fourth quarter of 2025. Management expects adjusted operating expenses to range from $48 million to $50 million for the same period.

Bullish ended the quarter with $3.48 billion in net liquid assets. This figure excludes customer funds and borrowings.

next