Key Notes

- November marks the worst month for Bitcoin ETFs with cumulative outflows surpassing all previous monthly records since launch.

- Average spot Bitcoin ETF purchase price sits at $90,146, leaving many investors at breakeven or loss levels amid current prices.

- Despite massive withdrawals, IBIT maintains market leadership with $87.63 billion in assets under management as of Nov 19.

Investors pulled approximately $523 million from BlackRock ‘s iShares Bitcoin Trust (IBIT) on Nov. 18, marking the fund’s largest outflow since its debut in January 2024, according to data from Farside Investors.

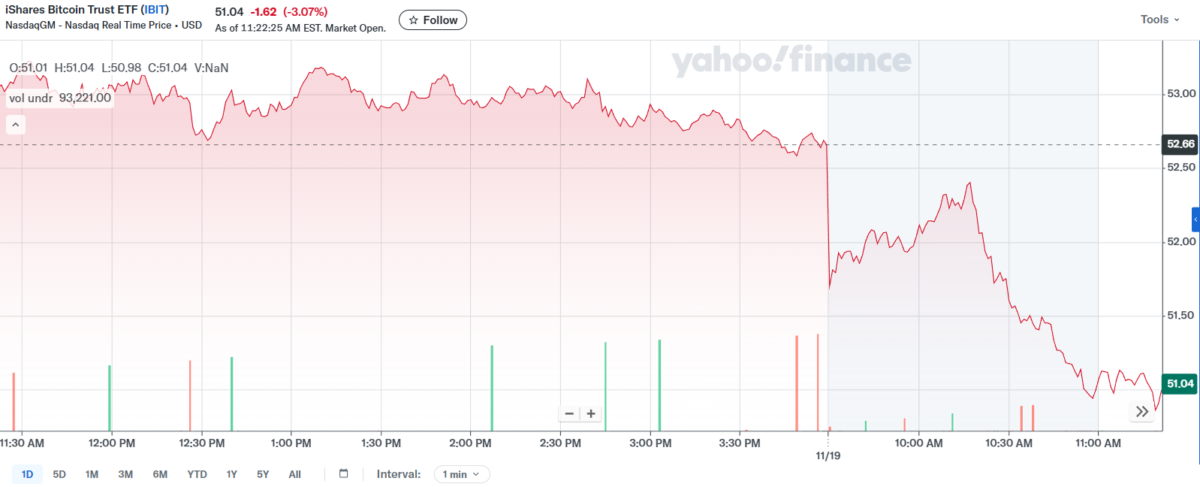

This significant withdrawal comes amid a broader decline in Bitcoin BTC $89 157 24h volatility: 4.4% Market cap: $1.78 T Vol. 24h: $74.42 B prices, which recently reached a seven-month low. The ETF price rose slightly at the beginning of Nov. 19, but at the time of publication, it was down by more than 3%.

IBIT price | Source: Yahoo! Finance

Five Straight Days of Net Redemptions on IBIT

The record outflow continued a trend of sustained withdrawals from Bitcoin ETFs, representing the fifth consecutive day of net redemptions. In total, the BlackRock Bitcoin ETF has shed $1.425 billion in capital over this period.

November is shaping up to be the worst month for Bitcoin ETFs , with cumulative outflows surpassing previous monthly records.

While BlackRock’s IBIT experienced record outflows, other Bitcoin ETFs, such as the Grayscale Bitcoin Mini Trust (BTC) and Franklin Templeton’s ETF (EZBC), recorded inflows of $139.6 million and $10.8 million, respectively, on Nov. 18.

According to Reuters , this divergence suggests that some investors may be shifting to alternative Bitcoin investment vehicles even as broad risk aversion persists.

Bitcoin Price Downside Pressures ETF Withdrawals

Bitcoin’s price decline to less than $90,000, down approximately 30% from its October high above $126,000, has coincided with increased selling pressure in ETFs.

On Nov. 19, the Bitcoin price is testing again levels below $90,000, with 24-hour trading volume 42% lower. At $89,620 per BTC, it represents another 4.30% dip in a day.

Bitcoin price | Source: TradingView

Analysts note that the average purchase price for spot Bitcoin ETF buyers is around $90,146, suggesting many investors are either breaking even or incurring losses at current levels, possibly prompting redemptions.

Despite this week’s heavy withdrawals , BlackRock’s iShares Bitcoin Trust remains the leading Bitcoin ETF by assets under management, with $87.63 billion as of Nov. 19. The fund had seen strong inflows in the months before this sell-off, accumulating nearly $25 billion from March through October 2025.

next