Key Notes

- ADIC increased its IBIT position from 2.4 million to 8 million shares between Q2 and Q3 2025, marking a strategic expansion into digital assets.

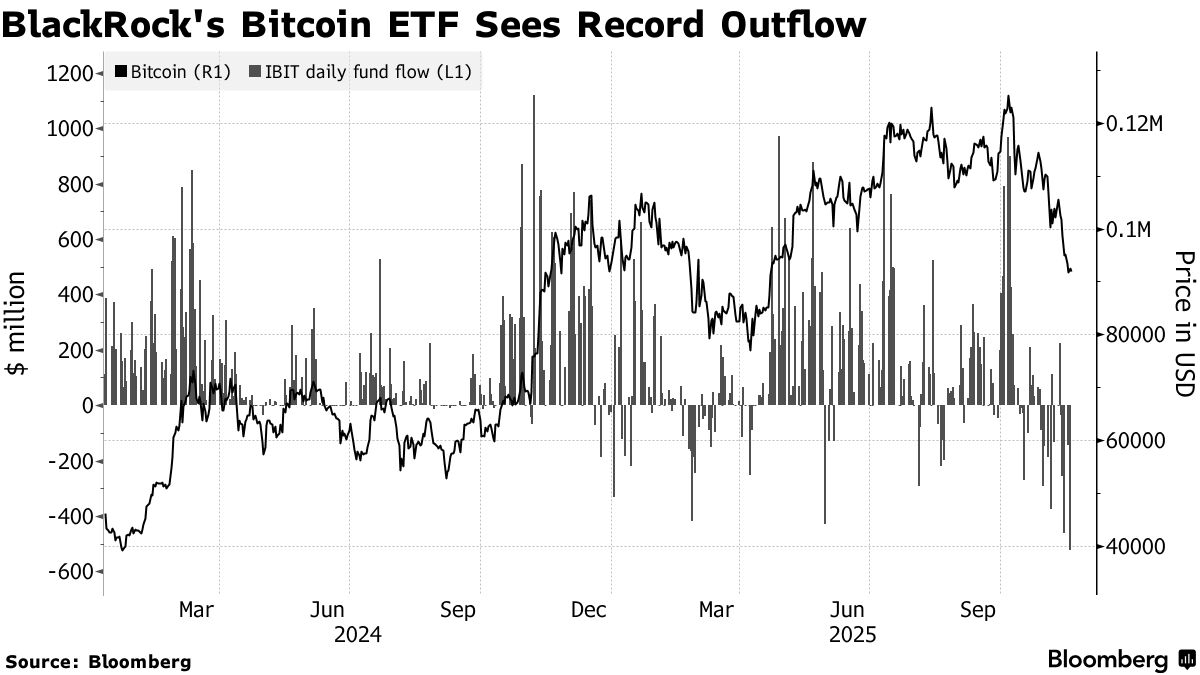

- The investment coincided with $3.1 billion in November outflows from US Bitcoin ETFs, including a record $523 million single-day withdrawal from IBIT.

- Abu Dhabi continues positioning itself as a crypto finance hub, with sovereign funds managing over $1.7 trillion making multiple digital asset investments.

The Abu Dhabi Investment Council (ADIC) significantly increased its exposure to the Bitcoin BTC $89 288 24h volatility: 4.3% Market cap: $1.79 T Vol. 24h: $70.60 B market, tripling its position in BlackRock’s iShares Bitcoin Trust ETF during the third quarter of 2025. Regulatory disclosures show the sovereign wealth manager boosted its stake from 2.4 million shares to 8 million shares as of Sept. 30, bringing the total value of its holding close to $518 million at the end of the quarter.

According to Bloomberg report , the position was taken shortly before a sharp reversal in the cryptocurrency market, with Bitcoin’s value falling around 20% since the end of September. The ETF, trading under the ticker IBIT, saw a 6.2% gain in the third quarter, but sustained outflows and declining digital asset prices have since erased those advances. The average purchase price for Abu Dhabi’s acquisition is not specified, but Bloomberg data lists the ETF’s quarter-average at $64.52 per share.

An Abu Dhabi Investment Council spokesperson reiterated its outlook on Bitcoin, describing the asset as a long-term store of value comparable to gold. The spokesperson said Bitcoin and gold both serve to diversify portfolios, and confirmed that the Council intends to retain both as part of a continued investment strategy.

It is worth noting that the first purchase was in February 2025, for $436.9 million in BlackRock’s iShares Bitcoin Trust ETF .

Market Outflows Gather Momentum

Abu Dhabi Investment Council’s move came amid a wave of institutional interest in US-listed spot Bitcoin ETFs . Other prominent investors, such as Harvard Management Co. , also increased exposure to IBIT during the same period. However, the sector has since seen major withdrawals: in November alone, $3.1 billion has exited US Bitcoin ETFs, with IBIT recording a single-day outflow of $523 million .

Graph of BlackRock’s Bitcoin ETF outflow. Source: Bloomberg

Market analysts note that Abu Dhabi’s investment is notable for its scale and for the city’s emerging role as a crypto finance hub. Abu Dhabi’s sovereign wealth funds, managing over $1.7 trillion, have made multiple forays into the digital asset sector.

The city’s activity is seen as part of a broader shift among major financial institutions toward regulated crypto investment products, as well as the licensing of international companies like Bybit , Circle , and Tether to operate in the country.

Sector Turbulence and Long-Term Strategy

As the value of Bitcoin and related ETFs declined, the decision by Abu Dhabi Investment Council to dramatically increase its IBIT stake just before the downturn has drawn scrutiny within the investment community.

While the Council has reaffirmed its confidence in Bitcoin’s long-term role, the sharp reversal in market conditions underscores the volatility institutional investors face in the digital asset sector.

next