Morning Brief | Bitcoin's sharp decline leads to record fund outflows from BlackRock's ETF; U.S. Treasury TGA sees significant drop for the first time; Vitalik Buterin introduces Ethereum in 30 minutes

Overview of major market events on November 19

Compiled by: ChainCatcher

Key News:

- The Ethereum treasury company led by Huobi founder Li Lin has been shelved, with a previously planned $1 billion fundraising

- Cloudflare: Major outage caused by misconfiguration, not a cyberattack

- Christopher Hui: Hong Kong plans to expand tax exemption scope to digital assets, bill to be submitted next year

- QCP: The current US economy is closer to the late cycle rather than a recession, this week's data will determine bitcoin's future trend

- Vitalik: Quantum computing may crack elliptic curve cryptography before the 2028 US election

- Bitcoin's sharp drop leads to record redemptions from BlackRock's ETF

- US Treasury TGA sees significant decline for the first time, market liquidity expected to ease

What important events happened in the past 24 hours?

The Ethereum treasury company led by Huobi founder Li Lin has been shelved, with a previously planned $1 billion fundraising

According to ChainCatcher, as reported by Wu Blockchain, the $1 billion Ethereum DAT plan led by Li Lin, Shen Bo, Xiao Feng, and Cai Wensheng has been shelved, and the funds raised have been returned. This plan was the largest DAT led by Asian investors. Industry insiders speculate the shelving was mainly due to the market turning bearish after the 1011 incident, and recently, many DAT company stock prices have also seen sharp declines. Regarding whether the plan will be restarted, relevant parties stated that investors' interests will be prioritized, and further market observation is needed to act accordingly.

Earlier, Bloomberg reported that Li Lin (Huobi founder) was working with Shen Bo (Distributed Capital co-founder), Xiao Feng (HashKey CEO), and Cai Wensheng (Meitu founder), among other early Asian Ethereum supporters, to set up a new digital asset trust fund, initially planning to purchase about $1 billion worth of ETH. The team was negotiating to acquire a Nasdaq-listed shell company for structural setup, with funding including $200 million from Li Lin's Avenir Investment and about $500 million from Asian institutions such as Sequoia China.

Cloudflare: Major outage caused by misconfiguration, not a cyberattack

ChainCatcher reports, according to an analysis published on Cloudflare's official blog, the major outage on November 18 was not caused by an external cyberattack, but by a misconfigured file generated after a database permission adjustment, which caused core proxy system failures and interruptions to multiple products including CDN, security services, Workers KV, Turnstile, and Access. This was the most severe incident since 2019.

The report noted that the team initially misjudged the incident as a DDoS attack, but ultimately resolved it by rolling back to an old configuration file. All related services were restored by 01:06 AM (UTC+8) on November 19. Cloudflare called the outage "unacceptable" and will accelerate efforts to improve system resilience.

Christopher Hui: Hong Kong plans to expand tax exemption scope to digital assets, bill to be submitted next year

ChainCatcher reports, according to 21jingji.com, Christopher Hui, Secretary for Financial Services and the Treasury of Hong Kong, revealed in a recent interview that Hong Kong is continuously optimizing its tax exemption policy, planning to expand the current scope from family offices and funds to new product categories such as private credit, carbon credits, and digital assets. A bill will be submitted to the Legislative Council next year.

QCP: The current US economy is closer to the late cycle rather than a recession, this week's data will determine bitcoin's future trend

ChainCatcher reports, QCP's daily market commentary stated that this week, bitcoin continued to decline, once falling below the key $90,000 mark, due to tightening rate hike expectations and continued ETF outflows dampening market sentiment. Thin liquidity further amplified this drop, showing bitcoin's increasing sensitivity to macroeconomic changes.

This correction occurred against the backdrop of a rapid repricing of Fed expectations—from an almost certain rate cut to a roughly balanced probability. This puts pressure on rate-sensitive assets like bitcoin, while the stock market remains relatively stable due to solid corporate earnings, especially strong profits and record AI-driven capital expenditures from large tech companies.

With the US government reopening, official data is being released, providing the market with necessary insights into economic fundamentals. This week, the market is highly focused on labor market data and the Conference Board's leading economic indicators, which now include the latest job vacancy data. This information will help determine whether labor tightness or inflation will dominate the Fed's policy response.

Beneath the surface, the US economy still shows a K-shaped divergence: high-income households' spending remains resilient, while low-income groups face increasing pressure. Fed Chair Powell reiterated a cautious stance, noting that rate cuts are "not a given." Overall, current economic conditions are closer to the late cycle rather than a recession.

Although fiscal constraints and labor market divergence pose ongoing risks, strong household balance sheets and resilient corporate capital expenditures still provide a buffer against downside risks. This week's data will determine whether bitcoin's pullback is a temporary position adjustment or the start of a broader decline in risk appetite.

Vitalik: Quantum computing may crack elliptic curve cryptography before the 2028 US election

ChainCatcher reports, according to Solid Intel monitoring, Vitalik Buterin warned at Devconnect that quantum computing may crack elliptic curve cryptography before the 2028 US presidential election and urged ETH to transition to quantum-resistant cryptography within the next four years.

Bitcoin's sharp drop leads to record redemptions from BlackRock's ETF

ChainCatcher reports, according to Golden Ten Data, bitcoin's sharp drop has led to record redemptions from BlackRock's ETF.

AI-native tax engine company Sphere completes $21 million Series A funding round led by a16z

ChainCatcher reports, AI-native tax engine startup Sphere announced the completion of a $21 million Series A funding round led by a16z, with participation from Y Combinator, Felicis, 20VC, and others.

Sphere uses AI to automatically parse global tax laws and, through more than 100 local tax filing channels, achieves end-to-end tax compliance automation needed for global business expansion, earning it the nickname "the Deel of tax." The system is designed for cross-border income compliance, aiming to enable companies to "operate globally from day one."

US Treasury TGA sees significant decline for the first time, market liquidity expected to ease

ChainCatcher reports, the latest data shows that the US Treasury General Account (TGA) has seen a significant decline for the first time: Treasury cash dropped by $34 billion from $959 billion to $925 billion.

JPMorgan traders believe that pressure in the repo market is the main reason for this month's stock market reversal. Due to the government shutdown, the increase in the Treasury General Account (TGA), and the combined effect of quantitative tightening (QT), the US Treasury previously absorbed a large amount of capital, leading to deteriorating cash accessibility in the financial system.

Now, as the US Treasury begins to release funds, market liquidity is expected to ease. (Wallstreetcn)

Strike founder: Buy the dip, because bitcoin's decline is essentially a currency collapse, not an asset collapse

ChainCatcher reports, Jack Mallers, founder of bitcoin payment app Strike, responded to the recent bitcoin market decline on X, stating that investors need to understand that what is truly collapsing is not the asset but the currency. Bitcoin is the only market honest enough to show this, and gold's repeated record highs indicate that the fiat currency system has collapsed. Bitcoin acts as a liquidity alarm; buy the dip because it's the currency that's the problem.

ChainCatcher reports, Tom Lee said in a CNBC interview the day before yesterday, "We are close to bottoming this market."

In response, Bitwise CIO Matt Hougan agreed, calling it a "once-in-a-lifetime long-term buying opportunity." Matt Hougan believes investors are overly anxious about AI valuations, macroeconomics, tariffs, and other events.

"Machi" has been liquidated 71 times on Hyperliquid so far this month

ChainCatcher reports, according to lookonchain monitoring, since November 1, the top three "on-chain daredevils" with the most liquidations on Hyperliquid are:

1. Machi Big Brother (@machibigbrother) — 71 liquidations

2. James Wynn (@JamesWynnReal) — 26 liquidations

3. Andrew Tate (@Cobratate) — 19 liquidations

10x Research: Bitcoin breaks below sentiment hype but smart money is looking for contrarian opportunities

ChainCatcher reports, 10x Research stated in its latest report that although the narrative of "bitcoin entering a bear market" is growing stronger, many traders are actually still holding long positions and are under pressure from this downturn.

The firm pointed out that the popular "three years up, one year down" old cycle logic is being cited again, but the key is whether a "crowded consensus expectation" has formed, creating contrarian opportunities. 10x Research mentioned that they turned bearish at the end of October, after which Coinbase's implied volatility dropped significantly, showing the typical feature of "sharp drops and sharp rallies coexisting" in a bear market environment.

They emphasized that bear markets are extremely difficult to operate in, but precisely because of the volatility, they often breed the best strategic opportunities. The report says bitcoin is testing its long-term uptrend line, and in previous years, every time it touched this trend line, it formed a key bottom, which could be a short-term or strategic turning point.

The key question now is not whether the market has entered a bear market, but "is this a place to buy the dip, or a turning point to be more cautious."

New Hampshire launches the first bitcoin-collateralized municipal bond in the US

ChainCatcher reports, New Hampshire has officially approved the nation's first municipal bond collateralized by bitcoin, with a size of $100 million, marking the first entry of digital assets into the traditional municipal financing system and seen as an important step for bitcoin towards the $140 trillion global bond market.

The bond is authorized by the state's Business Finance Authority (BFA) but does not put the state government or taxpayers at risk. The funds' safety is ensured by over-collateralized bitcoin held in custody by BitGo. Borrowers must provide about 160% BTC as collateral, and if the collateralization ratio falls to about 130%, the system will automatically liquidate to protect bondholders' interests. New Hampshire Governor Kelly Ayotte called this a "historic breakthrough in digital finance," attracting investment without using public funds.

The structure was designed by Wave Digital Assets and Rosemawr Management, with Orrick law firm involved in compliance architecture. Industry insiders say this model could pave the way for digital assets to enter municipal and corporate bond markets and lay the foundation for future bitcoin bonds issued directly by state treasuries.

Meme Trending List

According to data from the meme token tracking and analysis platform GMGN, as of 09:00 on November 20 (UTC+8),

The top five trending ETH tokens in the past 24h are: SHIB, LINK, PEPE, UNI, ONDO

The top five trending Solana tokens in the past 24h are: TRUMP, PEENGU, ME, PUMP, VINE

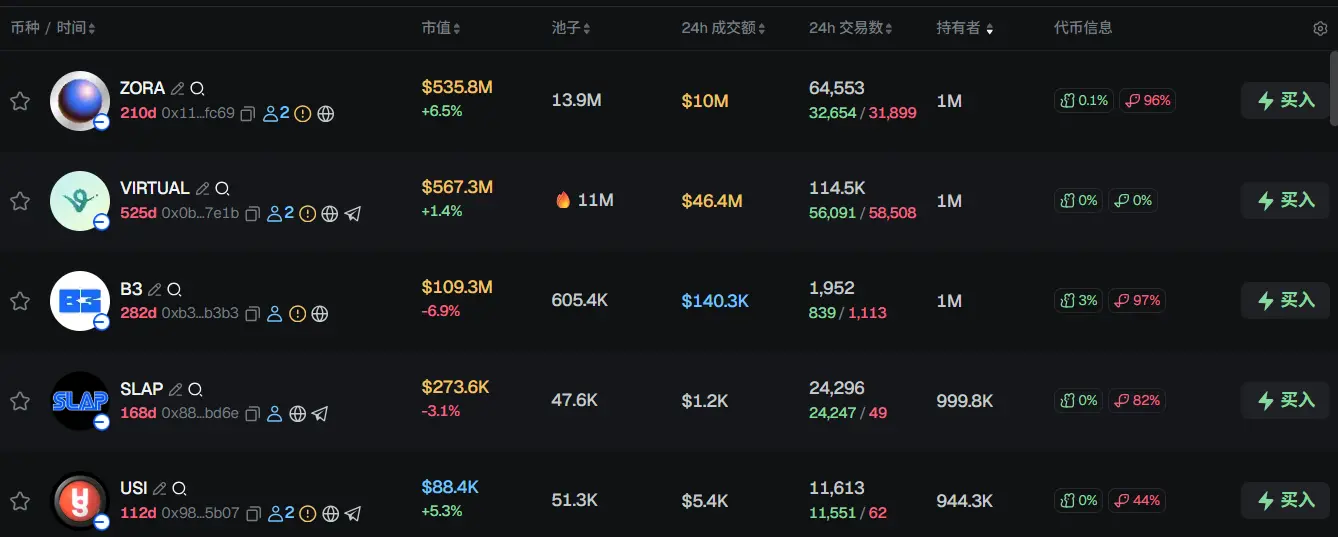

The top five trending Base tokens in the past 24h are: ZORA, VIRTUAL, B3, SLAP, USI

What are some must-read articles from the past 24 hours?

It is alimited-scale computer, but designed for global consensus, extreme robustness, and decentralization, allowing anyone anywhere in the world to trust that it will continue to operate exactly as programmed.

A $500,000 lesson: he predicted correctly but ended up in debt

Last week's hottest global topic was "the end of the US government shutdown," as global capital markets were watching the US, and when the government would reopen signaled potential policy changes.

On the largest prediction market, Polymarket, the "when will the government reopen" market saw over $100 million in trading volume, reflecting the market's attention. Interestingly, many people predicted the outcome correctly but still lost money.

Let's go back to November 12. On this day, there was a stream of good news: first, a White House press conference sent an optimistic signal, indicating that "the government shutdown is likely to end on Wednesday (November 12) night." Later that evening, President Trump officially signed the bill to end the shutdown, which was broadcast live on TV.

After an 80% drop in stock price, does BitMine have a value mismatch?

With all three main buying channels under simultaneous pressure and the staking ecosystem receding, Ethereum's next stage of price support faces structural challenges. BitMine is still buying, but is almost fighting alone. If even BitMine, the last pillar, can no longer buy, the market will lose not just a stock or a wave of funds, but possibly the very foundation of belief in the Ethereum narrative.

Why hasn't your token gone up?

Crypto ETFs have launched; stablecoins are being integrated by mainstream enterprises; regulatory attitudes have become friendlier; everything we wanted has arrived!

So why hasn't your token gone up? Why did bitcoin give back all its gains, while the US stock market rose 15–20% for the year?

The mainstream view has shifted to "crypto is no longer a scam," so why is your favorite altcoin still underwater?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin tests the bottom again; 2026 may be a good opportunity to enter the market

This article mainly discusses the role of bitcoin and AI in the future economy and their impact on the risk asset market, as well as predicts the market trends for 2026.