Hopes for a December rate cut fade? Bitcoin erases its yearly gains

After the release of the delayed U.S. September non-farm payroll data, which was postponed by 43 days, the market has almost abandoned expectations for a rate cut in December.

After the release of the delayed US September Nonfarm Payrolls data by 43 days, the market has almost abandoned expectations for a rate cut in December

Written by: ChandlerZ, Foresight News

Bitcoin price experienced another sharp decline after rebounding to retest the 2025 opening price at noon on November 20. Following the release of the delayed US September Nonfarm Payrolls data in the evening, bitcoin surged to $92,564 (UTC+8) before falling, with an intraday low near $86,000 (UTC+8), erasing its gains for the year.

ETH briefly fell below $2,800 (UTC+8) during the session and has now slightly rebounded to around $2,850 (UTC+8); SOL dropped to as low as $131 (UTC+8) and is now quoted at $134 (UTC+8). According to Coinglass data, the total liquidations across the network in the past 24 hours amounted to $832 million (UTC+8), with long positions liquidated for $712 million (UTC+8) and short positions for $119 million (UTC+8). Of these, bitcoin liquidations reached $410 million (UTC+8), and ethereum liquidations were $177 million (UTC+8).

According to SoSoValue data, the overall crypto market is in a downward trend. The Layer1 sector fell 3.79% in 24 hours (UTC+8), with NEAR Protocol (NEAR) dropping 12.36% (UTC+8); the CeFi sector fell 3.98% (UTC+8), with Aster (ASTER) down 9.93% (UTC+8); the Meme sector fell 4.25% (UTC+8), but Cheems Token (CHEEMS) bucked the trend and rose 10.40% (UTC+8); the DeFi sector dropped 4.32% (UTC+8), with Uniswap (UNI) down 7.88% (UTC+8); the PayFi sector fell 4.82% (UTC+8), with Telcoin (TEL) down 19.39% (UTC+8); the Layer2 sector fell 5.05% (UTC+8), with SOON (SOON) down 17.72% (UTC+8).

September Nonfarm Payrolls Data Arrives Late, Rate Cut Expectations Hit by Major Shock

The US September Nonfarm Payrolls data showed an increase of 119,000 jobs in September (UTC+8), significantly higher than the economists' previous consensus estimate of around 50,000 (UTC+8). However, this job growth was accompanied by a 0.1 percentage point rise in the unemployment rate to 4.4% (UTC+8), the highest since October 2021, making the market's assessment of the employment situation more complicated.

Chicago Fed President Austan Goolsbee hinted that he remains cautious about another rate cut at the Fed's December meeting. He noted that inflation appears to have stalled, and there are even warning signs that it may be heading in the wrong direction. "That makes me a bit uneasy," he said.

Goolsbee stated that the September employment data shows a stable but slightly cooling job market, and unemployment claims data does not indicate a rapid deterioration in the labor market. He even directly stated that after the Fed's rate cut in September, only one more rate cut would be needed in 2025. These remarks have poured cold water on the US market's expectations for rate cuts.

Some US economists emphasized that stronger-than-expected job growth is a reassuring highlight, but this resilience also means there is not enough reason to force the Fed to further ease monetary policy in December. At the same time, the slight rise in the unemployment rate suggests some weakness within the labor market, making the overall economic assessment more nuanced. Some traders believe that this jobs report will reduce the likelihood of the Fed continuing to cut rates in December.

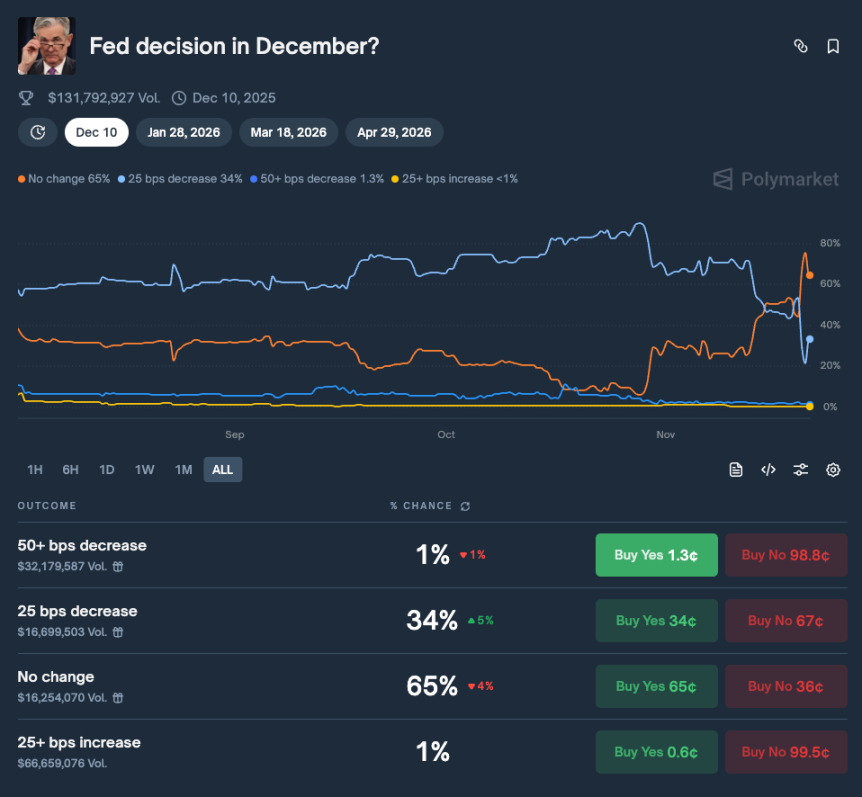

According to Polymarket data, the probability of the market betting that the Fed will not cut rates in December has risen to 65% (UTC+8), and even reached 76% (UTC+8) at one point on the 20th. The total trading volume in this prediction market currently exceeds $132 million (UTC+8).

Global Stock Markets Experience Major Shock, Tech Assets Under Pressure Across the Board

Against this macro backdrop, bitcoin's decline is not an isolated event but a microcosm of the sharp downturn in global market sentiment. US stocks experienced severe volatility, with all three major indices closing lower. The Nasdaq plunged 2.15% (UTC+8), the S&P 500 fell 1.56% (UTC+8), and the tech sector was particularly weak—even Nvidia's strong earnings report could not stop investors from quickly fleeing high-risk assets.

On the 21st, Asian stock markets plummeted across the board. South Korea's KOSPI index saw intraday losses expand to 4% (UTC+8), the Nikkei 225 fell more than 2% (UTC+8), and the semiconductor and tech sectors led the decline: SK Hynix plunged 9% (UTC+8), Kioxia fell more than 16% (UTC+8) intraday, and SoftBank dropped over 11% (UTC+8).

Risk assets faced indiscriminate sell-offs globally, meaning capital quickly withdrew from tech stocks, growth stocks, and crypto assets, flowing back into more liquid and safe-haven assets such as the US dollar and short-term bonds. At the same time, safe-haven funds returned to US dollar assets on a large scale, pushing the US dollar index higher in the short term and further increasing valuation pressure on global risk assets. Commodities such as gold and crude oil also came under pressure and failed to show the resilience expected of traditional safe-haven assets. Market risk appetite is shifting from holding assets to holding liquidity.

11 Consecutive Daily Declines: What’s Next for Bitcoin?

According to Glassnode's analysis, almost all investor groups have suffered losses recently. This structure has historically triggered panic selling and weakened market momentum, requiring time to recover. In the short term, the $95,000 to $97,000 (UTC+8) range may form local resistance. If the price can regain this range, it would indicate that the market is gradually returning to balance.

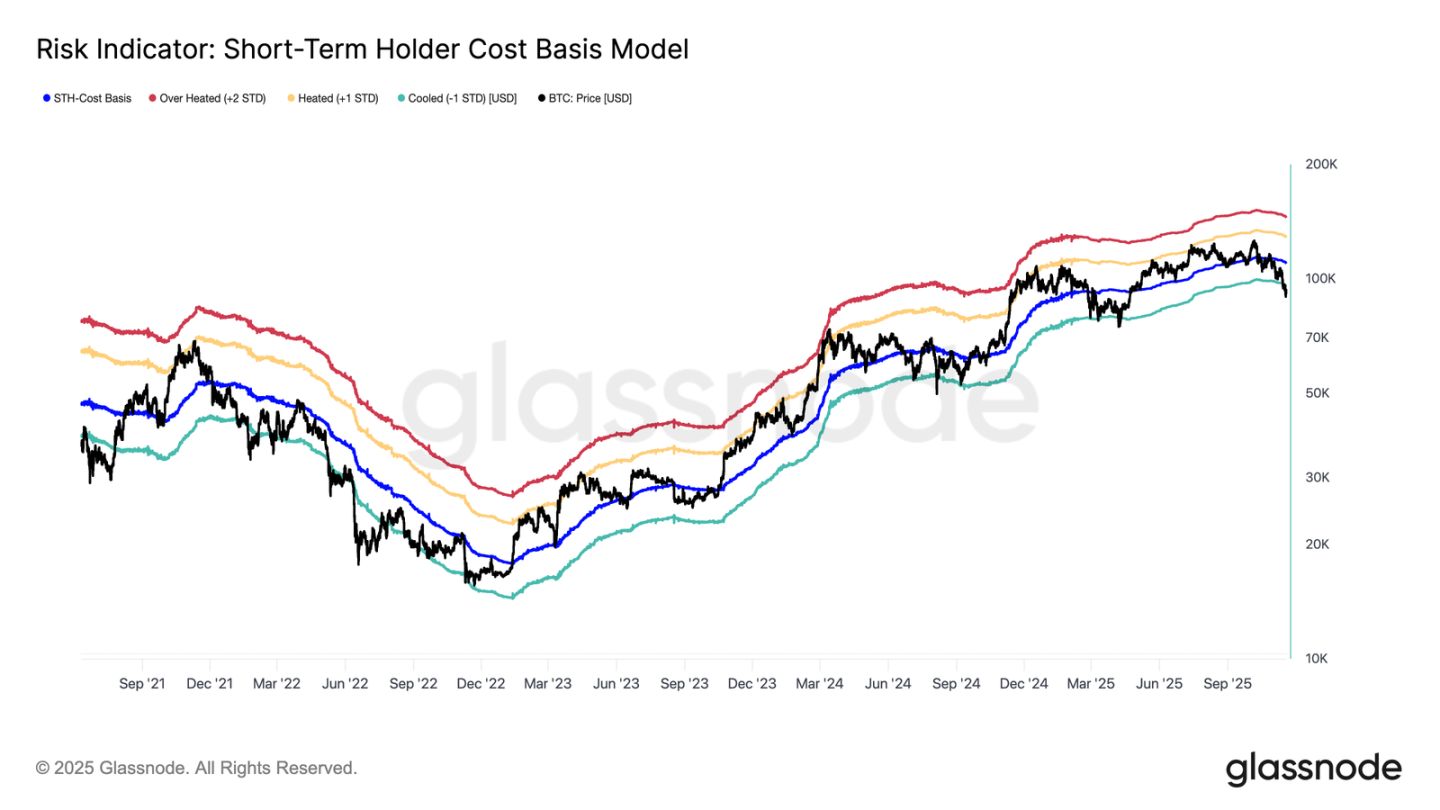

From an investor behavior perspective, this crash marks the third time since the beginning of 2024 that the price has fallen below the lower bound of the short-term holder cost basis model. This time, the panic among top buyers is significantly higher. The 7-day moving average of realized losses for STH has soared to $523 million per day (UTC+8), the highest level since the FTX collapse.

Such high realized losses highlight the heavier top structure formed between $106,000 (UTC+8) and $118,000 (UTC+8), with a density far exceeding the peaks of previous cycles. This means that either stronger demand is needed to absorb the sold coins, or the market will need to undergo a longer and deeper accumulation phase to restore balance.

Additionally, from an investor behavior perspective, this crash marks the third time since the beginning of 2024 that the price has fallen below the lower bound of the short-term holder cost basis model. This time, the panic among top buyers is significantly higher. The 7-day moving average of realized losses for STH has soared to $523 million per day (UTC+8), the highest level since the FTX collapse.

Such high realized losses highlight the heavier top structure formed between $106,000 (UTC+8) and $118,000 (UTC+8), with a density far exceeding the peaks of previous cycles. This means that either stronger demand is needed to absorb the sold coins, or the market will need to undergo a longer and deeper accumulation phase to restore balance.

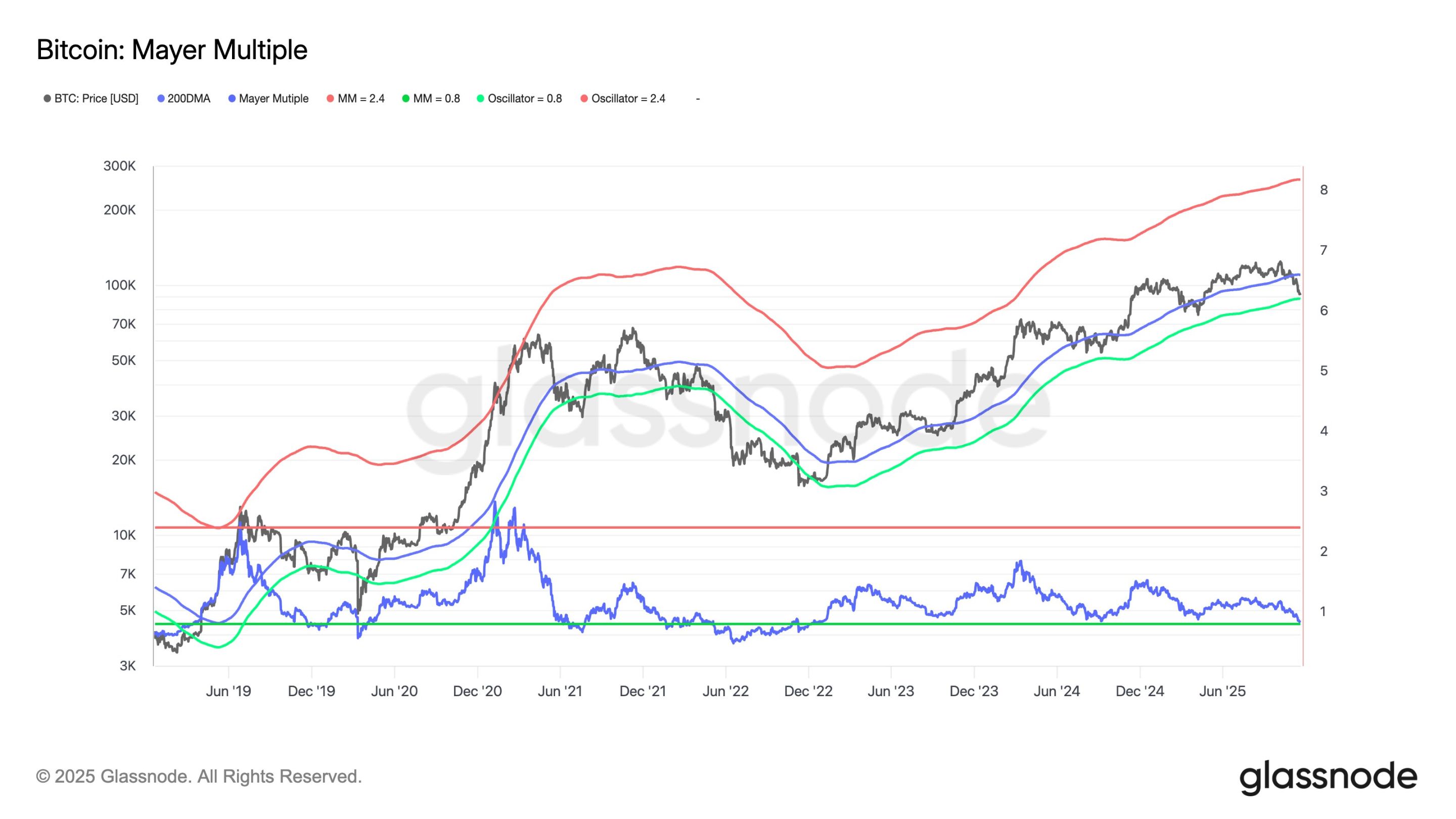

Currently, bitcoin's Mayer Multiple has retreated to the lower bound of its long-term range, indicating a slowdown in momentum. Historically, this usually coincides with a period of price consolidation and the beginning of value-driven demand entering the market.

However, it is also noted that although bitcoin's price has fallen below the main lower bound of the short-term holder cost basis model, the scale and extent of investor losses are far less extreme than during the 2022-2023 bear market. The price range between the active investor's actual price ($88,600 (UTC+8)) and the true market mean ($81,900 (UTC+8)) may serve as the dividing line between a mild bear market phase and a full-blown bear market structure similar to 2022-2023.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gold Rush Handbook | Circle Arc Early Interaction Step-by-Step Guide

Remain proactive even during a sluggish market.

Mars Morning News | Nvidia's impressive earnings boost market confidence, while growing divisions in the Fed minutes cast doubt on a December rate cut

Nvidia's earnings report exceeded expectations, boosting market confidence and fueling the ongoing AI investment boom. The Federal Reserve minutes revealed increased disagreement over a possible rate cut in December. The crypto market is seeing ETF expansion but faces liquidity challenges. Ethereum has proposed EIL to address L2 fragmentation. A Cloudflare outage has raised concerns about the risks of centralized services. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved during iteration.

Surviving a 97% Crash: Solana’s Eight-Year Struggle Revealed—True Strength Never Follows the Script

Solana co-founder Anatoly Yakovenko reviewed the origins, development process, challenges faced, and future vision of Solana, emphasizing the transaction efficiency of a high-performance blockchain and the comprehensive integration of financial services. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the iterative update stage.

The rate cut illusion is shattered, the AI bubble is shaking, and Bitcoin leads the decline: this round of plunge is not a black swan, but a systemic stampede.

Global markets experienced a systemic decline, with U.S. stocks, Hong Kong stocks, A-shares, bitcoin, and gold all falling simultaneously. The main reasons were a reversal in Federal Reserve rate cut expectations and Nvidia's positive earnings failing to boost prices. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.