$1.3 million in 15 minutes, the ones who always profit are always them

In a week when bitcoin fell below $82,000 and market risk appetite cooled rapidly, the Base ecosystem witnessed an experiment that was not particularly lively but full of controversy.

Base lead Jesse Pollak launched a creator token named after himself, $jesse, aiming to explore whether the “creator economy can form a new value mechanism on-chain.”

However, the heated discussion in the market still came from familiar faces: two on-chain sniping bots were the first to complete the entire process of building and selling positions.

The Original Intention of JESSE: Turning “Personal Brand Value” into a Co-owned Asset

This is not the first time Pollak has sparked controversy by issuing tokens. Since April 2025, he has been continuously experimenting with “content coins” on his personal and Base official Zora accounts:

April 17, 2025: The official Base account posted “Base is for everyone” on Twitter, which was automatically minted as the $BASE token. Its market cap plummeted from $16.9 million to $1.3 million within two hours, a drop of 92%. Pollak later admitted to personally approving the post, calling it an “experiment,” but it still raised concerns about market manipulation.

He subsequently minted his daily tweets into coins in batches. Statistics show that among the content coins he minted, 40% dropped more than 90%, with only three appreciating in value.

While promoting content coins, Pollak also attempted to build a “content coin—creator coin” narrative system on Zora. He repeatedly explored a core proposition: can a creator’s influence, attention, and works form a more direct and sustainable value cycle on-chain?

According to his vision, the path is very clear: creators tokenize their personal brand, fans become a “community of interest” by holding tokens, and creators use this income to support their creative work, thus forming a closed loop.

Pollak repeatedly emphasized that $JESSE is a “cultural experiment,” not an investment product—sounding more like an artistic act or social test than financial speculation.

However, on-chain trading mechanisms never change their rules for idealism. Once the experiment begins, it falls into a system far more sophisticated—and ruthless—than its designer imagined.

Sniping Bots Earn $1.3 Million in 15 Minutes

JESSE’s issuance adopted a “one-time liquidity injection” model:

-

Total supply of 1 billion tokens;

-

500 million tokens directly injected into the liquidity pool;

-

But within the block where the injection occurred, 260 million tokens were instantly swept up by two snipers.

According to Arkham Intelligence data, these two snipers ultimately profited:

-

$707,700

-

$619,600

A total of over $1.3 million.

The operations of one wallet were particularly typical:

-

Spent about 67 ETH ($191,000) to buy 7.6% of the supply;

-

Paid over $44,000 in priority fees to gain sorting advantage;

-

Sold all after a short-term price spike, quickly increasing 67 ETH to 303 ETH,

making over $600,000 in profit within minutes.

This is a “first-mover wins” structure:

By the time ordinary users see the price chart, the profits have already been extracted.

The core reason for this outcome lies in the flashblocks mechanism launched by Base in July.

Nominally, Base produces a block every two seconds; but internally, these two seconds are split into multiple micro-blocks of 200 milliseconds each. Whoever grabs the first micro-block almost holds the first-mover advantage for “risk-free arbitrage.”

In this structure, sniping is no longer a technical game, but a competition around “speed + fees.” Bots monitor contracts in advance, and once they detect a liquidity injection, they immediately place orders;

Transactions bypass the public mempool and are sent directly to the sequencer via private channels;

Finally, they use high priority fees to secure sorting. A 200-millisecond gap is enough to determine hundreds of thousands of dollars in profit, while ordinary users haven’t even loaded the price chart yet.

This is the natural tilt brought by the flashblocks structure—first movers have an absolute advantage, while ordinary participants are excluded from the profit zone.

Some community users sharply pointed out: the project team closed the personal profile access interface on the website within the first minute of JESSE going live (possibly to prevent bots from automatically scraping information).

But this measure may have backfired: ordinary users needed this interface to obtain the contract address from the official website to purchase, while advanced snipers operated directly at the smart contract level, not needing the website frontend at all. As a result, this measure only hindered ordinary users and actually reduced competition for snipers.

Earlier this year, the BASE token minted by Zora also plummeted 90% from its peak within minutes of launch. Now that JESSE has been sniped again, it’s hard not to wonder: can the creator token experiment ever truly escape the shadow of arbitrage bots?

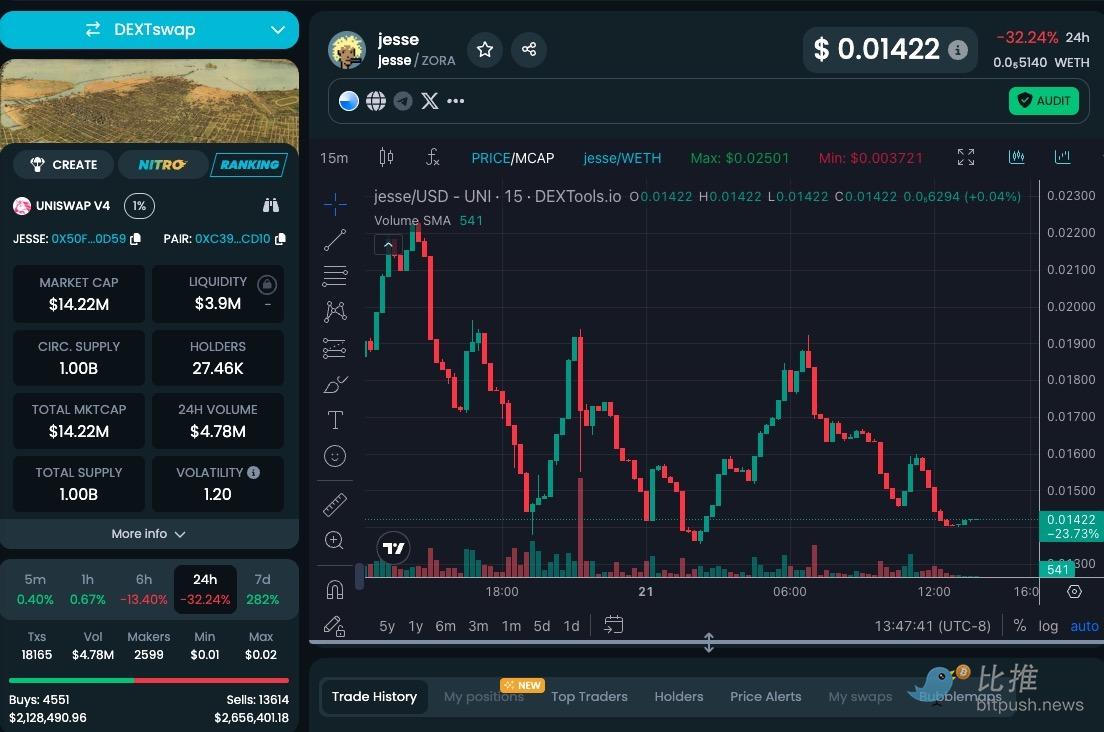

As of writing, the price of the JESSE token has dropped 32.24% in the past 24 hours, with a total market cap falling back to $14.22 million, 24-hour trading volume at $4.78 million, and a trading volume to market cap ratio as high as 33.6%. This ratio is significantly higher than normal, indicating a strong speculative atmosphere in the market, with funds mainly focused on short-term trading.

SocialFi in a Bear Market

Placing JESSE in a larger narrative framework, it’s clear that the SocialFi sector is showing obvious differentiation during the bear market. Creator tokens are more like attention options and struggle to form long-term value accumulation.

A typical case is the now-defunct Friend.tech; other personal IP-type tokens face similar dilemmas: their value relies more on hype and sentiment, and once on-chain activity drops, buy-side demand dries up almost immediately.

On the contrary, infrastructure is attracting more “patient capital.”

Zora’s platform token ZORA has seen strong growth after deeper integration with the Base App: the number of creators, coins minted, and total transaction volume have all climbed simultaneously.

The market is squeezing out emotional bubbles, and value judgment is shifting from chasing personal “attention assets” back to focusing on scalable “practical tools.” This is the dilemma for JESSE: creator tokens that rely on hype are inherently fragile, because the market’s “carrying capacity” can never be sustained by fleeting speculation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Where Meta's ambitions for the metaverse fell short

ETH Stalls & Pepe Dips, Zero Knowledge Proof’s Stage 2 Coin Burns Could be the Start of a 7000x Explosion!

Targeting $900B Remittances Could Drive The Best Crypto To Buy 2026

Crypto Enthusiasts Witness HYPE Coin’s Rebound as Key Resistance Breaks Loom