Pump.fun Co-Founder Denies $436M Cash-Out, Calls Lookonchain Report “Misinformation”

Quick Breakdown

- Pump.fun co-founder rejects Lookonchain’s report alleging a $436M stablecoin cash-out.

Co-founder says transfers were internal treasury movements

Pump.fun’s pseudonymous co-founder, Sapijiju, has dismissed claims that the project offloaded more than $436 million in USDC, calling allegations from blockchain analytics platform Lookonchain “complete misinformation.”

complete misinformation from @lookonchain again. $0 have been cashed out – we’re not involved in the transactions between Kraken and Circle that you’re alleging us to be a part of.

What’s happening is a part of pump’s treasury management, where USDC has been…

— Sapijiju (@sapijiju) November 24, 2025

In an X post , Sapijiju clarified that none of the crypto from wallets linked to the project had been sold. Instead, he said the USDC came from the platform’s token offering and was redistributed across internal wallets as part of routine treasury management.

“This is simply Pump’s treasury management,”

he said.

“USDC has been transferred into different wallets so the company’s runway can be reinvested back into the business. Pump has never directly worked with Circle.”

Report flags $436M moved to Kraken

The clarification followed Lookonchain’s report that Pump.fun-related wallets had transferred $436 million in USDC to Kraken since mid-October, movements that many interpreted as a major cash-out.

The timing sparked additional scrutiny: Pump.fun’s monthly revenue slid to $27.3 million in November, its lowest since July, according to DefiLlama.

Despite the concerns, data from DefiLlama, Lookonchain, and Arkham indicated that a wallet tagged to Pump.fun still holds more than $855 million in stablecoins and over $211 million in Solana (SOL).

Mixed reactions from analysts

Reactions to the perceived sell-off differed sharply across the crypto analytics space.

Nansen analyst Nicolai Sondergaard suggested the movement might signal more selling, while EmberCN argued the funds likely stemmed from private placements rather than market dumping.

The project’s community appeared split. Some users questioned Sapijiju’s messaging, pointing out inconsistencies in claiming no involvement in the transfers while describing them as treasury management.

Others went further, accusing Pump.fun of poor execution and “price manipulation via airdrops,” as the PUMP token trades at $0.002714, 32% below its price of $0.004 and nearly 70% below its September peak of $0.0085, according to CoinGecko.

Some community members defended Pump.fun’s right to manage its treasury as it sees fit, but emphasized that the real issue is clarity around reserves.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The most profitable application in the crypto world starts to slack off

Why is pump.fun being questioned for "rug pulling"?

Interpretation of the Five Winning Projects from Solana's Latest x402 Hackathon

The Solana x402 hackathon showcased cutting-edge applications such as AI autonomous payments, model trading, and the Internet of Things economy, indicating a new direction for on-chain business models.

The crypto market takes a breather as Bitcoin rebounds to $91,000—can it continue?

With three major positive factors, can the crypto market shake off its slump in December?

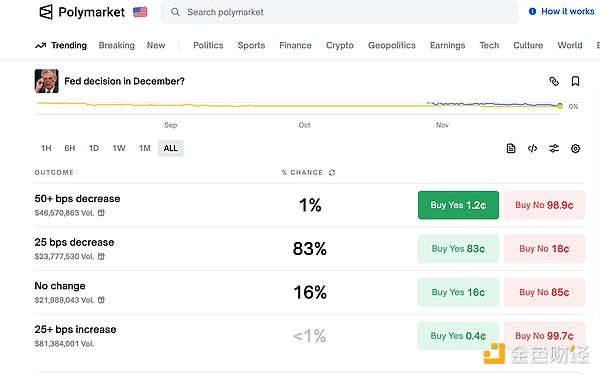

Ethereum upgrade, Federal Reserve rate cuts, and the confirmation of a dovish Federal Reserve candidate.