Nobel laureate criticizes: "Trump trade" is collapsing

Author: Paul Krugman ( Paul Krugman )

Original Title:The Trump Trade is Unraveling

Compiled and edited by: BitpushNews

Paul Krugman, winner of the 2008 Nobel Prize in Economics and columnist for The New York Times, is known for his distinct Keynesian stance and sharp public policy analysis. He excels at translating complex economic mechanisms into clear social insights and never shies away from controversial political assertions.

In his latest article on November 24, 2025, Paul Krugman puts forward a pointed view:

Bitcoin has evolved into a "Trump trade," its fate deeply tied to Trump's political influence. Therefore, in his view, the recent sharp drop in bitcoin prices is not an isolated market event, but a direct reflection of the waning of Trump's political power and influence in the financial markets.

—————————————-

The following is the main text:

What is bitcoin actually useful for? It is not a currency—that is, it is not a medium of exchange that can be used for payments.

It cannot hedge against inflation.

It also cannot hedge against financial risk—on the contrary, bitcoin prices usually fluctuate in the same direction as recent AI concept stocks driving the stock market, but with even greater volatility.

If there is a use case for bitcoin, its core function is to obscure the flow of funds: cryptography facilitates anonymous transactions that leave no paper trail. Such transactions are not necessarily all illegal, but many of them indeed are.

It is worth noting that anonymity not only fuels criminal activity among crypto users, but also makes them more likely to become targets of crime. As long as you possess the bitcoin key—the code that unlocks it—no matter who you are or how you obtained it, it belongs to you. In this sense, obtaining a bitcoin key is like getting a bag full of hundred-dollar bills.

This feature has triggered a wave of kidnappings targeting large cryptocurrency investors, with criminals demanding that victims hand over their keys.

In fact, such kidnappings have become so common that a recent major bitcoin conference set up a full-day "anti-kidnapping" workshop, where participants learned skills such as biting through zip ties with their teeth.

In addition to fueling crime, bitcoin is increasingly becoming a tool for financial predation. Cryptocurrencies—worse still, stocks of companies that buy cryptocurrencies with borrowed money—are being heavily marketed to naive investors who have not yet realized the risks. When bitcoin rises, they can profit, but most may have no idea how much they stand to lose when it crashes.

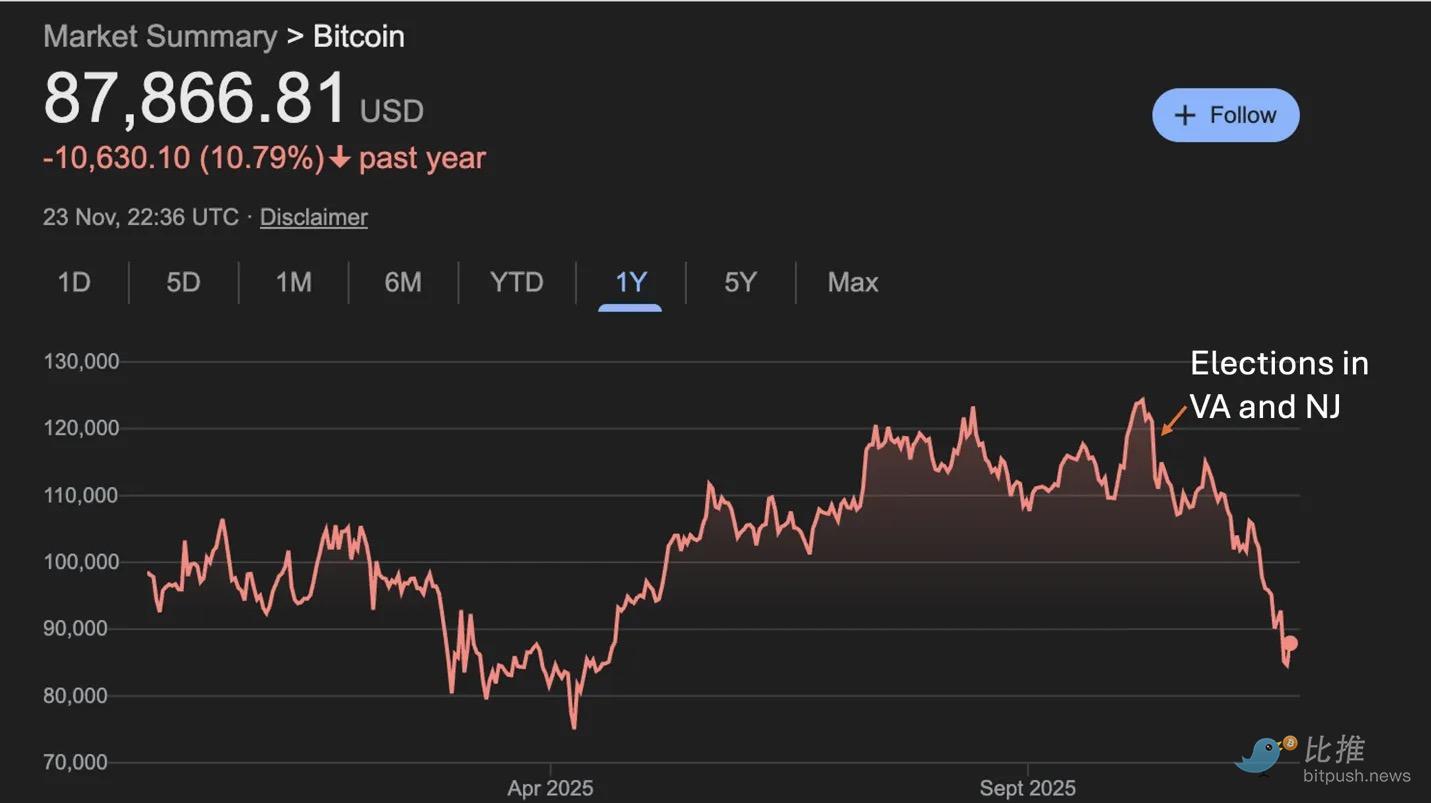

Recently, cryptocurrencies have indeed fallen sharply. Although bitcoin has performed better than more obscure small-cap coins, it has still dropped by about 25% since late October.

Bitcoin may rebound, because it is not just an asset, but a kind of faith.

When I spoke with Hasan Minhaj (a well-known American host and political commentator) about bitcoin, he immediately responded to my criticism by saying: "I don't want to become a meme, the bitcoin faithful are already watching me."

This faith-like quality allows bitcoin to always recover from setbacks and scandals that would destroy ordinary investments, because loyal believers only double down in the face of price drops. Perhaps this time will be the same.

But it may also be different—because bitcoin has now essentially become a "Trump trade." After Trump's victory last year, bitcoin prices soared, and the recent plunge coincided with a series of political setbacks for Trump.

Why call it a Trump trade?

Partly because, after his family effectively accepted huge bribes from the crypto industry, Trump is now repaying the sector with pro-crypto policies.

Notably, he has signed executive orders allowing ordinary Americans to invest their 401(k) retirement funds in crypto assets—though these investors are often unaware of the risks involved.

More broadly, as I have said, crypto technology is increasingly becoming a tool for financial predation, and the Trump administration is extremely permissive of such predatory behavior. Just ask Binance founder Changpeng Zhao—he was convicted of violating U.S. anti-money laundering laws, but was subsequently pardoned by Trump.

This administration is working hard to dismantle institutions established after the 2008 financial crisis to protect investors and market safety, such as the Consumer Financial Protection Bureau.

Treasury Secretary Scott Besant and other Trump administration officials and allies (including some Federal Reserve officials) are also sparing no effort to weaken banking regulation—regulations that were originally established to limit the high-risk behaviors that triggered the 2008 crisis.

All of this is bad for retail investors, bad for financial stability, but beneficial for financial speculators like bitcoin promoters.

So how should we interpret the recent plunge in bitcoin? It can be seen as the unraveling of the "Trump trade." Although Trump is still trying hard to reward the industry that made his family rich, and his cronies are still working to create a breeding ground for all kinds of predatory behavior, Trump's power is clearly waning. Therefore, the price of bitcoin, which has essentially become a bet on Trumpism, has fallen accordingly.

Why has Trump suddenly shown signs of weakness? Polls have consistently given him very low ratings since spring, but his net approval rating has dropped significantly in the past month.

Although he just claimed to have the "highest approval rating of his political career"—no one knows which poll he was citing—the Democratic victories in Virginia and New Jersey on November 4 have completely dispelled doubts about his extremely unpopular poll results.

These electoral defeats have shaken Congressional Republicans' willingness to follow Trump blindly. Meanwhile, the ongoing fallout from Trump's relationship with Jeffrey Epstein is undermining the MAGA base.

Many political analysts may not fully appreciate that: a large number of supporters once firmly believed Trump was protecting the world from Democratic pedophiles, and when they gradually realize they may have confused the hero with the villain, the psychological shock is immense.

Is it far-fetched to link Trump's political predicament with cryptocurrency prices? Not at all. As Josh Marshall often emphasizes—power is unified. A weakened Trump will have less ability to impose his will on all fronts, including efforts to promote the crypto industry.

I will explore the connection between politics and crypto in more depth in future articles. For now, I just want to reiterate:

Bitcoin has become a Trump trade, and its price decline is a sign of Trump's waning control over the Republican Party.

The music stops, and the crash comes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

Summarizing the "holistic reconstruction of the privacy paradigm" from dozens of speeches and discussions at the Devconnect ARG 2025 "Ethereum Privacy Stack" event.

Shareholder Revolt: YZi Labs Forces BNC Boardroom Showdown

Halving Is No Longer the Main Theme: ETF Is Rewriting the Bitcoin Bull Market Cycle

The Crypto Market Amid Liquidity Drought: The Dual Test of ETFs and Leverage