Can Bitcoin start a Christmas rally after returning to $90,000?

Author: Rhythm Junior Worker

Original Title: After Bitcoin Returns to $90,000, Is the Next Stop Christmas or a Christmas Crash?

Regardless of whether they are Chinese or foreigners, no one can escape the traditional mentality of "reuniting and celebrating the holidays." The fourth Thursday of November each year is Thanksgiving, a major traditional holiday in the United States.

This year, the thing crypto people are most thankful for on Thanksgiving might be Bitcoin returning to $90,000.

Besides the influence of the "holiday market," a "Beige Book" that unexpectedly became a key decision-making reference due to a government shutdown also helped rewrite the direction of this year's final monetary policy. The probability of a Federal Reserve rate cut in December soared from 20% a week ago to 86%.

When the Federal Reserve reverses its stance, when major global economies simultaneously start the "money printing mode," and when the cracks in the traditional financial system are widening, crypto assets are standing at their most critical seasonal window. After the global liquidity floodgates open, how will it affect the direction of the crypto industry? More importantly, is the upcoming holiday going to be Christmas or a Christmas crash?

December Rate Cut Probability Soars to 86%

According to Polymarket data, the probability of the Federal Reserve cutting rates by 25 basis points at the December FOMC meeting has soared from about 20% a week ago to 86%. This is likely one of the main reasons for Bitcoin's recent surge, and the reversal in probability is due to an economic report—the "Beige Book."

An Important Report Deciding the Rate Cut

On Wednesday, the "Beige Book," compiled by the Dallas Fed and summarizing the latest conditions from 12 regions across the U.S., was officially released. Normally, it is just routine material, but due to the government shutdown causing a delay in updating key economic data, this report instead became a rare and comprehensive information source that the FOMC could rely on before making decisions.

In other words, in the absence of data, this is one of the few windows through which the Federal Reserve can truly reflect the grassroots economic situation.

The overall assessment given by the report is straightforward: economic activity has changed little, labor demand continues to weaken, business cost pressures have increased, and consumer spending willingness is becoming cautious. Beneath the surface stability of the U.S. economy, some structural loosening is beginning to appear.

The most closely watched part of the report is its description of changes in the job market. Over the past six weeks, the U.S. labor market has shown few positive signs. About half of the regional Feds reported that local businesses are less willing to hire, even showing a tendency to "avoid hiring if possible." Hiring difficulties have eased significantly in several industries, a sharp contrast to the severe labor shortages of the past two years. For example, in the Atlanta district covering several southeastern states, many companies are either laying off workers or only minimally replacing departing employees; in the Cleveland district, which includes Ohio and Pennsylvania, some retailers are proactively reducing staff due to declining sales. These changes mean that the loosening of the job market is no longer isolated but is gradually spreading to more industries and regions.

Meanwhile, although inflation pressure is described as "moderate," the real situation businesses face is more complex than the numbers suggest. Some manufacturing and retail companies are still under pressure from rising input costs, with tariffs being one reason—for example, a brewery in the Minneapolis district reported that rising aluminum can prices have significantly pushed up production costs. But even more challenging are healthcare costs, which were mentioned by almost every district. Providing healthcare for employees is becoming increasingly expensive, and unlike tariffs, this cost is not cyclical but a more difficult-to-reverse long-term trend. As a result, companies are forced to make tough choices between "raising prices" and "shrinking profits." Some companies pass costs on to consumers, further pushing up prices; others choose to absorb the costs themselves, further squeezing profit margins. Either way, the impact will eventually be reflected in the coming months' CPI and corporate earnings.

Compared to business-side pressures, changes on the consumer side are equally noteworthy. High-income groups continue to support strong high-end retail performance, but broader American households are tightening their spending. Several regions mentioned that consumers are finding it increasingly difficult to accept price increases, especially middle- and low-income families, who are more likely to delay or forgo non-essential spending when budgets are tight. Feedback from car dealers is particularly typical: as federal tax subsidies expire, electric vehicle sales have slowed rapidly, indicating that consumers are becoming more cautious about large expenditures, even in previously booming industries.

Among various economic disruptions, the impact of the government shutdown is clearly amplified in this report. The length of the shutdown set a record, directly affecting the income of federal employees, whose reduced spending also dragged down local consumption—car sales in the Philadelphia district fell significantly as a result. But what is truly surprising is that the shutdown also affected broader economic activity through other channels. Some airports in the Midwest became chaotic due to fewer travelers, which in turn slowed commercial activity. Some companies also experienced delays in orders. This chain reaction shows that the economic impact of a government shutdown goes far beyond the mere "suspension of government functions."

On a more macro-technical level, artificial intelligence is quietly changing the economic structure. Respondents in the "Beige Book" showed a subtle "dual-track phenomenon": on the one hand, AI is driving investment growth—for example, a manufacturer in the Boston district received more orders due to strong demand for AI infrastructure construction; on the other hand, it is causing some companies to reduce entry-level positions, as basic work is partially replaced by AI tools. Even the education sector has similar concerns—colleges in the Boston area reported that many students are worried that traditional jobs will be affected by AI in the future, so they are more inclined to switch to more "risk-resistant" majors such as data science. This means that AI's restructuring of the economy has already penetrated from the industrial level to the talent supply side.

It is worth noting that the changes presented in the "Beige Book" are also corroborated by the latest data. Signs of weak employment have appeared simultaneously in several districts, and on the price side, the Producer Price Index (PPI) year-on-year is only 2.7%, the lowest since July, and core prices continue to weaken, with no signs of reigniting. Both employment and inflation, which are directly related to monetary policy, are prompting the market to reassess the Federal Reserve's next move.

Economic "Fatigue" Spreads Across Regional Feds

National trends can be seen in macro data, but regional Fed reports are more like putting the camera close to businesses and households, making it clear that the cooling of the U.S. economy is not uniform but shows a "distributed fatigue."

In the Northeast, businesses in the Boston district generally reported slight expansion in economic activity, and home sales regained some momentum after a long stagnation. But consumer spending only held steady, employment declined slightly, and wage growth became moderate. Rising food costs pushed up grocery prices, but overall price pressure remained controllable, and the overall outlook remained cautiously optimistic.

The situation in the New York area is noticeably colder. There, economic activity declined moderately, many large employers began layoffs, and employment shrank slightly. Price increases have slowed but remain high; manufacturing has slightly recovered, but consumer spending remains weak, with only high-end retail showing resilience. Business expectations for the future are generally low, and many believe the economy is unlikely to improve significantly in the short term.

Further south, the Philadelphia Fed describes a reality where "weakness appeared even before the shutdown." Most industries are experiencing moderate declines, employment is decreasing in tandem, and price pressures are squeezing the living space of middle- and low-income families, while recent policy changes have left many small and medium-sized enterprises feeling cornered.

Further down, the Richmond district appears slightly more resilient. The overall economy maintains moderate growth, consumers are still hesitant about large purchases, but daily consumption continues to grow slowly. Manufacturing activity contracted slightly, while other industries remained roughly flat. Employment did not change significantly, employers prefer to maintain existing team sizes, and both wages and prices are rising moderately.

The Atlanta Fed's southern region is more like a "standing still" state: economic activity is generally flat, employment is stable, and both prices and wages are rising moderately. Retail growth has slowed, tourism has declined slightly, real estate remains under pressure, but commercial real estate shows some signs of stabilization. Energy demand has grown slightly, and manufacturing and transportation are operating at low speeds.

In the central St. Louis district, overall economic activity and employment show "no significant change," but demand is further slowing due to the government shutdown. Prices are rising moderately, but businesses are generally worried that the increase will expand in the next six months. Under the dual pressure of economic slowdown and rising costs, local business confidence has become slightly pessimistic.

Piecing together these regional reports, we can see the outline of the U.S. economy: no full-blown recession, no obvious recovery, but rather varying degrees of fatigue scattered throughout. It is this set of "different temperatures" from local samples that forces the Federal Reserve to face a more realistic problem before the next meeting—the cost of high interest rates is fermenting in every corner.

Federal Reserve Officials Shift Their Stance

If the "Beige Book" presents the "expression" of the real economy clearly enough, then the statements of Federal Reserve officials over the past two weeks further reveal that the policy level is quietly shifting. Subtle changes in tone may seem like mere wording adjustments to outsiders, but at this stage, any change in tone often means a shift in internal risk assessment.

Several heavyweight officials have begun to emphasize the same fact: the U.S. economy is cooling, prices are falling faster than expected, and the slowdown in the labor market is "worth watching." Compared to their almost unanimous stance over the past year of "maintaining a sufficiently tight policy environment," the tone has clearly softened. In particular, statements about employment have become especially cautious, with some officials frequently using words like "stable," "slowing," and "moving toward a more balanced direction," rather than emphasizing "still overheated."

This way of describing things rarely appears at the end of a hawkish cycle; it is more like a tactful expression of "we have seen some preliminary signs, and current policy may already be tight enough."

Some officials have even begun to explicitly mention that excessive tightening of policy would bring unnecessary economic risks. The appearance of this statement is itself a signal: when they start to guard against the side effects of "over-tightening," it means the policy direction is no longer one-way but has entered a stage that requires fine-tuning and balance.

These changes have not escaped the market's attention. Interest rate traders were the first to react, and futures market pricing showed significant jumps within a few days. The rate cut expectation, originally thought to be "at the earliest by mid-next year," has gradually been brought forward to spring. The "rate cut before mid-year," which no one dared to discuss publicly a few weeks ago, has now appeared in many investment banks' baseline forecasts. The market logic is not complicated:

If employment continues to weaken, inflation continues to decline, and economic growth hovers near zero for a long time, maintaining excessively high interest rates will only make the problem worse. The Federal Reserve will ultimately have to choose between "persisting with tightening" and "preventing a hard economic landing," and from current signs, the balance is beginning to tilt slightly.

Therefore, as the "Beige Book" depicts the economy cooling to "slightly chilly," the Federal Reserve's attitude change and the market's repricing behavior are beginning to corroborate each other. The same narrative logic is taking shape: the U.S. economy is not plummeting, but its momentum is slowly running out; inflation has not completely disappeared, but it is moving in a "controllable" direction; policy has not clearly shifted, but it is no longer in last year's unhesitating tightening posture.

A New Cycle of Global Liquidity

Japan's 11.5 Trillion Yen New Debt and Underlying Anxiety

While expectations are loosening in the U.S., major overseas economies are also quietly pushing the curtain up on "global reflation," such as Japan.

The scale of Japan's latest stimulus plan is much larger than the outside world imagined. On November 26, multiple media outlets cited sources saying that Prime Minister Sanae Takaichi's government would issue at least 11.5 trillion yen (about $73.5 billion) in new bonds for the latest economic stimulus package. This scale is almost twice the size of the stimulus budget during the Shigeru Ishiba period last year. In other words, Japan's fiscal direction has shifted from "cautious" to "must support the economy."

Although authorities expect tax revenue to reach a record 80.7 trillion yen this fiscal year, the market is not reassured. Investors are more concerned about Japan's long-term fiscal sustainability. This also explains why the yen has been continuously sold off recently, Japanese government bond yields have soared to a 20-year high, and the USD/JPY exchange rate has remained high.

At the same time, this stimulus plan is expected to bring a real GDP boost of 24 trillion yen, with an overall economic impact close to $26.5 billion.

Domestically, Japan is also trying to use subsidies to suppress short-term inflation, such as a 7,000 yen utility subsidy per household to be distributed for three consecutive months to stabilize consumer confidence. But the deeper impact is on capital flows—the continued weakening of the yen is prompting more and more Asian funds to consider new allocation directions, and crypto assets are right at the forefront of the risk curve they are willing to test.

Crypto analyst Ash Crypto has already discussed Japan's "money printing" move together with the Federal Reserve's policy shift, believing it will push the risk appetite cycle all the way to 2026. And Dr. Jack Kruse, a long-time Bitcoin supporter, interprets it more directly: high Japanese bond yields themselves are a signal of pressure on the fiat system, and Bitcoin is one of the few assets that can continue to prove itself in such cycles.

The UK's Debt Crisis Feels Like 2008 Again

Now let's look at the UK, which has recently stirred up quite a storm.

If Japan is flooding the market and China is stabilizing liquidity, then the UK's current fiscal operations look more like adding more weight to an already leaking ship. The latest budget announcement has almost caused collective frowns in London's financial circles.

The Institute for Fiscal Studies, regarded as one of the most authoritative analytical institutions, gave an unequivocal assessment: "Spend now, pay later." In other words, spending is rolled out immediately, but tax increases will only take effect in a few years—this is a standard fiscal structure of "leaving the problem to future governments."

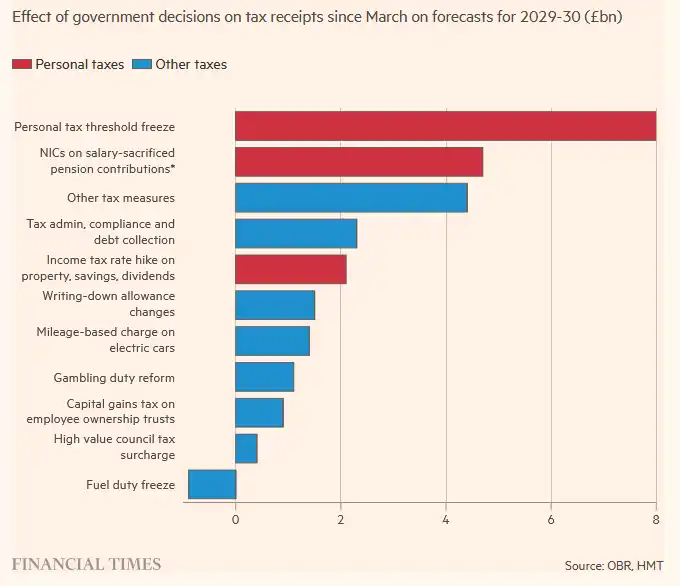

The most eye-catching part of the budget is the extension of the personal income tax threshold freeze. This seemingly minor technical move will contribute £12.7 billion to the Treasury in the 2030-31 fiscal year. According to the Office for Budget Responsibility, by the end of the budget cycle, a quarter of UK workers will be pushed into the higher 40% tax bracket. This means that even if Labour MPs applaud increases in landlord and dividend taxes, it is still the ordinary working class that will bear the brunt in the long run.

In addition, tax increases are coming one after another: the tax relief for pension salary sacrifice schemes will be limited, expected to contribute nearly £5 billion by 2029-30; from 2028, properties worth over £2 million will be subject to an annual "mansion tax"; from 2026, dividend tax will rise by two percentage points, with the basic and higher rates jumping to 10.75% and 35.75%. All these seemingly "tax the rich" policies will ultimately be transmitted to society in more subtle ways.

The tax increases are exchanged for an immediate expansion of welfare spending. According to OBR estimates, by 2029-30, annual welfare spending will be £16 billion higher than previously forecast, including extra costs from overturning the "two-child benefit cap." The outline of fiscal pressure is becoming increasingly clear: short-term political dividends, long-term fiscal black holes.

This year's budget backlash is fiercer than in previous years, partly because the UK's fiscal gap is no longer just "a bit wider," but is approaching crisis levels. In the past seven months, the UK government has borrowed £117 billion, almost equal to the scale of the entire bank bailout during the 2008 financial crisis. In other words, the debt black hole the UK is creating now is crisis-sized, even without a crisis.

Even the usually moderate Financial Times has rarely used the word "brutal," pointing out that the government still does not understand a basic issue: in a long-term stagnant economy, repeatedly raising tax rates to fill the gap is doomed to fail.

The market's view of the UK has become extremely pessimistic: the UK is "out of money," and the ruling party seems to have no viable growth path, only pointing to higher taxes, weaker productivity, and higher unemployment. As the fiscal gap continues to widen, debt is likely to be "effectively monetized"—the ultimate pressure will fall on the pound, becoming the market's "escape valve."

This is also why more and more analyses are spreading from traditional finance to the crypto world, with some directly concluding: when currency begins to be passively devalued, and wage earners and the asset-less are slowly pushed to the edge, the only thing that cannot be arbitrarily diluted is hard assets—including Bitcoin.

Christmas or Christmas Crash?

At the end of every year, the market habitually asks: is this year going to be "Christmas" or a "Christmas crash"?

Thanksgiving is almost over, and its "seasonal benefit" for U.S. stocks has been talked about in the market for decades.

The difference this year is that the correlation between the crypto market and U.S. stocks is already close to 0.8, with their ups and downs almost synchronized. On-chain accumulation signals are strengthening, and the low liquidity during holidays often amplifies any upward movement into a "vacuum rebound."

The crypto community is also repeatedly emphasizing the same thing: holidays are the easiest window for short-term trend markets to appear. Low trading volume means that lighter buying can push prices out of dense trading zones, especially when sentiment is cool and chips are more stable.

You can sense that market consensus is quietly forming: if U.S. stocks start a small rebound after Black Friday, crypto will be the most reactive asset class; and Ethereum is seen by many institutions as "equivalent to a high-beta small-cap stock."

Going further, shifting the focus from Thanksgiving to Christmas, the core discussion has changed from "will the market rise" to "will this seasonal rebound continue into next year."

The so-called "Santa Claus Rally" was first proposed in 1972 by Stock Trader's Almanac founder Yale Hirsch and gradually became one of the many seasonal effects in U.S. stocks. It refers to the last five trading days of December and the first two trading days of the following year, during which U.S. stocks usually see a rise.

The S&P 500 has closed higher around Christmas in 58 out of the past 73 years, with a win rate close to 80%.

More importantly, if the Santa Claus Rally occurs, it may be a precursor to a good performance in the stock market the following year. According to Yale Hirsch's analysis, if the Santa Claus Rally, the first five trading days of the new year, and the January Barometer are all positive, then the U.S. stock market is likely to perform well in the new year.

In other words, these few days at the end of the year are the most indicative micro window of the whole year.

For Bitcoin, the fourth quarter itself is historically the easiest period for it to start a trend. Whether it was the early miner cycle or the later institutional allocation rhythm, Q4 has become a natural "right-side market season." And this year, it is compounded by new variables: U.S. rate cut expectations, improved Asian liquidity, enhanced regulatory clarity, and institutional position inflows.

So the question becomes a more realistic judgment: if U.S. stocks enter a Santa Claus Rally, will Bitcoin rise even more sharply? If U.S. stocks don't rally, will Bitcoin go its own way?

All of this will determine whether crypto industry practitioners will have a Christmas or a Christmas crash.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Another Thanksgiving arrives, and crypto donations become a new trend

Now is the right time for crypto for good.

CME Group Halts Trading After Cooling Failure Disrupts Global Markets

UK’s Crypto Promo Rules “Holding Back Innovation,” Says Aave Founder

Worldcoin Price Prediction 2025, 2026 – 2030: Will WLD Price Reach $10?