Key Notes

- This is the US Fed’s second-largest liquidity operation since COVID-19.

- Fundstrat’s Tom Lee expects improved liquidity to benefit risk assets, projecting a potential Bitcoin rally to all-time highs by January 2026.

- However, market uncertainty remains as BOJ rate hike odds for December rise to 81%.

By officially putting an end to the quantitative tightening (QT) on Dec. 1, the US Federal Reserve has initiated the first steps for liquidity expansion. Market experts see this as a stepping stone for the next major crypto rally.

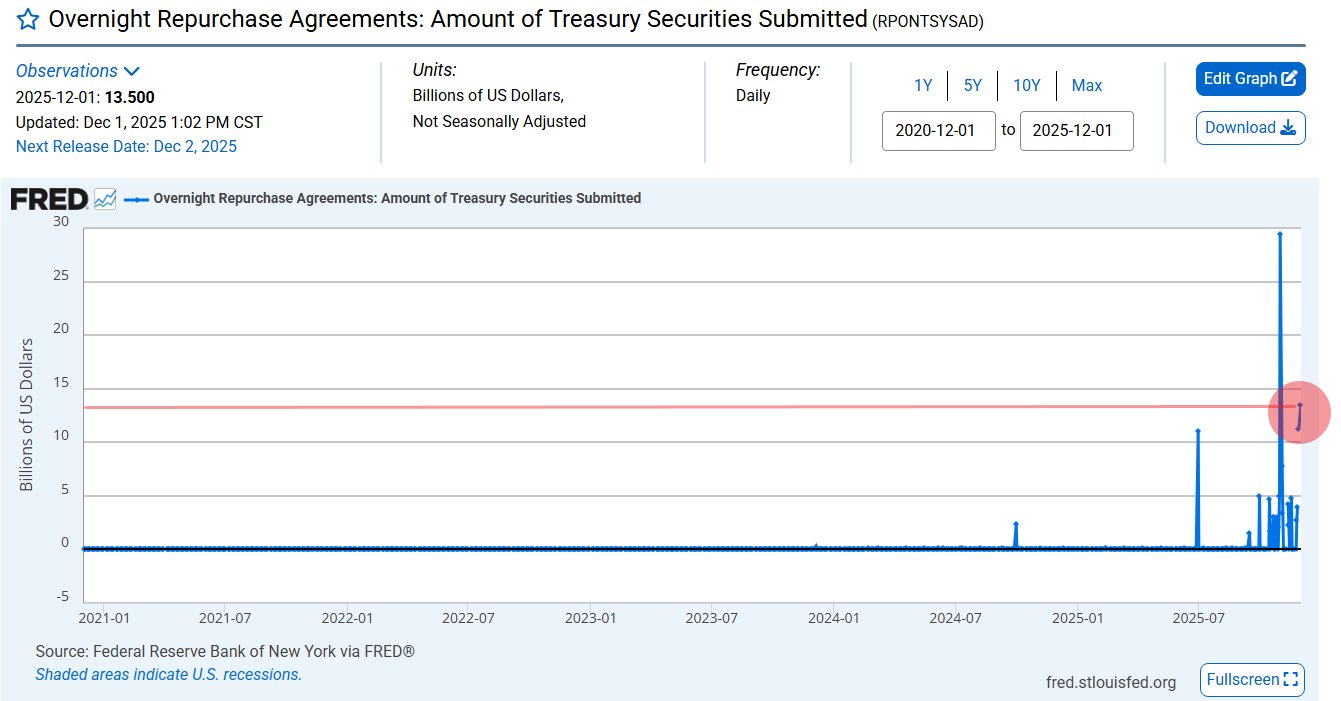

US Fed Injects $13.5 Billion in Banking System

The US Federal Reserve injected $13.5 billion into the banking system through overnight repurchase agreements. This marks the second-largest single-day liquidity operation since the COVID-19 crisis. The move also exceeds the peak repo injections recorded during the Dot-Com bubble.

US Fed Liquidity Injection | Source: Barchat

The operation signals heightened short-term funding demand within the banking sector. This could ultimately bode well for risk-on assets such as US equities and even the crypto market.

The Federal Reserve has officially halted its Quantitative Tightening program as of December 1, 2025, marking a notable shift in US monetary policy. The decision comes after the central bank withdrew approximately $2.4 trillion from the financial system since the tightening cycle began in June 2022. However, just ahead of the Fed officially ending QT, the crypto market faced a major pullback.

Experts Remain Divided on What Happens Next in the Crypto Market

Fundstrat’s Tom Lee said the Federal Reserve’s decision to halt quantitative tightening would be a turning point for the crypto market. Lee noted that the last time the Fed ended QT, markets rallied roughly 17% within three weeks.

Moreover, Lee believes that this shift is particularly relevant for Bitcoin

BTC $89 124 24h volatility: 3.6% Market cap: $1.78 T Vol. 24h: $76.43 B , as improved liquidity historically supports stronger performance in risk assets. He expects market conditions to strengthen into year-end and is projecting a potential new Bitcoin all-time high by late January.Following the end of QT, everyone is eagerly eyeing the Fed rate cuts scheduled ahead during the December FOMC. But on the other hand, market analyst Ted Pillows noted that the probability of a Bank of Japan (BOJ) rate hike at the December meeting has climbed to 81%.

BOJ rate hike odds in December are now at 81%.

BOJ first rate hike happened in March 2024.

The 2nd one happened in July 2024, and the last one happened in January 2025.

Interestingly, after each rate hike, BTC and the crypto market dumped. pic.twitter.com/XcCaj2HSZT

— Ted (@TedPillows) December 1, 2025

The BOJ has raised rates three times in the current tightening cycle, in March 2024, July 2024, and most recently in January 2025. Pillows highlighted that each of these rate hikes was followed by a broad selloff in Bitcoin and the wider crypto market.

next