The new Federal Reserve chairman could bring the possibility of a wild bull market

Accelerating rate cuts and resuming QE?

Author: Cookie, BlockBeats

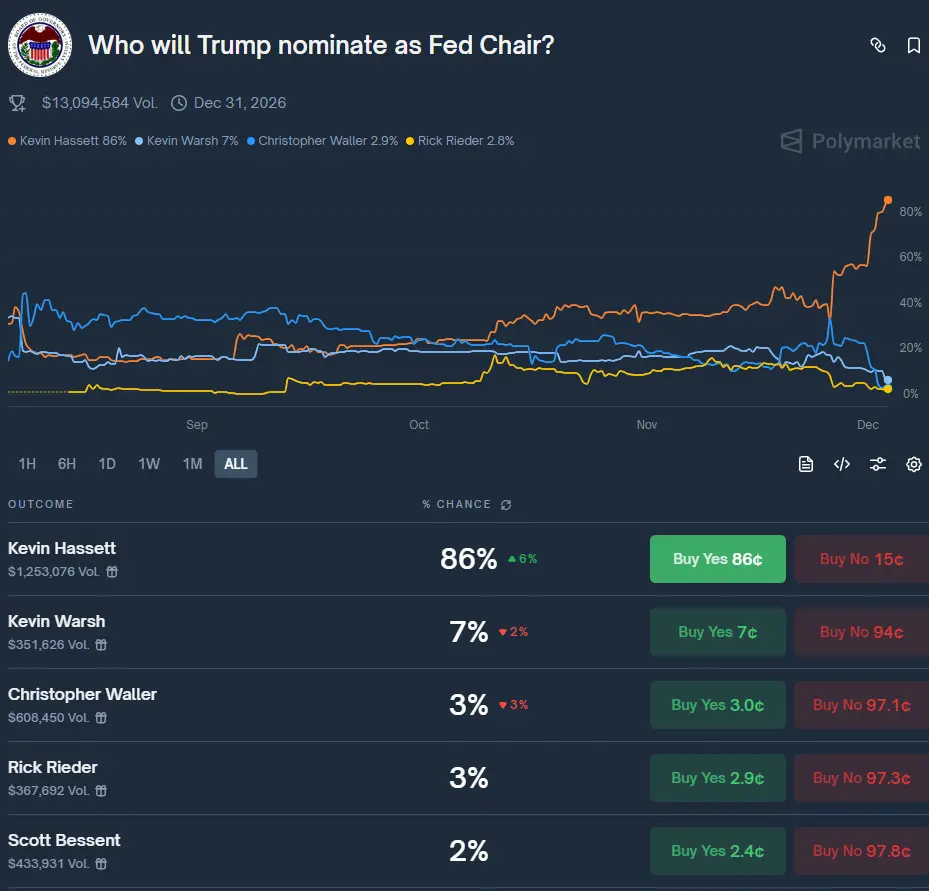

On the prediction market Polymarket, the probability of Hassett being elected as the next Federal Reserve Chair has risen to 86%, far ahead of other potential candidates for the position.

Barring any surprises, Kevin Hassett is expected to be the next Federal Reserve Chair, Trump’s favorite.

The actions of the Federal Reserve have always been a major factor influencing the cryptocurrency market. So, if Hassett ultimately becomes the new Federal Reserve Chair as the market expects, what impact is anticipated on the market?

Accelerated Rate Cuts

At the end of November, Hassett stated that pausing rate cuts at this time would be "a very bad time," as the government shutdown had already dragged down economic growth in the fourth quarter. He predicted that the government shutdown would cause the fourth quarter GDP to drop by 1.5 percentage points. Meanwhile, he pointed out that the September Consumer Price Index (CPI) showed inflation was better than expected.

Earlier, on November 13, Hassett said he expected fourth quarter GDP to fall by 1.5% due to the government shutdown. He saw little reason not to cut rates.

Therefore, if Hassett becomes the new Federal Reserve Chair, he is expected to push for faster rate cuts, possibly lowering the federal funds rate below 3%, or even close to 1%, to stimulate economic growth and employment.

This is also what Trump wants to see.

Resuming QE

On December 1, the Federal Reserve officially ended its quantitative tightening (QT) policy, marking the end of the balance sheet reduction process that began in 2022. Although some believe the effects may not be seen until early next year, expectations for looser liquidity are gradually being realized.

Hassett may be more tolerant of inflation, viewing the 2% inflation target as a flexible upper limit rather than a strict anchor. He would focus on employment and GDP growth, reducing reliance on data-driven "gradual" decisions and shifting toward more proactive, pro-growth interventions.

In September this year, Hassett said in an interview with Fox Business that the US is in a period of supply-side prosperity, and in an economy without real inflation, current interest rates are hindering economic growth and job creation. He also stated that the US is expected to achieve 4% GDP growth.

With a focus on economic development rather than inflation control, it is reasonable to expect that the Federal Reserve under Hassett could restart QE.

Impact on Bitcoin

Every Federal Reserve Chair candidate, whether or not they directly discuss crypto topics, will have a structural impact on the cryptocurrency industry. Hassett, however, has an undeniable connection to the crypto industry: he has publicly held Coinbase stock worth millions of dollars and has served as a member of Coinbase’s advisory board.

In addition, he has participated in White House working groups on digital asset policy, promoted regulatory frameworks that leave room for innovation, and believes that crypto technology is an important variable affecting the future economic structure. He once stated that Bitcoin would "rewrite the rules of finance."

Hassett’s crypto background may reduce regulatory uncertainty, promote institutional adoption, and encourage the Federal Reserve to explore crypto integration. This could enhance Bitcoin’s legitimacy and liquidity, potentially pushing its price to new highs.

Many traders are optimistic about the market after Hassett takes office, believing that his appointment will mark the beginning of a bull market, expected around mid-next year (UTC+8), making the second half of 2026 crucial for the cryptocurrency industry.

Recommended Reading:

Rewriting the 2018 script: Will the end of the US government shutdown = a Bitcoin price surge?

1.1 billions USD worth of stablecoins evaporate: What’s the truth behind the DeFi chain explosions?

MMT short squeeze review: A carefully designed money-grabbing game

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Volatility Weekly Review (November 17 - December 1)

Key metrics (from 4:00 PM HKT on November 17 to 4:00 PM HKT on December 1): BTC/USD: -9.6% (...

When all GameFi tokens have dropped out of the TOP 100, can COC reignite the narrative with a Bitcoin economic model?

On November 27, $COC mining will be launched. The opportunity to mine the first block won't wait for anyone.

Ethereum's Next Decade: From "Verifiable Computer" to "Internet Property Rights"

Fede, the founder of LambdaClass, provides an in-depth explanation of anti-fragility, the 1 Gigagas scaling goal, and the vision for Lean Ethereum.

The reason behind the global risk asset "Tuesday rebound": a "major change" at asset management giant Vanguard Group

This conservative giant, which had previously firmly resisted crypto assets, has finally compromised and officially opened bitcoin ETF trading access to its 8 million clients.