Key Notes

- The $1.6 trillion asset manager received SEC approval and NYSE listing within one week of final filing submission.

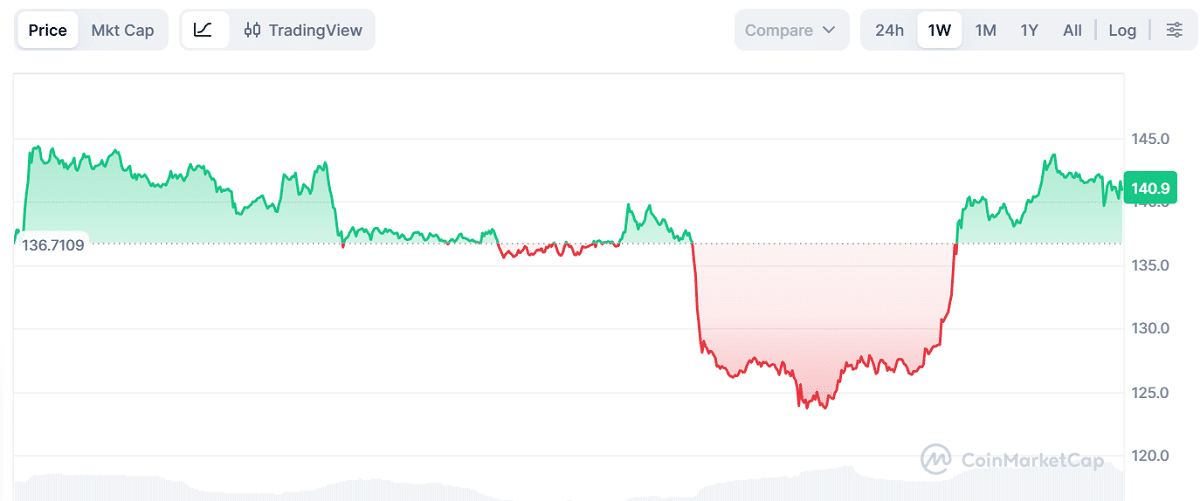

- SOL price stabilized around $140 following recent volatility, supported by strong ETF inflows over 48 hours.

- Franklin's crypto portfolio now includes eight major digital assets through SOEZ and its existing EZPZ index fund.

US-based investment holdings firm Franklin Templeton’s Solana ETF has officially begun live trading on the New York Stock Exchange (NYSE) Arca platform.

The launch comes as multiple Solana ETFs have recently entered a period of increased positive inflows with total assets reaching more than $933 million .

Franklin Templeton’s entry into the space marks one of the largest traditional finance institutions to launch a Solana ETF. The firm reports more than $1.6 trillion in current assets under management as of Dec. 2.

Another Meme-Worthy Ticker From a TradFi Institution

The firm was quick to celebrate the meme-worthiness of the NYSE-registered ticker name for its Solana ETF, “SOEZ,” posting that “this one was so easy” on twitter.com to mark the ETF’s launch.

This one was so easy.

Ticker name decider guy here at @FTI_US on an absolute heater this quarter.

Franklin Solana ETF – $SOEZ is now live, making exposure to $SOL almost too easy? pic.twitter.com/bBA0YfB2LG

— Franklin Templeton Digital Assets (@FTDA_US) December 3, 2025

SOEZ joins Franklin’s “EZPZ” crypto Index ETF which recently expanded its holdings to include XRP XRP $2.19 24h volatility: 1.6% Market cap: $132.14 B Vol. 24h: $3.81 B , Solana SOL $141.5 24h volatility: 2.0% Market cap: $79.17 B Vol. 24h: $5.82 B , Dogecoin DOGE $0.15 24h volatility: 3.8% Market cap: $22.87 B Vol. 24h: $1.46 B , Cardano ADA $0.45 24h volatility: 2.3% Market cap: $16.29 B Vol. 24h: $766.77 M , Stellar Lumens XLM $0.26 24h volatility: 0.5% Market cap: $8.31 B Vol. 24h: $201.46 M , and Chainlink LINK $14.39 24h volatility: 8.0% Market cap: $10.03 B Vol. 24h: $1.24 B alongside Bitcoin BTC $93 175 24h volatility: 2.4% Market cap: $1.86 T Vol. 24h: $80.99 B and Ethereum ETH $3 134 24h volatility: 5.1% Market cap: $377.91 B Vol. 24h: $27.37 B .

As Coinspeaker recently reported , Franklin Templeton submitted its final regulatory filing for the launch of its SOEZ ETF to the US Securities and Exchange Commission (SEC) on Nov. 26. The subsequent SEC approval and NYSE Arca listing occurred in a matter of just one week including a US federal holiday (Thanksgiving) and weekend.

In the wake of the Dec. 3 SOEZ launch, the price of SOL experienced mild volatility before settling at $141.13 as of the time of this article’s publication. On Nov. 28 the price of SOL dipped from about $143 to $137 ultimately dropping to around $123 by Dec. 1.

Solana appears to be hovering around the $140 mark as trading begins for SOEZ | Source: CoinMarketCap .

However, strong ETF inflows over the 48 hours after the drop shored the price back up to the $140 range. It remains to be seen if the Franklin Templeton ETF will contribute further to SOL’s return to the $200+ mark it last held in October.

next