I. Project Overview

Talus Network is an AI Agent Layer 1 built with the Move language, designed to enable the deployment, coordination, and monetization of AI agents through blockchain technology. Its core components include the Talus Agentic Framework (TAF) and the Nexus protocol, which together support fully on-chain workflows for DeFi, gaming, and consumer AI applications.

Compared with traditional AI+Crypto projects, Talus focuses on a verifiable on-chain execution layer. It introduces agent-vs-agent markets and an autonomous digital economy to create a transparent, trust-minimized environment where AI agents can compete and monetize on-chain.

Talus has released its litepaper and established partnerships with Walrus, Sui, and others to enhance data availability and agent autonomy. A recent Messari report positions Talus as foundational infrastructure for on-chain execution in the emerging digital economy. Its zero-inflation, utility-driven token model further strengthens the value base of $US. The project has launched its staking module and Talus Vision demo, progressing toward mainnet launch and full decentralization.

II. Key Features

Talus is built around autonomous Smart Agents, which are AI programs capable of decision-making, task execution, and interaction with other digital entities entirely on-chain.

Core products include:

Nexus Protocol: Enables workflow execution and coordination for AI agents.

IDOL.fun: A prediction-market-style platform supporting agent-vs-agent battles and competitive forecasting.

Talus Vision: A no-code visual workflow builder that allows users to deploy AI agents.

Talus positions itself as decentralized execution infrastructure for AI agents, offering transparency and verifiability. Highlights include: building a complete on-chain AI workflow ecosystem; enabling autonomous economic activity between agents; deep technical collaboration with infrastructures like Sui to enhance data availability and modularity; and a unique zero-inflation, burn-driven token model.

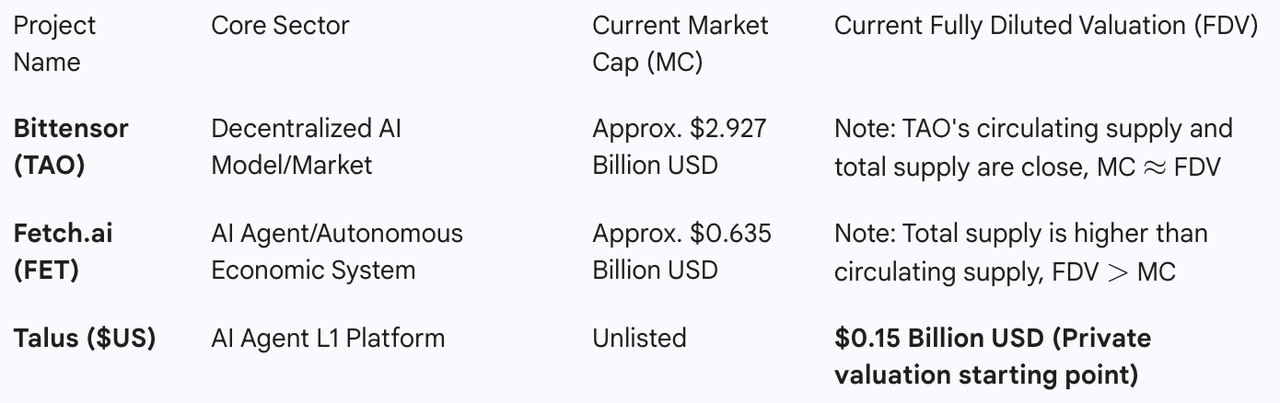

III. Market Valuation Outlook

Talus Network serves as foundational infrastructure for decentralized AI agents, capturing strong real-world applicability and network effects. Having completed multiple funding rounds at a valuation of $150M, with a total token supply of 10 billion and a TGE circulating supply of 222 million, its token utility includes execution fees, node staking, and governance. As AI and blockchain continue converging, Talus is evolving into a key protocol for on-chain AI execution.

Initial circulating supply valuation:

Total supply: 10 billion $US

Initial circulating supply (self-reported): approx. 2.2 billion $US (22%)

If launched at a $1B FDV, the initial token price would be $0.10

Initial circulating market cap = 2.2B × $0.10 = $220M

Initial FDV reference chart:

IV. Token Economics

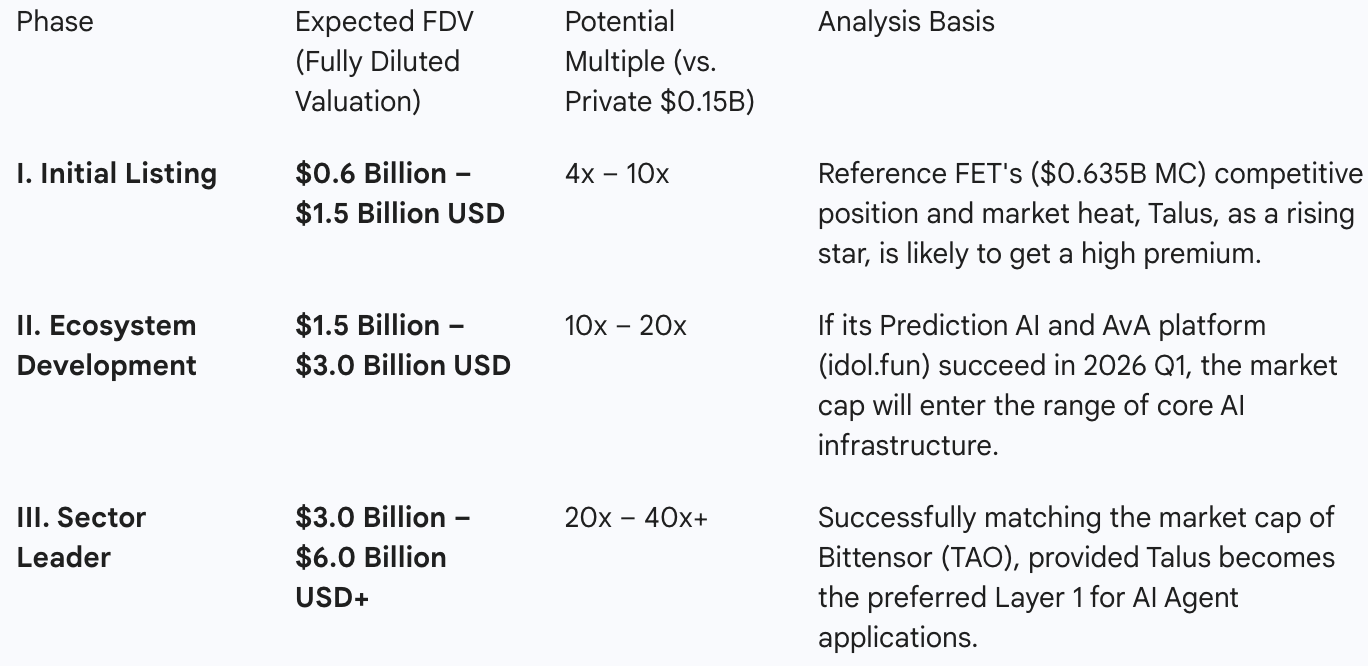

$US has a total supply of 10 billion, distributed as follows:

Distribution scheme:

Community & Ecosystem 30% — incentives for users, developers, and ecosystem expansion; 36-month linear unlock.

Core Contributors 22% — rewards for the development team; 12-month lockup followed by linear unlocking

Investors 20.5% — early supporters; locked for 12–36 months.

Foundation 20% — operations and strategic reserve.

Bootstrapping & Airdrops 7.5% — early user incentives and network bootstrapping.

Token utilities include:

Payment: Fees for AI agent execution and trusted on-chain services;

Staking: Used for node coordination, tool registration, yield distribution, and network security;

Governance: Participation in DAO governance with decision-making privileges;

Access: Payment for advanced AI agent features and complex workflow services.

V. Team and Funding

Co-founder and CEO Mike Hanono oversees strategic direction and long-term vision. He previously held key positions at Nvidia, IBM, and Render, with expertise in AI and distributed systems. COO Ben Frigon focuses on ecosystem development, community operations, market expansion, and partnerships. The team currently consists of 11–50 members, primarily from major global tech companies.

Talus has raised over $10M in total funding, with major backers including Polychain Capital, complemented by strategic support from Sui Foundation and Walrus.

Funding history:

Early 2024: Seed round of ~$3M from Polychain Capital, dao5, Hash3, TRGC, and others;

Nov 2024: Strategic round of ~$6M at a $150M valuation led by Polychain Capital with participation from Foresight Ventures, Animoca Brands, etc.

Sep 2025: Additional strategic investment from Sui Foundation, Walrus Protocol, and others, raising cumulative funding to over $10M.

VI. Risk Considerations

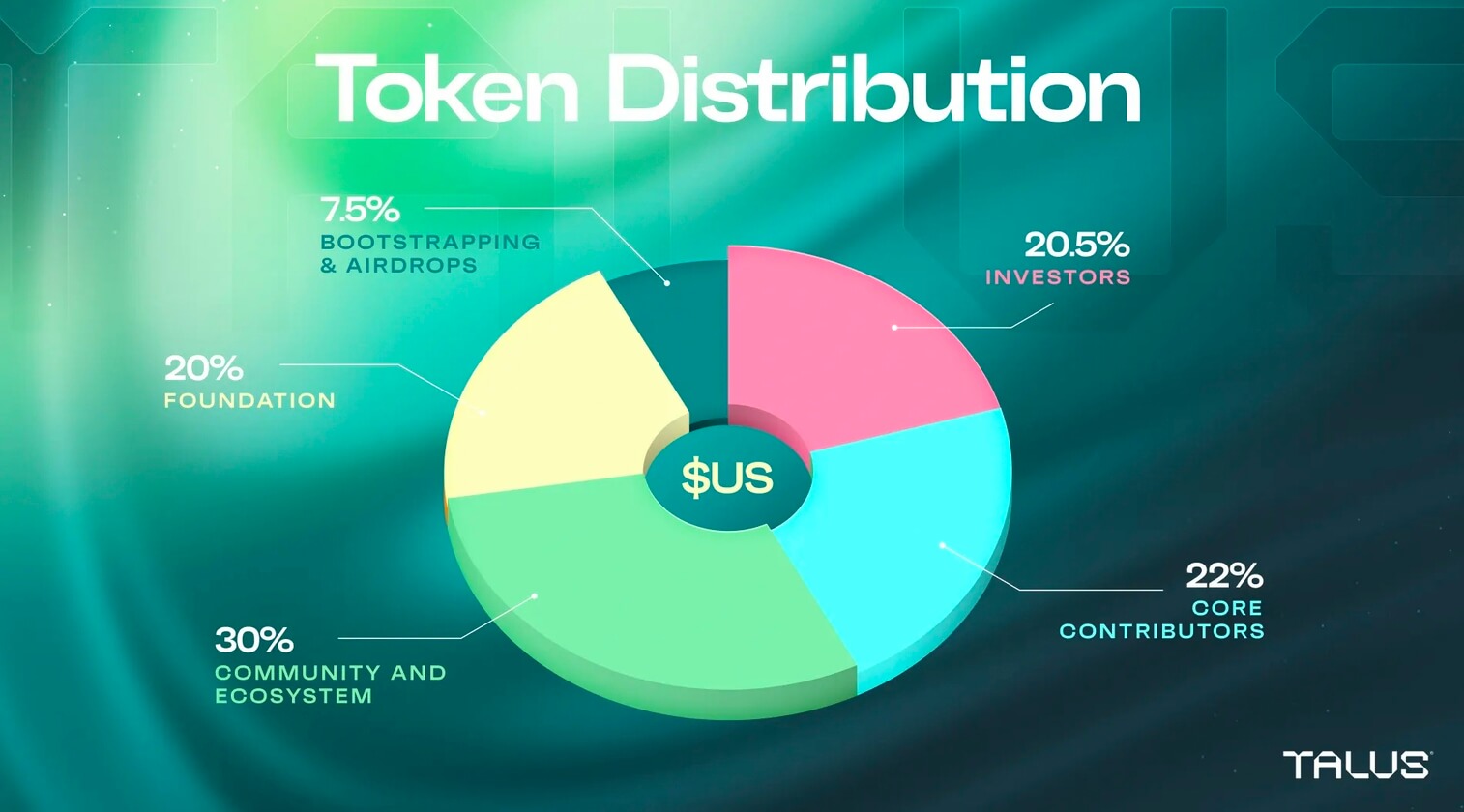

$US unlock analysis:

Unlock percentage remains low (≈20–25%) during the first 12 months;

First significant unlock jump occurs at month 12;

Months 12–36 represent the primary unlock period, rising from 25% to ~85%;

Months 36–48 release the remaining supply, reaching 100% with a slower curve.

Total unlock period spans 48 months. Month 12 is the most critical supply shock point, when Foundation, Investors, and Core Contributors begin unlocking. Approximately 85% of all tokens are unlocked before month 36. Community & Ecosystem tokens represent the largest and most long-term unlocking tranche.

Sell pressure factors:

Potential post-listing speculative surges or inflated valuations;

Significant unlock-related volatility around the 12-month mark.

VII. Official Links

Disclaimer: This report is AI-generated and does not constitute investment advice.