Analyst: BTC short-term holders "capitulate," current market faces localized pressure

Jinse Finance reported that CryptoQuant analyst Axel Adler Jr stated on social media that the Bitcoin market is currently in a correction phase, having pulled back 30% from its all-time high. Two on-chain indicators—the Short-Term Holder Spent Output Profit Ratio (STH SOPR) and the Profit/Loss Block (P/L Block)—show that market participants are realizing losses and market sentiment is deteriorating. Short-term holders are exhibiting capitulation behavior, and the current market is facing localized pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

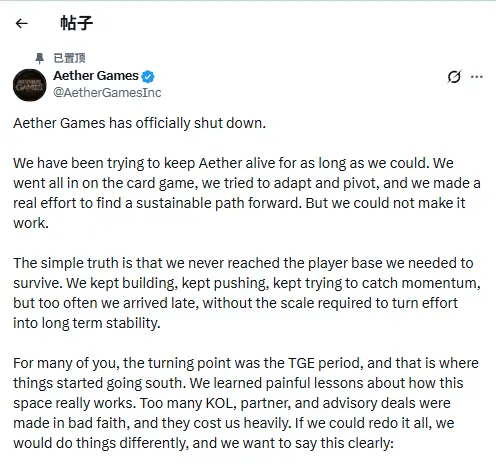

Aether Games announces official cessation of operations

14 out of the 25 largest banks in the United States are developing bitcoin products

Glassnode: Bitcoin Faces Resistance at $94,000, Derivatives and On-Chain Signals Remain Cautious

Scam Sniffer: A user lost over $560,000 worth of aEthUSDT tokens after signing a malicious "authorization" signature