Morning News | Infrared to conduct TGE on December 17; YO Labs completes $10 million Series A financing; US SEC issues crypto asset custody guidelines

A summary of major market events on December 14.

Compiled by: ChainCatcher

Key News:

- Wu Jiezhuang: The development of stablecoins in Hong Kong will move forward steadily, and different industries can boldly explore the integration of RWA and Web3

- Justice Net published an article suggesting the exploration of three disposal measures for criminal virtual currency cases: "liquidation, destruction, and return"

- Analysis: Due to investor de-risking, exchange leverage ratio has dropped to the lowest level in five months

- US SEC issues crypto asset custody guidelines, systematically reviewing wallet types and major risks

- Berachain liquid staking protocol Infrared to conduct TGE on December 17

- Crypto yield optimization protocol YO Labs completes $10 million Series A funding round, led by Foundation Capital

What important events happened in the past 24 hours?

Wu Jiezhuang: The development of stablecoins in Hong Kong will move forward steadily, and different industries can boldly explore the integration of RWA and Web3

ChainCatcher reports that Hong Kong Legislative Council member Wu Jiezhuang posted on X, stating that he will continue to promote the development of Web3 in Hong Kong. He shared his views on the future direction of stablecoins and the development of RWA as follows:

He believes that the development of stablecoins in Hong Kong will not undergo major changes and will continue to move forward steadily. The Stablecoin Ordinance Bill was passed in the seventh Legislative Council after a long period of brewing and discussion. The overall development will be in line with the actual financial environment of both the international community and Hong Kong, progressing steadily, starting with the local market as a trial, with the goal of developing the international market and leveraging Hong Kong's status as a financial and innovation center.

RWA is a topic that is currently widely discussed in both traditional and Web3 industries. Hong Kong has already promoted a regulatory sandbox, and it is believed that the sandbox will explore the importance of compliant development and the direction of future regulation. He believes that different industries can boldly try to integrate Web3 technology, which will drive the development of a large number of real-world applications.

Developer demand is increasing rapidly. More and more companies in Web3 public chains, compliant trading platforms, and underlying infrastructure are setting up in Hong Kong. The success of developers is closely linked to tech innovation companies. In the future, efforts will be made to help the industry build a talent ecosystem and attract more developers and practitioners to settle in Hong Kong.

Coinbase CEO: Crypto promotes the creation of property rights and a sound monetary system, but institutional reforms such as deregulation are still needed

ChainCatcher reports that Coinbase CEO Brian Armstrong posted on social media, stating, "Crypto helps create property rights, a sound monetary system, and free trade for everyone. But it is not a panacea; institutional reforms such as deregulation and eliminating corruption are still needed."

ChainCatcher reports that Strategy founder Michael Saylor has once again released information related to the Bitcoin Tracker.

According to previous patterns, Strategy always discloses additional Bitcoin purchases the day after such information is released.

10x Research: Bitcoin's four-year cycle still exists, but the driving force has shifted from halving to politics and liquidity

ChainCatcher reports, citing Cointelegraph, that Markus Thielen, Head of Research at 10x Research, stated that Bitcoin's four-year cycle still exists, but its main driving factors are no longer halving events, but rather political factors, liquidity environment, and election cycles.

The Bitcoin market reached historical peaks in 2013, 2017, and 2021. This year, against the backdrop of recent Fed rate cuts, Bitcoin has not regained strong momentum. The reason is that institutional investors have become the dominant force in the crypto market, but their decision-making is more cautious. With the Fed's policy signals still swinging and overall liquidity tightening, the pace of capital inflows has slowed significantly, weakening the momentum needed for sustained price breakthroughs. Until liquidity improves significantly, Bitcoin is more likely to maintain range-bound consolidation rather than quickly entering a new parabolic rally.

Crypto yield optimization protocol YO Labs completes $10 million Series A funding round, led by Foundation Capital

ChainCatcher reports, citing CoinDesk, that the team behind the crypto yield optimization protocol YO Protocol, YO Labs, announced it has completed a $10 million Series A funding round led by Foundation Capital, with participation from Coinbase Ventures, Scribble Ventures, and Launchpad Capital. To date, its total funding has reached $24 million.

The company plans to use the funds to expand the protocol to more blockchains and improve its infrastructure.

Justice Net published an article suggesting the exploration of three disposal measures for criminal virtual currency cases: "liquidation, destruction, and return"

ChainCatcher reports that Justice Net published an article titled "Establishing Multiple Judicial Disposal Paths for Criminal Virtual Currency Cases." The article proposes improving the judicial disposal path for criminal virtual currency cases:

First, clarify the legal status and role positioning of third-party institutions. Future legislation can include third-party institutions as judicial auction assistants, granting them exclusive qualifications for "one-time, targeted, non-public bidding."

Second, build a dual system of technical standards and procedural norms. The Supreme Court and Supreme Procuratorate, together with financial regulators, should jointly issue dual standards. Price evaluation should use the average price of the 20 days prior to the transaction or the victim's acquisition cost as the benchmark, unify on-chain evidence formats, and transfer liquidation proceeds directly to a fiscal account to prevent funds from flowing back into speculative channels.

Third, strengthen the full-process connection between prosecutorial supervision and rights protection. Prosecutors should participate throughout the disposal process, require third-party institutions to regularly submit progress reports, and establish rights notification and objection mechanisms.

Fourth, explore differentiated disposal models. Differentiated application of liquidation, destruction, and return measures: for cases involving the return of victims' property, priority can be given to targeted bidding liquidation to ensure full compensation. For stablecoins not yet exchanged after victims were defrauded, if the victim wishes to have the original currency returned, it can be directly returned under compliance, avoiding exchange rate losses. For cases involving confiscation of contraband, destruction or technical sealing can be used to prevent re-entry into the market. For tokens used for pyramid schemes or gambling, if liquidity is poor and market depth insufficient, forced liquidation may cause devaluation, so they can be destroyed and the destruction recorded in the judgment. For criminal proceeds mixed with legitimate high-value tokens, liquidation is preferred to recover losses as much as possible. For cases involving small amounts or difficult technical tracing, simplified procedures can be explored, such as comprehensive recognition models, i.e., when the full transaction path cannot be ascertained, comprehensively determine the value and ownership of the virtual currency involved based on relevant evidence.

It is reported that Justice Net is an integrated Internet service platform sponsored by the Procuratorial Daily of the Supreme People's Procuratorate. The authors of this article are a member of the Party Committee and a first-level researcher at the Third Branch of the Beijing People's Procuratorate, a professor and doctoral supervisor at the Law School of Capital University of Economics and Business, and a research assistant at the Center for Integrity and Rule of Law at Capital University of Economics and Business.

Yuzhi Financial's related virtual asset projects exposed for withdrawal restrictions, multiple regions have issued risk warnings

ChainCatcher reports that Yuzhi Financial, which operates under the guise of "virtual asset copy trading," has been accused of attracting investors with high returns. Recently, its virtual asset trading app "HSEX" has been reported by many investors to have withdrawal issues. The platform then required users to pay a "self-certification deposit" equal to 20% of their account balance and raised the withdrawal fee from 10% to 30%.

Previously, the Joint Conference Office for the Prevention and Crackdown on Illegal Financial Activities of Xinyi City, Guangdong Province, the Leading Group Office for the Prevention and Crackdown on Illegal Financial Activities of Yulin City, Guangxi Zhuang Autonomous Region, and the Financial Affairs Center of Shigu District, Hengyang City, Hunan Province, all issued related risk warnings. The Hong Kong Stock Exchange also disclosed that Yuzhi Financial and its related HSEX and HKEX have been repeatedly listed as suspicious websites and have no connection with the Hong Kong Stock Exchange. Industry insiders pointed out that such projects lack real business support and are characterized by high return promises and referral rebates. Investors are reminded to be wary of high-yield temptations in the virtual asset field and to guard against illegal financial risks.

Suspected robbery at a cryptocurrency exchange shop in Mong Kok, Hong Kong

ChainCatcher reports, citing Ming Pao, that a suspected attempted robbery occurred at a cryptocurrency exchange shop in Mong Kok, Hong Kong. Police received a report from a security guard at around 8 p.m., stating that a suspected robbery took place in the stairwell of a mall at 608 Nathan Road.

Preliminary police investigation showed that the 46-year-old male victim was the owner of the cryptocurrency exchange shop at the location. While preparing to close the shop and leave, he was suddenly asked to open the door by two men, suspected of attempting a robbery, and then another suspected accomplice appeared.

The victim and his wife got into a scuffle with the three men. During the process, the male victim's finger was injured and he was sent to Kwong Wah Hospital for treatment, conscious upon arrival. After investigating the scene, police preliminarily believe the victim did not suffer any property loss. They are reviewing CCTV footage and tracking down the suspects. The shop involved is located on the 1st floor of W Plaza President Commercial Building, and a small amount of blood was found on the stairs leading to Soy Street. The case is still under investigation.

Analysis: Due to investor de-risking, exchange leverage ratio has dropped to the lowest level in five months

ChainCatcher reports that analyst Ali posted on X that due to investor de-risking, the leverage ratio on crypto exchanges has dropped to its lowest level in five months.

Data: NFT trading volume down 10% this week, number of buyers down nearly 67%

ChainCatcher reports, citing Crypto.news, that data shows NFT market trading volume fell 10.18% in the past week to $66.71 million. The number of NFT buyers dropped 66.91% to 165,759; the number of sellers dropped 70.44% to 120,912; and the number of NFT transactions fell 13.88%.

Among them, Ethereum network trading volume reached $24.93 million, down 3.02% from the previous week; BNB Chain network trading volume reached $10.83 million, up 45.64%; Solana network trading volume reached $5.65 million, up 48.27%.

US SEC issues crypto asset custody guidelines, systematically reviewing wallet types and major risks

ChainCatcher reports, citing Cointelegraph, that the US Securities and Exchange Commission (SEC) issued crypto wallet and asset custody guidelines for investors on Friday, systematically reviewing the advantages and risks of different crypto asset storage methods.

The guidelines compare self-custody and third-party custody models and remind investors to pay special attention to whether custodians engage in asset rehypothecation or commingle client assets when choosing third-party custody. The SEC also introduced the main differences between hot and cold wallets: hot wallets, being connected to the internet, face higher risks of hacking and cybersecurity threats; cold wallets reduce online attack risks, but if the storage device is damaged, stolen, or the private key is lost, it may result in permanent asset loss. Market participants believe the guidelines indicate a clear shift in the SEC's regulatory attitude toward the crypto industry.

The previous day, SEC Chairman Paul Atkins stated that the traditional financial system is accelerating its migration on-chain, and the SEC has approved DTCC to begin exploring the tokenization of stocks, ETFs, and government bonds.

Berachain liquid staking protocol Infrared to conduct TGE on December 17

ChainCatcher reports, according to an official announcement, that Berachain's liquid staking protocol Infrared has released details of the IR token airdrop. This airdrop aims to reward early community members who continuously used Infrared during the points program, participants in the Boyco pre-deposit event, and users who actively participated in community activities (such as Discord interactions, user surveys, community events, testnet participation, etc.).

The IR token has three main functions: staking to obtain sIR for governance voting rights; participating in profit sharing through buybacks; and token issuance to optimize protocol efficiency and revenue. Users can claim the airdrop in advance through the CEX pre-deposit process, with the three participating centralized exchanges being: Bitget, Gate, and KuCoin.

Key dates are as follows: the centralized exchange pre-deposit window opens at 1:00 (UTC+8) on December 16, closes at 16:00 (UTC+8) on December 17, and the IR token officially launches. All claims permanently end at 08:00 (UTC+8) on January 12, 2026.

Tom Lee: Bitmine will never sell its ETH holdings

ChainCatcher reports, citing Decrypt, that Tom Lee, Chairman of Ethereum treasury company BitMine, stated, "Bitmine is close to holding 4% of the total supply of Ethereum and believes the company will never sell this ETH. If we stake this ETH now, it will generate over $1 million in net income per day."

Meme Hot List

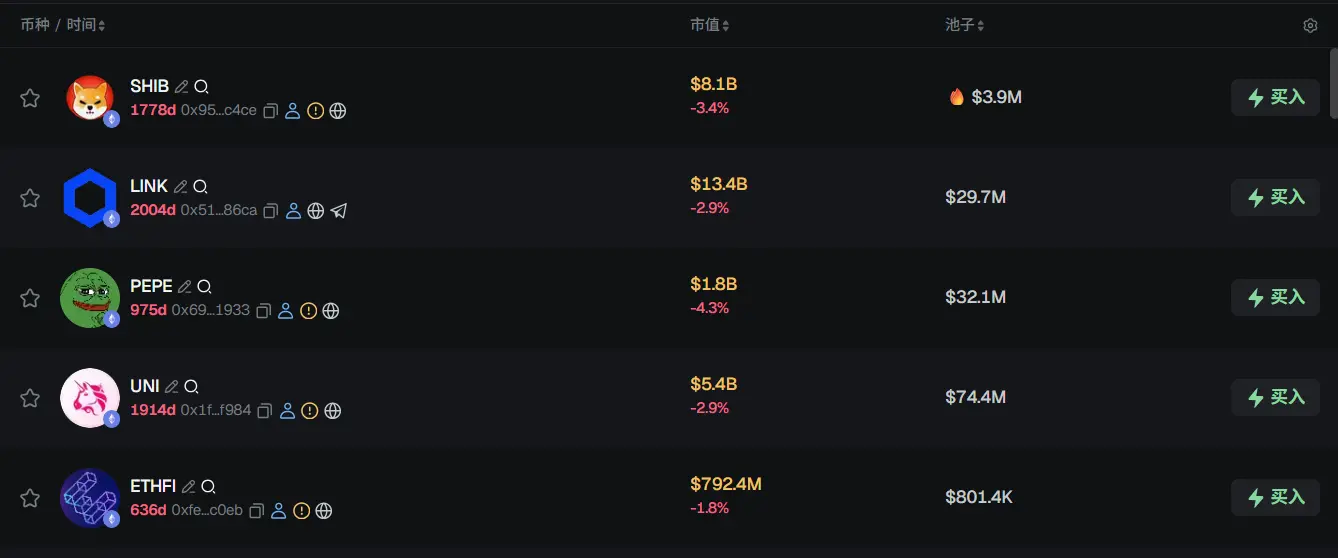

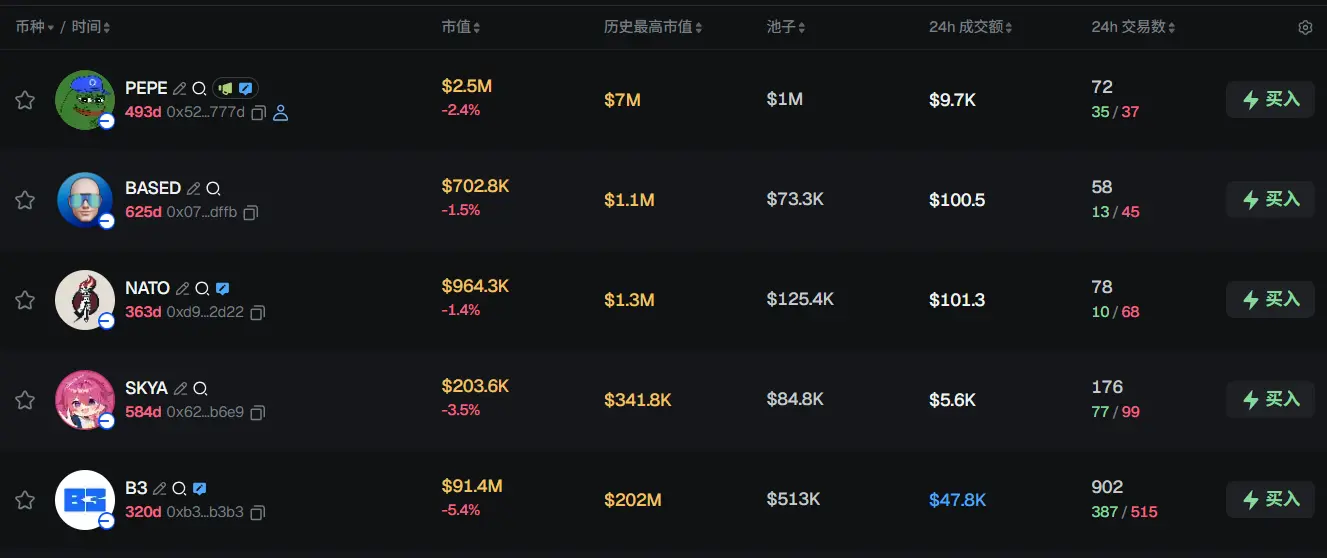

According to data from the Meme token tracking and analysis platform GMGN, as of 09:00 (UTC+8) on December 15,

The top five trending ETH tokens in the past 24h are: SHIB, LINK, PEPE, UNI, ETHFI

The top five trending Solana tokens in the past 24h are: TRUMP, PENGU, MELANIA, FO, ME

The top five trending Base tokens in the past 24h are: PEPE, BASED, NATO, SKYA, B3

What are some great articles worth reading in the past 24 hours?

First, let's get to know one faction—the "financialists." Who are they? They include the Federal Reserve, JPMorgan, those long-established European banking families, and the complex derivatives markets they support. It can be said that since secretly establishing the framework of a synthetic currency system in a small room in 1913, they have controlled the world for over a century.

The decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

On December 10, US Senators Gillibrand and Lummis stated at the Blockchain Association Policy Summit that the "Crypto Market Structure Bill" (CLARITY Act) is expected to release a draft this weekend and enter the revision and hearing voting stage next week. This means that this long-brewing legislative project has officially entered a decisive window.

The bill was first formally introduced to the US House of Representatives on May 29, 2025, jointly proposed by House Financial Services Committee Chairman Patrick McHenry and Digital Assets and Innovation Subcommittee Chairman French Hill. It passed the House vote by an overwhelming majority (294 votes in favor) on July 17 and is now awaiting final review by the Senate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Stable But Fragile Ahead Of BoJ Decision

BONK Remains Under Pressure as Bearish Structure Limits Recovery Attempts

Bitcoin Short-Term Holders Capitulating: What This Critical Signal Means for BTC Price

SEC Crypto Lawsuits: The Stunning Halt in Legal Action Under New Leadership