Ethereum Price Prediction: ETH Price Consolidates, Open Interest Declines, BitMine Increases Holdings

Ethereum price is hovering around $2,900 as traders weigh various technical signals, derivatives positions, and long-term accumulation trends. Earlier this month, after a sharp drop in the $3,400 to $3,450 region, Ethereum entered a consolidation phase.

This setback changed the short-term structure, forcing market participants to reassess recent trends. Despite recent weakness, Ethereum continues to attract the attention of institutional investors and long-term holders, maintaining overall market interest.

Ethereum Price Structure Sends Cautious Signals

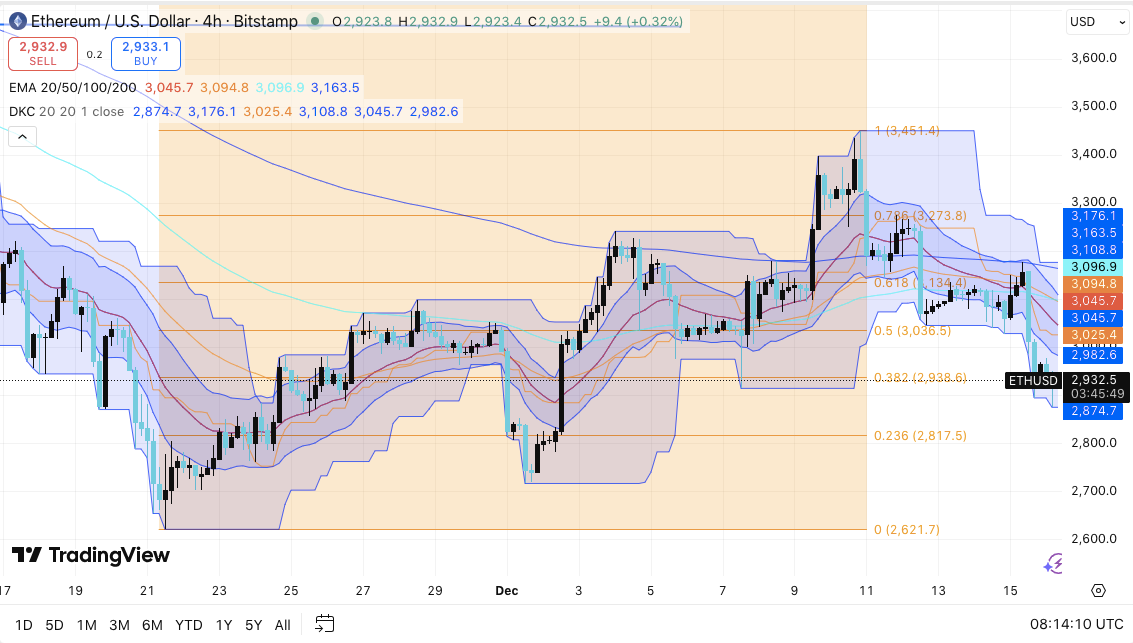

Ethereum price is fluctuating near $2,930, struggling to hold key technical levels on the four-hour chart. Price action is capped below the 50, 100, and 200-period exponential moving averages, which are clustered around $3,050 to $3,160.

As a result, this area acts as dynamic resistance, limiting the upside potential. In addition, the recent rebound failed to reclaim the 0.618 Fibonacci level near $3,135, further consolidating sellers' control.

Recent narrowing of volatility suggests the market will continue to trade within a range. Furthermore, since the December high, market highs have been trending lower, shifting the overall market bias from bullish to neutral.

Related: Bitcoin Price Prediction: Treasury Purchases Fail to Change Market Sentiment

Short-term support is near $2,900, with deeper support at around $2,875 and $2,820. Therefore, if the price continues to fall below these areas, it could further test the $2,620 level.

Futures and Spot Data Reflect Measurable Risks

Source: Coinglass

Source: Coinglass Ethereum futures open interest data reveals trader behavior during the consolidation period. The data shows that when ETH price fluctuated around $2,960, open interest was close to $3.9 billions. Notably, previous open interest levels retreated from peaks that coincided with local price highs. This pattern suggests traders are reducing leverage rather than actively shorting.

Source: Coinglass

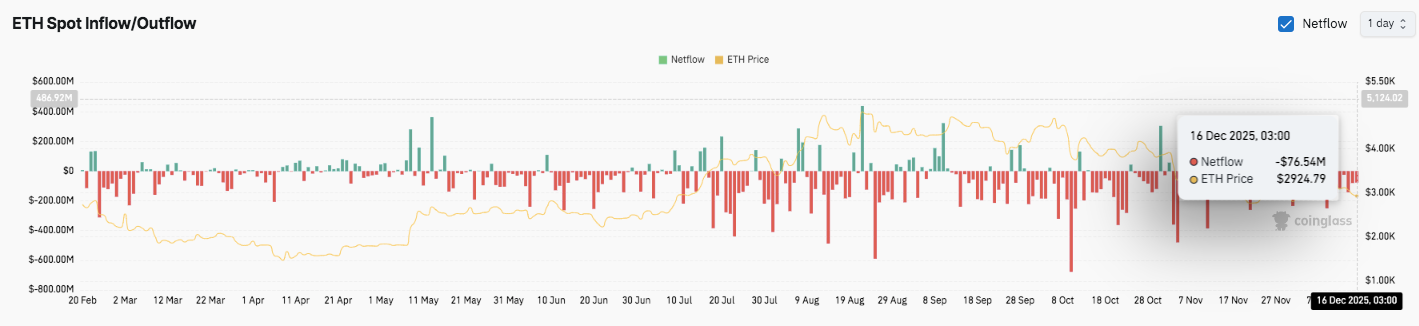

Source: Coinglass In addition, outflows from spot exchanges continue to outpace inflows. Most trading sessions are dominated by red bars, reflecting ongoing capital withdrawals from centralized exchanges.

Moreover, there have been intermittent spikes in inflows during short-term price increases, indicating limited profit-taking. The latest trading day recorded a net outflow of nearly $76 millions, further supporting the view of reduced liquidity supply.

Institutional Accumulation Adds a Longer-Term Perspective

Ongoing accumulation of Ethereum by corporations reflects their long-term investment strategies. BitMine Immersion Technologies recently added over 102,000 ETH, bringing its total holdings close to 4 millions ETH. As a result, the company controls over 3% of the total Ethereum supply. Previously, the company also announced a $70 millions purchase of Ethereum.

However, BitMine's stock price has fallen sharply in recent months, reflecting execution risks and market concerns. Nevertheless, the company continues to advance the development of its MAVAN staking platform, which is scheduled for launch in 2026. Management expects the staking business to generate potential annual revenue close to $400 millions.

Related: Mind Network Price Prediction for 2025, 2026, 2027-2030

Ethereum Price Technical Outlook: Key Levels Tighten

Ethereum price continues to fluctuate within a clearly defined range, with both upside and downside potential drawing attention as volatility increases. ETH is currently below major moving averages, with a short-term structure that is neutral to slightly bearish. Therefore, price reactions near nearby resistance and support levels are likely to determine its next move.

Upside potential: Immediate resistance is between $3,045 and $3,095, with the EMA indices capping prices in this area. If the price continues to break above $3,135, it could reverse the downtrend and challenge the $3,275 to $3,300 range. If the price holds above $3,300, it is more likely to retest the supply zone between $3,400 and $3,450.

Downside risk levels: Initial support is between $2,935 and $2,900. If this area is breached, the price could test $2,875, and then $2,820. Failure to hold these levels could accelerate the decline to the macro support at $2,620.

Resistance ceiling: The $3,045 to $3,135 area remains a key turning point for short-term upward rebounds. If resistance holds in this area, Ethereum price will continue to trade within the range.

Will Ethereum Rise?

The outlook for Ethereum price depends on whether buyers can hold the $2,900 area while challenging the resistance range between $3,045 and $3,135. The narrowing technicals suggest that volatility may expand in the future.

If market momentum increases with higher participation, Ethereum price could return to $3,275 or even higher. However, a drop to $2,875 would weaken its structure and increase downside risk. Currently, Ethereum remains at a critical turning point.

Related: Pippin Price Prediction: Pippin Maintains Bullish Structure, Open Interest Hits Record High

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Monero bucks the market trend and continues to strengthen: What are the reasons?

Bank of America Urges Onchain Transition for U.S. Banks

Hong Kong Court Adjourns $206M JPEX Fraud Case Until March: Report