The Chairman of the US Securities and Exchange Commission stated that the regulator is ready to respond to the cryptocurrency market structure bill.

Key Insights

- The latest timeline reveals when the Cryptocurrency Market Structure Bill is expected to be passed.

- Paul Atkins states that the US Securities and Exchange Commission and the Commodity Futures Trading Commission are ready to advance the Market Structure Bill.

- An overview of the bill's impact on the market.

The Cryptocurrency Market Structure Bill is expected to open up new territory for cryptocurrency regulation.

This highly anticipated bill was originally scheduled to be approved by the end of 2025, but the latest data shows it may face another delay.

The Cryptocurrency Market Structure Bill is expected to provide a clear regulatory framework for digital assets while eliminating ambiguity in cryptocurrency regulation.

Given its broad impact on the market, it is one of the most important pieces of legislation.

US President Donald Trump previously stated that his goal was to sign the Market Structure Bill into law by the end of 2025.

However, Congress is still reviewing the bill, so as the holidays approach, the bill will be postponed until early 2026 for passage.

Cryptocurrency Market Structure Bill/Source: X, provided by Coin Bureau

Cryptocurrency Market Structure Bill/Source: X, provided by Coin Bureau Paul Atkins, Chairman of the US Securities and Exchange Commission, says US regulators are ready to introduce cryptocurrency legislation.

The current pro-crypto chairman of the US Securities and Exchange Commission, Paul Atkins, recently made some comments on the Cryptocurrency Market Structure Bill. He pointed out that the bill is about to become law.

He also noted that both the US Securities and Exchange Commission (SEC) and the US Commodity Futures Trading Commission (CFTC) are actively working to ensure a smoother transition to a clear cryptocurrency regulatory environment.

Atkins stated in an interview that the two regulatory agencies will coordinate the Cryptocurrency Market Structure legislation and the Clarity Act.

This statement highlights a significant shift in the current regime of the SEC. Atkins' predecessor was known for his anti-crypto stance.

This shift underscores that the US market is ready to transition to an economy where digital assets are part of the financial system.

Atkins' stance on cryptocurrency legislation also highlights the rapid pace of change in the regulatory environment this year.

2025 will go down in history as the year the US government legalized cryptocurrency and established a regulatory framework.

What is the impact of the Cryptocurrency Market Structure Bill?

The passage of the Cryptocurrency Market Structure Bill will be a significant milestone in the development of the cryptocurrency market.

This is equivalent to opening the floodgates of institutional liquidity, allowing capital to flow freely into the cryptocurrency market.

This is because the previous lack of a regulatory framework made it difficult for investors to access market investment opportunities.

A clear market structure means clear boundaries, which not only guide investors but also provide appropriate investor protection measures.

The cryptocurrency market has experienced some of the largest thefts and scams in history. Regulatory measures may help curb such challenges.

In addition, a maturing cryptocurrency regulatory framework will pave the way for investments that could drive innovation in the cryptocurrency and blockchain sectors.

This may guide the direction of market development, having a broader impact on many other industries.

Market participants should also expect increasingly mature regulation in the cryptocurrency industry, providing guidance on compliance and taxation.

In terms of liquidity, cryptocurrencies such as bitcoin, ethereum, and several others may eventually have the opportunity to enter the mainstream market.

Currently, cryptocurrencies are being integrated with traditional finance through real-world assets (RWA).

The risk-weighted assets (RWA) sector is currently one of the fastest-growing areas. It may be one of the best examples of how changes in the regulatory environment are moving toward a future where digital assets become the norm.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

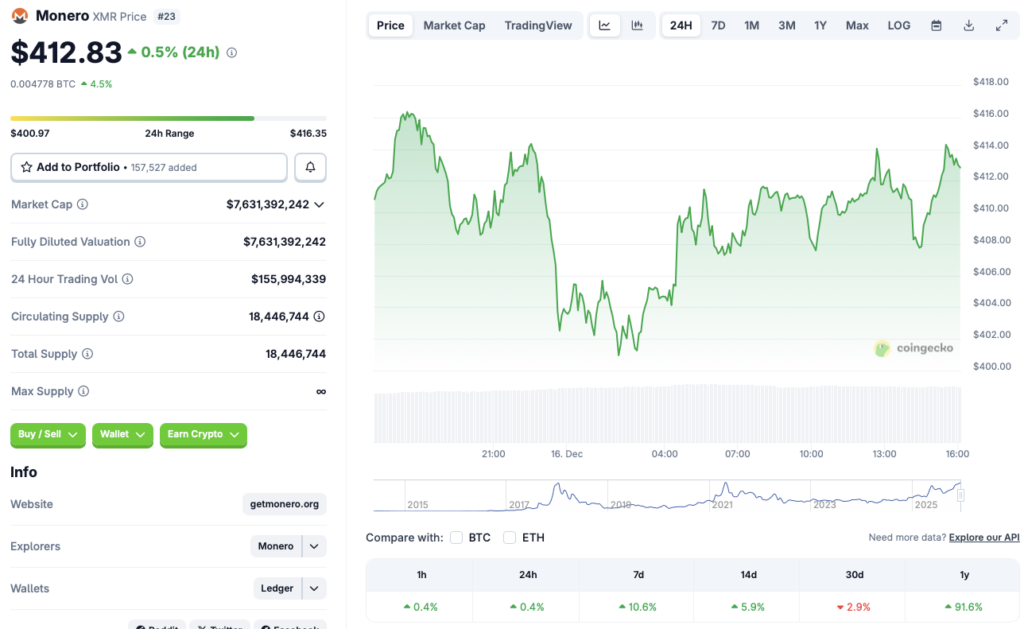

Monero bucks the market trend and continues to strengthen: What are the reasons?

Bank of America Urges Onchain Transition for U.S. Banks

Hong Kong Court Adjourns $206M JPEX Fraud Case Until March: Report