Canary XRP ETF Debuts on Nasdaq: Will Ripple’s XRP Soar to $5 in 2025?

Developed by Canary Capital, the XRP ETF (ticker: XRPC) has just received regulatory approval, making it the first U.S. ETF fully backed by physical XRP tokens. The fund is scheduled to begin trading this Thursday, pending final certification. This approval not only opens the door for institutions and everyday investors to access XRP through familiar brokerage platforms, but also represents a significant milestone for the broader digital asset market, which has long awaited regulatory clarity on products like this. This article breaks down everything you need to know about the new XRP ETF debut on Nasdaq, including how the fund works. We’ll also explore Ripple’s recent moves in traditional finance and the key catalysts experts say could push XRP towards the $5 mark in 2025.

Canary XRP ETF Nasdaq Debut: Facts & Structure

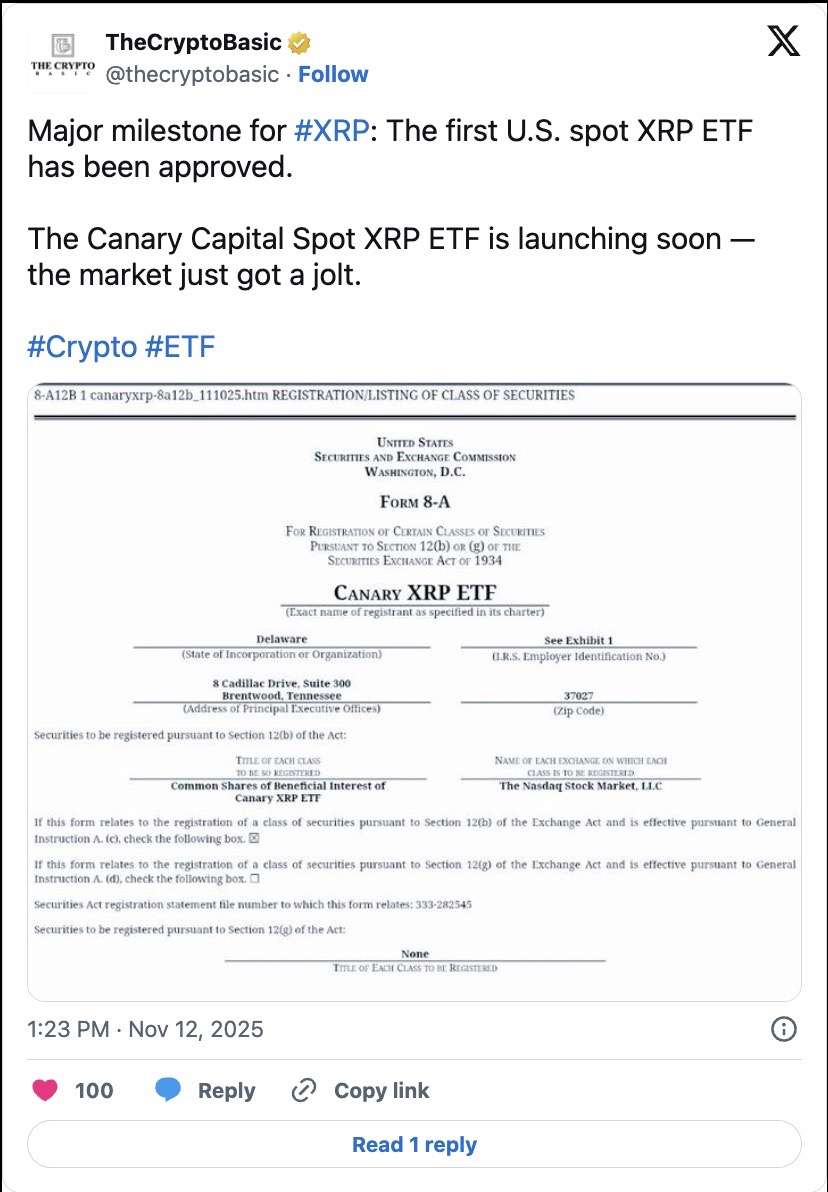

On the heels of significant anticipation, Canary Capital’s spot XRP ETF, traded under the ticker XRPC, is set to open on the Nasdaq Stock Market this Thursday, pending final certification. The formal green light comes after Canary Capital’s Form 8-A registration filing with the U.S. Securities and Exchange Commission (SEC). This crucial step registers the ETF’s shares for public trading, fully in compliance with the Exchange Act of 1934.

What distinguishes the XRP ETF is its “physical” or “spot” structure: the fund will hold 100% of its assets in XRP, rather than derivatives. It mirrors the price of XRP through the XRP-USD CF Benchmarks Reference Rate Index. With this setup, investors gain transparent, direct exposure to XRP’s performance via a regulated product, without having to handle custody or navigate cryptocurrency exchanges themselves.

The fund features a 0.50% annual management fee, placing it on par with recently launched crypto spot ETFs. This low-fee structure aims to maximize investor appeal, whether for hedge funds, family offices, or individual traders.

Industry analysts underscore this ETF launch as a pivotal step for XRP, once mired in regulatory uncertainty. Following recent regulatory momentum—including multiple XRP fund listings on the Depository Trust and Clearing Corporation (DTCC) by issuers like Bitwise, Franklin Templeton, and CoinShares—the XRP ETF now provides a definitive on-ramp for institutions eager to trade XRP through standard brokerage channels.

Ripple’s Strategic Expansion into Traditional Finance

The launch of the XRP ETF fits seamlessly into Ripple’s aggressive strategy to bridge the worlds of crypto and legacy finance. In 2025 alone, Ripple has spent nearly $4 billion acquiring financial technology assets: $1.3 billion went to prime brokerage Hidden Road in April, and another $1 billion to treasury solutions provider GTreasury in the fall. This acquisition spree aims to establish Ripple as the core infrastructure provider in the new era of global finance.

Ripple has also expanded institutional offerings, rolling out an over-the-counter spot trading venue for U.S. clients, enabling direct access to major digital assets, including XRP. Its recent $500 million funding round has catapulted Ripple’s market value to $40 billion. CEO Brad Garlinghouse confirmed that Ripple is not only building its in-house services but also actively seeking partnerships to license the XRP Ledger to large institutions—a strategic move to drive both platform and XRP adoption.

Why Analysts See the XRP ETF as a Catalyst for a $5 XRP Price

The debut of the XRP ETF is catalyzing bullish sentiment across the market, with analysts projecting a significant XRP price rally—potentially to $5 by Q4 2025. Several on-chain and market metrics underpin this forecast:

Shrinking Exchange Balances

According to Glassnode, market analysts observed that more than 216 million XRP (worth about $556 million) were withdrawn from exchanges over a single week. This reflects a significant shift in holder behavior, as when tokens leave exchanges, they are generally moved into secure, long-term storage. Such trends often signify increasing conviction among investors, reduce the liquid supply, and historically have preceded major price rallies. In contrast, movement of coins onto exchanges typically means holders are looking to sell, often preceding a bearish trend.

On-Chain Momentum and Technical Patterns

Trader sentiment has turned notably positive, with on-chain data revealing a bullish flip in the Cumulative Volume Delta (CVD), a metric tracking buy-sell pressure. Technical analysts have identified a “cup-and-handle” formation—a classic bullish continuation pattern. The last time this setup occurred alongside a bullish CVD, XRP rallied by 75% in a matter of weeks. Currently, ETF speculation and accumulation are creating what some see as a “window bulls may not want to ignore.”

Three-Month High in Network Activity

Data from CryptoQuant shows that active XRP addresses have surged to their highest level since August, hitting a three-month peak. This burst of network activity typically precedes upward price movements and suggests a renewed wave of user engagement and utility, potentially fueled by increased institutional experimentation and speculation around the new ETF.

XRP Active Addresses

Source: CryptoQuant

XRP Dominance Rising Amid Bitcoin Weakness

As of mid-November, XRP’s market dominance is climbing, while Bitcoin’s (BTC.D) is declining. This capital rotation implies that, amid broader market uncertainty, investors are seeking alternative large-cap tokens such as XRP, which also benefit from current ETF-related optimism. Research cited from JPMorgan suggests up to $8 billion could flow into XRP ETF products in their first year, yet only 3–5 billion XRP tokens remain available on exchanges. This imbalance points to a possible “supply shock,” with ETF demand outpacing available liquidity.

Conclusion

Coupled with Ripple’s strategic acquisitions, growing institutional integrations, and powerful on-chain signals, the outlook for XRP price is more optimistic than it has been in years.

If inflows meet expectations and technical trends persist, XRP could potentially reach—and surpass—the $5 mark.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.