Bitcoin Cash Sees Largest Bets in 2 Years as BCH Doubles in a Week

Technical improvements and a listing on EDX Markets have likely fueled trading interest in bitcoin cash tokens.

Open interest in futures tracking Bitcoin Cash (BCH) tokens has surged to May 2021 levels as the Bitcoin offshoot network experiences a revival of activity and value.

BCH prices have , data shows, becoming one of the top-performing tokens above a $1 billion market capitalization. Bitcoin (BTC) and ether (ETH) added 13% and 8% respectively in this period.

Data shows BCH open interest, or the number of unsettled futures contracts, surged to over $400 million on Monday from just $75 million the week prior. Most of the trading interest arose from the crypto exchange Binance, where traders opened $240 million worth of BCH long or short positions.

Rising open interest either means that new money is flowing into the market or existing participants are increasing their allocation. The metric can be used as an indicator to determine market sentiment and the strength behind price trends.

A network upgrade and an influential exchange listing have likely served as two key catalysts for the sudden trading interest in BCH.

Bitcoin Cash underwent a network hard fork in May which improved the security and privacy of the fledgling network and introduced plans for “CashTokens” – a scaling system that would allow developers to build decentralized applications directly on the Bitcoin Cash blockchain.

Other improvements were the introduction of smaller transaction sizes – which help speed up transactional times – and smart contracts functionality that will allow Bitcoin Cash-based applications to offer recurring payments, derivatives trading, and crowdfunding opportunities, among other uses, to Bitcoin Cash users.

Elsewhere, BCH has also likely benefited from , according to crypto research firm Santiment.

The new exchange is backed by traditional finance heavy-weights Fidelity Digital Assets, Charles Schwab and Citadel Securities, and opened trading last Tuesday, supporting BCH along with bitcoin (BTC), ether (ETH) and litecoin (LTC).

The sudden price move has attracted retail trader attention, with social discussions about the token rising to their highest in three years and trading volumes this year hitting a record, Santiment last week.

Edited by Parikshit Mishra.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Animoca Partners with GROW to Connect Crypto and Traditional Finance

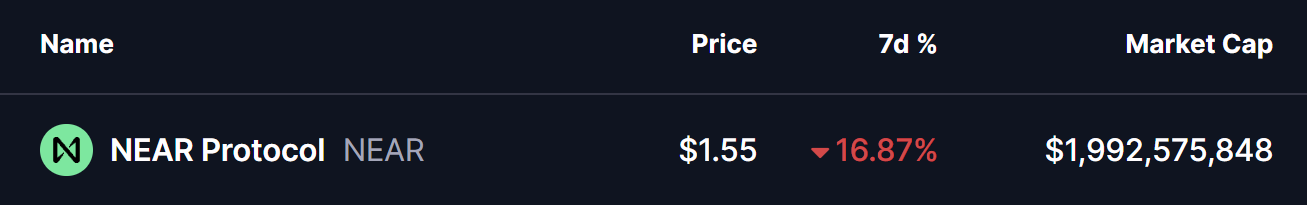

Near Protocol (NEAR) Flashes Potential Bullish Reversal Setup – Will It Bounce Back?

Solana Price Prediction: Grayscale Predicts New Bitcoin ATH, DeepSnitch AI’s Snowball to $900K Fuels the 100x Narrative

Whole Foods to install smart food waste bins from Mill starting in 2027