News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Crypto's Biggest Bull Run Could Come From the Most Unexpected Place: AI Bubble

Newsbtc·2026/02/26 04:03

New Zealand Overview

101 finance·2026/02/26 04:03

Crypto Rally Alert: Expert Reveals How High Bitcoin, Ethereum and XRP Prices Could Climb

CryptoNewsNet·2026/02/26 04:00

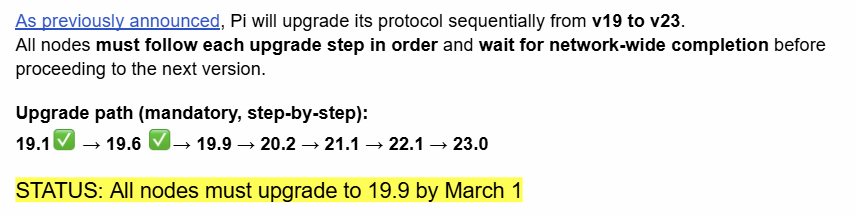

Pi Network Urges Mainnet Node Operators to Upgrade Before Key Deadline

Coinsprobe·2026/02/26 04:00

BoJ’s Takata indicates Japan is approaching the 2% goal, supports continued gradual increases in interest rates

101 finance·2026/02/26 03:33

Morgan Stanley Retains an Equal Rating on Xcel Energy Inc. (XEL)

Finviz·2026/02/26 03:33

Morgan Stanley Retains an Equal Rating on Dominion Energy, Inc. (D)

Finviz·2026/02/26 03:30

Morgan Stanley Maintains an Underweight Rating on The Southern Company (SO)

Finviz·2026/02/26 03:30

Nvidia Receives US Authorization to Export Limited Quantities of H200 Chips to China

101 finance·2026/02/26 03:00

NZD/USD, NZD/JPY Outlook: RBNZ's cautious stance on rates faces scrutiny

101 finance·2026/02/26 02:57

Flash

05:27

Uniswap's UNI token rises 15%, governance proposal could increase annual revenue by $27 millionUniswap's governance proposal suggests activating protocol fees on eight additional chains and automatically charging fees for all v3 liquidity pools, which is expected to generate approximately $27 million in additional annual revenue. As a result, Uniswap's UNI token rose about 15% within 24 hours, outperforming both Bitcoin and Ethereum. The proposal also includes the default application of the new v3 tiered fee system and the automatic collection of protocol fees for new pools, with approximately $34 million currently allocated for UNI burning.

05:22

An independent bitcoin miner mined a block reward worth $200,000 by renting computing power for only $75.Jinse Finance reported that an independent Bitcoin miner rented cloud computing power worth about $75 and successfully validated block number 938092, receiving the full reward of 3.125 BTC, valued at over $200,000. The miner rented 1 PH/s of computing power through CKPool, turning what was originally a lottery-like chance into a return of approximately 2,600 times the investment. Although the overall mining difficulty on the network continues to rise and it remains rare for independent miners to find a block, on-demand computing power rentals have lowered the entry barrier, making such cases increasingly common. Over the past year, 21 independent miners have collectively mined 66 BTC.

05:15

The latest Q4 financial report from a US physical therapy and healthcare company shows that its revenue reached $202.7 million, successfully surpassing the previous market analysts' expectation of $200.4 million.This performance highlights the company's strong growth momentum in the rehabilitation medical services sector. Notably, the data released this time are the revised and accurate figures, which are more precise than the initial information. The revenue exceeding expectations reflects the company's advantages in operational efficiency and market demand management, and also provides a positive signal for investors.