Can Bitcoin Break Out of its Funk? The Answer Appears to Be No

While overall bitcoin and ether price performance have been strong in 2023, it’s largely been a first quarter story

While July has traditionally delivered solid returns for bitcoin (), 2023 has left much to be desired, with the month’s malaise continuing on Wednesday.

The Bitcoin Fear Greed Index has declined to 50 from 64 a week prior, indicating neutral sentiment among traders – perfectly reflecting the relative lack of action of late.

Though nearly two weeks remain in the month, BTC’s daily average returns this July of negative 0.096% have been its second lowest of 2023, behind only May. Simil ar price action applies to ether () at negative 0.07%, with that crypto now on track to post its first losing month of the year.

Historically, average daily performance in July for bitcoin and ether are a positive 0.105% and 0.46%, respectively.

In some ways, it’s difficult to take issue with the relative lack of performance. Bitcoin and ether have essentially decoupled from everything, including once strong correlations to traditional equity indexes that have essentially disappeared.

There’s also the dissipation of a previously strong inverse relationship between bitcoin and the U.S. dollar index, which runs counter to the narrative of BTC serving as an inflation hedge.

One relationship that remains strong is that between BTC and ETH, but even that correlation has declined to 70% in 2023 vs. "normal readings in the 90% area.

Absent January and March this year, daily performance for bitcoin and ether have been relatively pedestrian, with the cryptos’ outperformance in 2023 for now being solely a first quarter story.

While there was a 20% advance for bitcoin in mid-June on the heels of BlackRock’s filing for a spot bitcoin ETF, there’s been a lack of new catalysts since, and a check of the docket doesn’t show any new catalysts immediately on the horizon.

It’s possible Thursday’s initial jobless claims figures may provide some additional context to the overall macroeconomic picture, with a read above consensus forecasts for 242,000 suggesting possible further easing in inflation and Federal Reserve rate hike forecasts.

Investors looking for a glimmer of bullish sentiment may find it in the (BTI) for both BTC and ETH. Currently, the BTI is signaling “uptrend” for both assets. Still, given the usage of short term moving averages in calculating the indices’ signals, both could fall into neutral territory in short order.

Edited by Stephen Alpher.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Implied Volatility at 45% as Traders Bet on $100K–$120K Rally and Hedge with Puts Near $85K

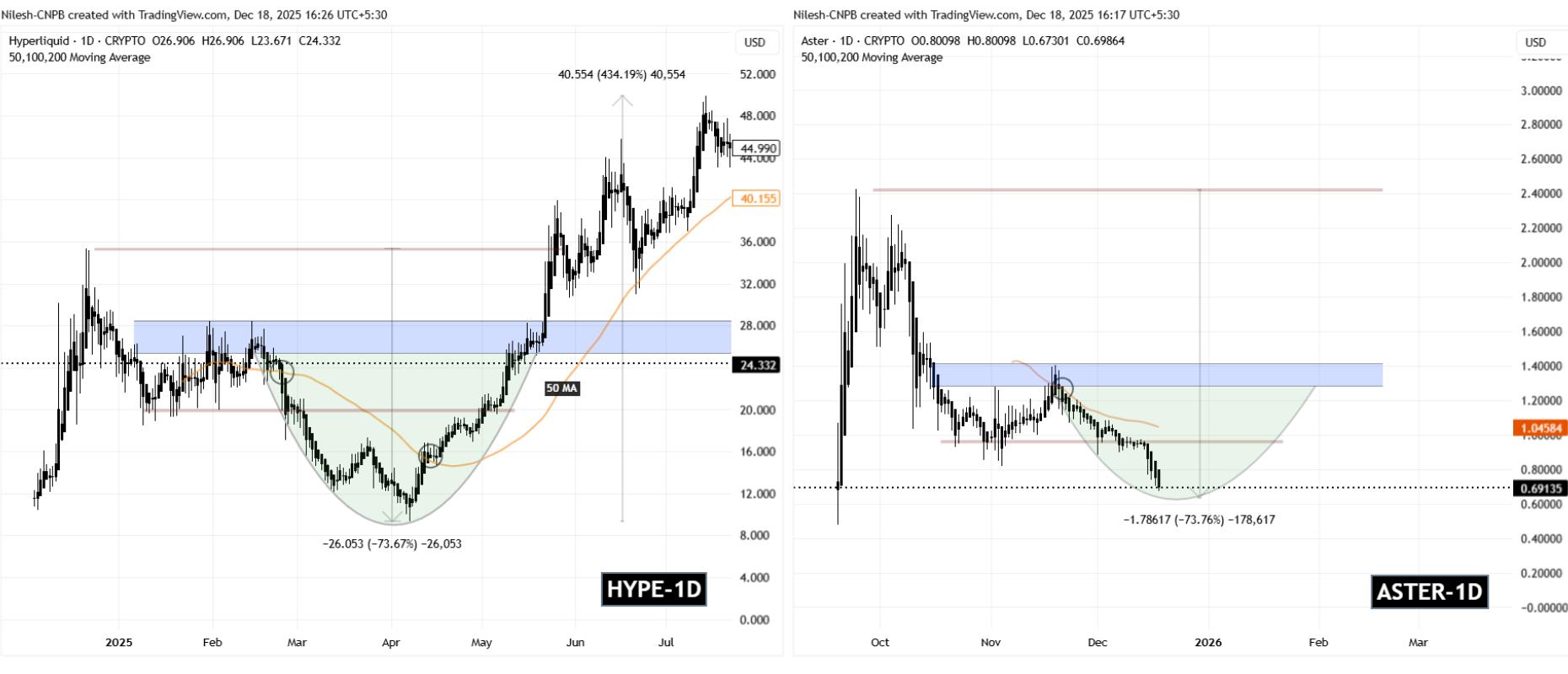

Is Aster ($ASTER) Nearing a Potential Bottom? A Key Emerging Fractal Suggests So!

XRP Algorithmic Trading Hits US Retirement Accounts with Digital Wealth Partners

Indian MP Proposes Bill for Asset Tokenization via Blockchain