Litecoin (LTC) in the Shadows as Aave (AAVE) Surfs the Bullish Tide: Will the Mood Change?

The cryptocurrency market remains optimistic, with Bitcoin (BTC) confidently trading above $40,000 after its impressive surge in early December. The positive sentiment is fueled by the anticipation of Bitcoin ETF approval which will bring forward mainstream adoption of the crypto. Notably, Blackrock has taken proactive steps by submitting a revised spot Bitcoin exchange-traded fund (ETF) proposal. This strategic move aims to reassure regulators and increase the probability of obtaining the first approval of this kind in the U.S.

As markets are closely watching these developments, some altcoins are taking a central stage with their bullish potential. This article delves into the technical indicators of Litecoin (LTC) and Aave (AAVE), offering insights into their price dynamics.

Litecoin (LTC) Price Analysis

The on-chain metrics for Litecoin (LTC) are currently favoring a bullish stance, with the positive reading of the Bid-Ask Volume Imbalance at 0.67%. The trading volume has experienced a slight 3.7% increase, indicating investors' moderate interest in the coin. Notably, Litecoin has faced a selling trend since early December. This trend was triggered by a significant liquidation of LTC holdings, involving approximately 199,000 wallets. The widespread sell-off points to an overarching sentiment of Fear, Uncertainty, and Doubt (FUD) that has cast a shadow over the asset. However, such negativity can sometimes serve as a precursor to a market turnaround. The current atmosphere of FUD and the selling pressure from small wallet holders might be laying the groundwork for a potential market reversal.

Examining the technical indicators, the MACD Levels is at 0.17711192, while other significant indicators, such as the Commodity Channel Index at 61.83050046 and the Awesome Oscillator at 0.91579928, are currently neutral.

In terms of trend analysis, the short-term outlook for LTC appears bullish, as indicated by moving averages. Specifically, the 10-day Simple Moving Average (SMA) is at $71.12353276, and the 10-day Exponential Moving Average (EMA) is at $71.04927300. Meanwhile, the longer-term trend is anticipated to be bearish, with the 100-day SMA standing at $71.51932848 and the 100-day EMA at $71.45460054, suggesting a potential selling opportunity.

Litecoin (LTC) Price Prediction

The short-term indicators are aligning with an upward trend, capturing the attention of bullish traders closely monitoring Litecoin's behavior around the pivotal point at $72.93986016. Sustaining momentum above this level could pave the way for the next upward target at $75.69638549. The most optimistic forecasts even suggest a potential surge to $80.25918644.

On the flip side, the prevailing FUD sentiment may trigger a deeper decline in LTC. Immediate support is identified at $68.37705921, and a failure to hold its position above this level might expose Litecoin to a further decline towards $65.62053388. Nevertheless, these lower price levels may present strategic opportunities for purchasing at undervalued prices.

Aave (AAVE) Price Analysis

The latest price analysis indicates that Aave (AAVE) is maintaining a robust uptrend, suggesting the potential for further gains. Currently trading near $105, the coin has experienced a notable 7.39% increase from its recent low of $94.00. The surge in trading volume, up by a significant 23.73% in the last 24 hours, underscores active investor participation, signaling a market gaining momentum. The upswing in both price and volume is driven by strong buying pressure.

Technical indicators overwhelmingly support a bullish outlook. Specifically, the Momentum is at 6.607209330, the MACD Level stands at 2.214299822, and the Bull Bear Power registers at 4.740635421, all pointing towards a Buy action.

The daily Aave price analysis reveals a clear dominance of bulls in the market. AAVE is currently trading above key support levels, with bulls successfully breaking through the 10-day Simple Moving Average (SMA) at $100.189113295 and the 100-day SMA at $81.447594941. This breakthrough indicates robust bullish momentum in the market.

Aave (AAVE) Price Prediction

Should Aave (AAVE) sustain its bullish momentum above the critical pivot point at $102.092735116, it positions itself for further upward movement, with a potential target of $116.683374212. A successful breach of this level could pave the way for the coin to challenge the subsequent resistance at $133.347576041.

In the event of a bearish scenario unfolding and Aave succumbing to downward pressure, immediate support is anticipated at $85.428533287. A descent below this level might trigger a more significant decline to $70.837894191. At these levels, traders may need to reassess their risks and consider readjusting stop loss levels to navigate the market fluctuations effectively.

Conclusion

The cryptocurrency market, driven by positive sentiments and anticipation of a Bitcoin ETF approval, sees Bitcoin trading confidently above $40,000. Litecoin (LTC) faces challenges with recent selling trends, potentially signaling a market reversal, while Aave (AAVE) maintains a robust uptrend, supported by strong buying pressure and positive technical indicators. Traders should closely monitor the evolving market conditions, considering potential bullish scenarios for LTC and AAVE. Adaptability and strategic decision-making are essential in navigating the dynamic cryptocurrency landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Massive Bitcoin ETF Inflows Fail To Break Resistance

Week Ahead: The US Dollar's Upward Adjustment Since Christmas Could Be Nearing Its End

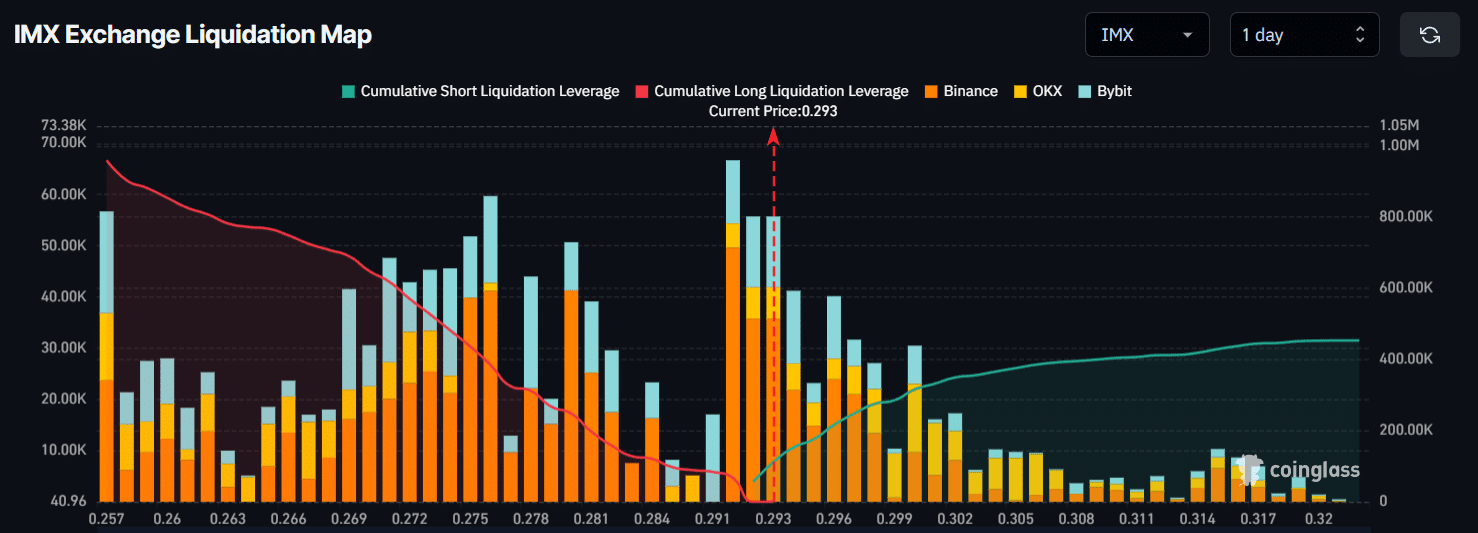

Why Immutable traders are betting long as IMX tests $0.30