Greeks.live: Option data suggests that the market has already priced in a Bitcoin ETF

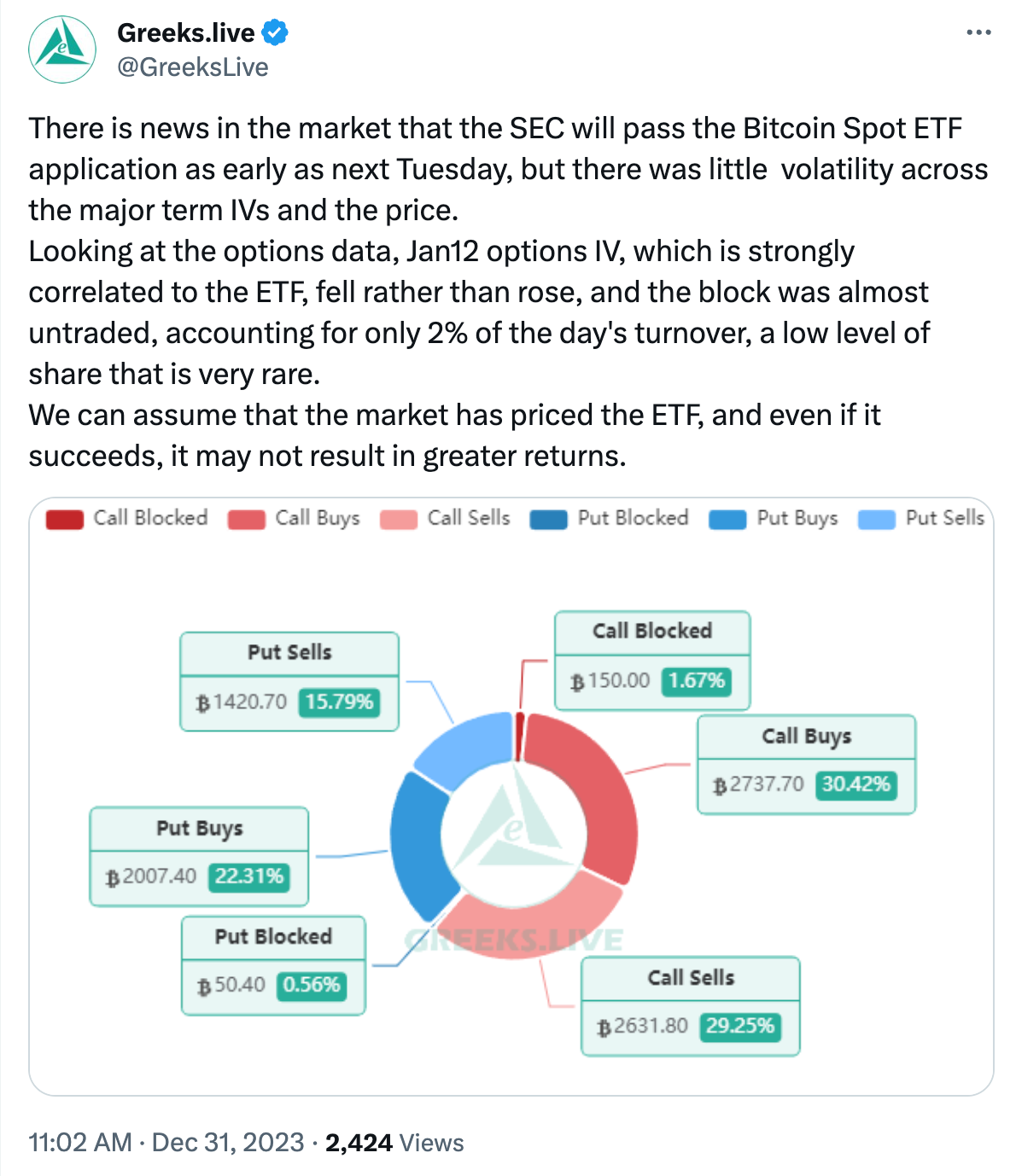

Greeks.live twittered: There is news in the market that the SEC will pass the Bitcoin Spot ETF application as early as next Tuesday, but there was little volatility across the major term IVs and the price. Looking at the options data, Jan12 options IV, which is strongly correlated to the ETF, fell rather than rose, and the block was almost untraded, accounting for only 2% of the day's turnover, a low level of share that is very rare. We can assume that the market has priced the ETF, and even if it succeeds, it may not result in greater returns.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: If ETH falls below $3,747, the cumulative long liquidation intensity on major CEXs will reach $1.302 billion.

TAO surpasses $390

Trending news

MoreData: In the past 24 hours, total liquidations across the network reached $127 million, with long positions liquidated for $55.43 million and short positions liquidated for $71.97 million.

Data: If ETH falls below $3,747, the cumulative long liquidation intensity on major CEXs will reach $1.302 billion.