Japan seeks to allow certain VCs to invest directly in crypto and Web3 startups

Quick Take: The proposed revision to existing law, if enacted, could be a huge opportunity for Web3 startups in Japan, one local expert said.

The ministry said in a Friday announcement that the approved revision, which contains amendments to the Act on Strengthening Industrial Competitiveness , would expand strategic investment to provide support for local startups and medium-sized companies. Such revision would allow venture capital firms to invest in projects that only issue cryptocurrencies, local news outlet Coinpost reported on Saturday.

Following the cabinet approval, the bill has been submitted to the legislative body and will be deliberated upon, the ministry said in the statement.

Limited partnerships in Japan often serve the purpose of investing in unlisted companies, which has become a common measure for VCs to invest in startups, according to local news outlet Coinpost .

“Under Japanese rules up until now, VCs were not able to invest in crypto assets,” Hiro Kunimitsu, founder and CEO of Gumi Inc., wrote in an X post . Gumi is a Japanese game development firm that has launched its own blockchain investment fund, gumi Cryptos Capital.

Kunimitsu explained in his X post that Japanese crypto projects had to source capital from foreign venture capitals, which has been a huge obstacle for funding. “I think that the fact that Japanese VCs can now invest will be a big opportunity for many Web3 startups from Japan,” Kunimitsu said.

Under Prime Minister Fumio Kishida’s “new capitalism” policy, Japan has been pushing to cultivate its Web3 industry. In December, the Japanese cabinet approved a revision to its tax regime that could exclude companies from paying taxes on unrealized profits from crypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Former Federal Reserve Governor Coogler faced an ethics investigation before resigning.

Nillion will gradually migrate to Ethereum.

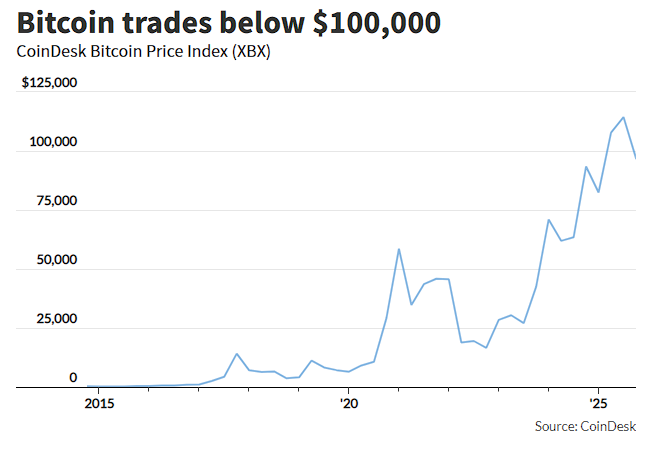

Both gold and tech stocks have seen dip-buying, but only bitcoin remains "sluggish."

Compared with the capital inflows into tech stocks and gold's sharp rebound after a plunge, bitcoin was a clear exception in Friday's market: it defied the trend by dropping 5%, hitting a six-month low, and has now declined for three consecutive weeks. This contrast highlights the unusual situation in the bitcoin market: even as it maintains a high correlation of 0.8 with the Nasdaq 100 Index, bitcoin exhibits an asymmetric pattern of "falling more on declines and rising less on rallies." Meanwhile, intensified whale sell-offs and concentrated selling by long-term holders are jointly suppressing bitcoin.

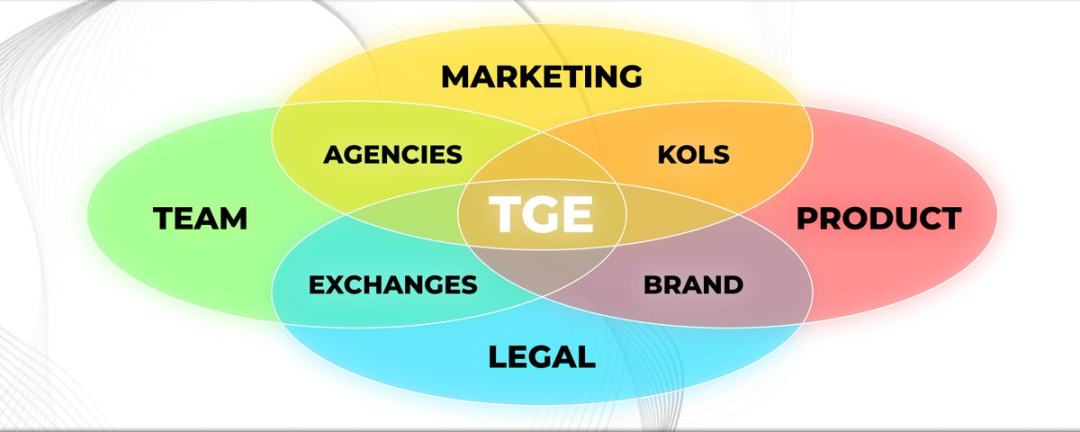

Why do 90% of project TGEs end in failure?

Doing these things is a prerequisite for a successful TGE.