BlackRock Creates Tokenized Asset Fund

According to a document submitted to the U.S. Securities and Exchange Commission (SEC), investment management giant BlackRock has created a tokenized asset fund registered in the British Virgin Islands, and will collaborate with tokenization company Securitize. Blockchain data shows that the fund has injected 100 million USDC stablecoins into the Ethereum network.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US stock storage sector shows strong performance at the start of 2026

SEC delays decision on IBIT options position and exercise limits

Strategy counterparty BTC short position turns profitable, with a floating profit of $2.1 million

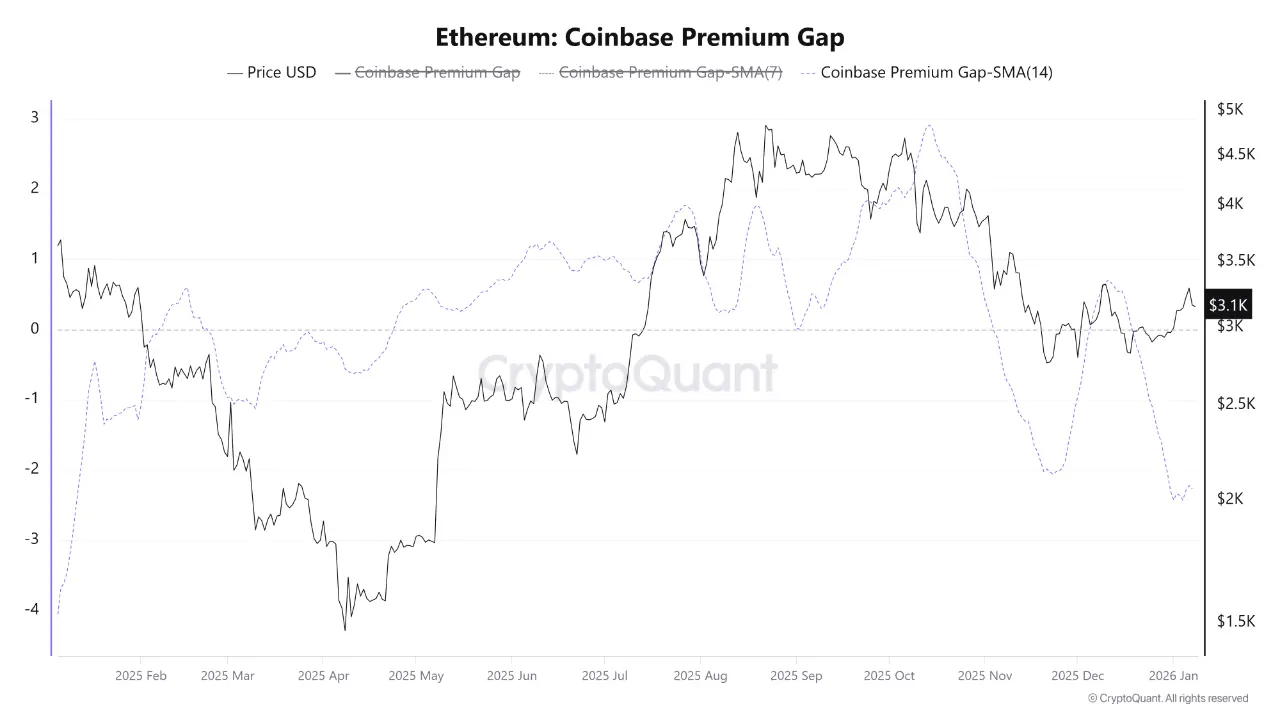

CryptoOnchain issues bearish alert for Ethereum: premium indicator on a certain exchange hits 10-month low