Bitcoin Price Drop - Here's Why

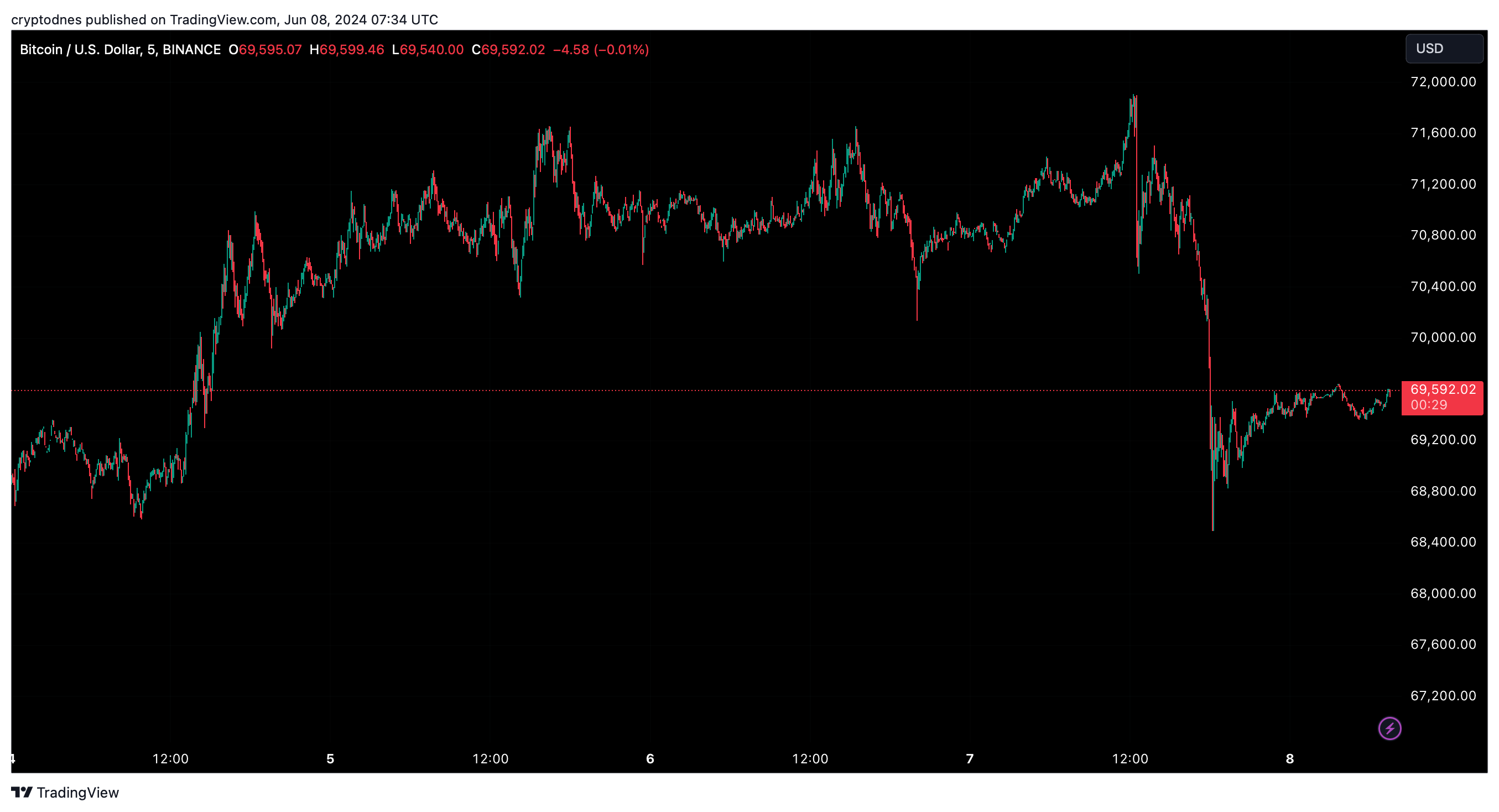

The price of Bitcoin (BTC) fell to the $69,000 level, reflecting a 2.5% decline in the past 24 hours after the release of mixed US employment data.

This decline occurred as the market reacted to the new economic data , showing both positive and worrying signs for the US economy.

Key economic indicators included nonfarm payrolls rising to 272,000 in May, well above April's 165,000 and the Dow Jones forecast of 190,000. However, the unemployment rate also rose to 4%, the highest since January 2022.

READ MORE:

Another optimistic prediction for Bitcoin from crypto expert PlanBJob gains were notable in the health care, government, recreation and hospitality sectors. Analysts viewed this report as "hawkish," suggesting it could delay an expected rate cut.

According to the CME FedWatch Tool, there is a 50,5% chance of a rate cut by September. This uncertainty has increased the volatility of the crypto market, affecting Bitcoin in particular. Данни from Coinglass revealed that the total amount of cryptocurrency liquidations in the last 24 hours reached over $410 million, affecting nearly 147,000 traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SignalPlus Macro Analysis Special Edition: Is Work Resuming Soon?

Macro assets faced a tough week, with the Nasdaq Index experiencing its worst weekly decline since the "Liberation Day" in April, mainly due to concerns over an artificial intelligence bubble...

487 new BTC for Strategy, Saylor's appetite does not wane

XRP Price Prediction: Is $6 the Next Big Target?