While the sharp decline in Asian markets causes great anxiety in the global and cryptocurrency markets, there is a bloodbath in all markets.

While the unprecedented sharp decline in Asian markets increased the selling pressure in risky assets, Bitcoin and altcoins also took their share, and all eyes turned to the US Federal Reserve.

Investors have begun to price that the FED may hold an emergency meeting and cut interest rates before the regular meeting in September.

The sharp decline in Asian markets and the Japanese stock market, unprecedented since 1987, caused recession concerns in the United States to strengthen, turned the markets upside down and created an expectation that the FED would take an urgent step.

Analysts said that concerns about the risk of high inflation in the USA disappeared completely after the data and were replaced by concerns about recession.

Investors now see the probability of a 25 basis point interest rate cut at an extraordinary meeting within a week as 60 percent.

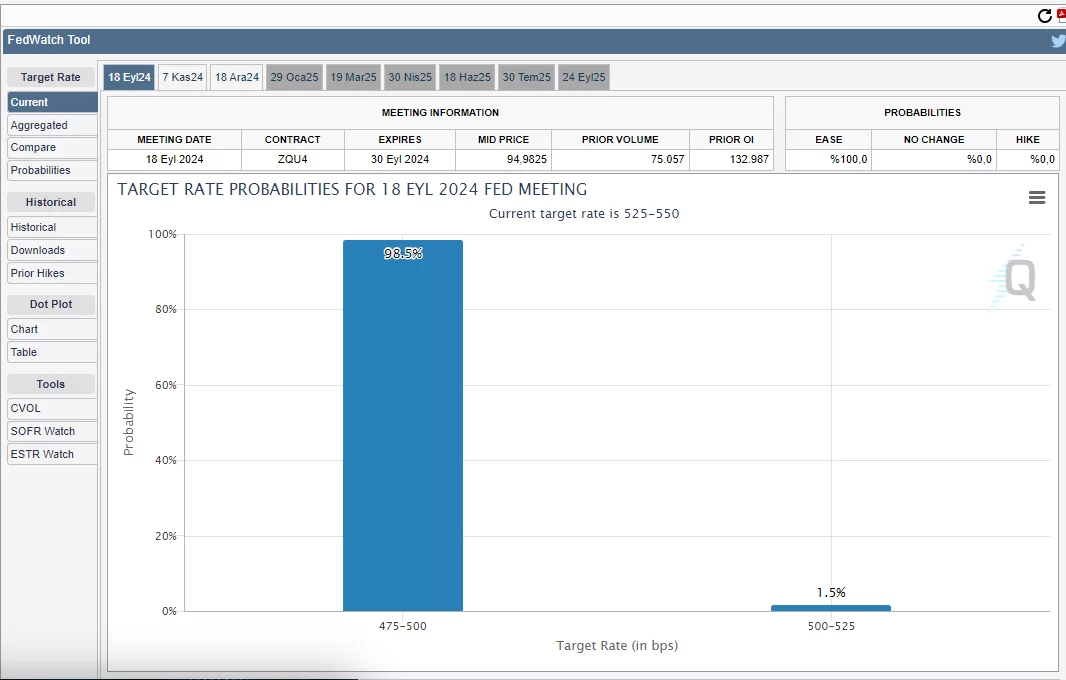

While it is certain in the market that the FED will reduce interest rates by 50 basis points in September, analysts state that there is a possibility that the FED will hold an emergency meeting to calm the anxiety in the markets and this probability is high.

According to the FEDWatch Tool, a 50 basis point cut in September is priced at 98.5%.

Market analysts also suggested that an interest rate cut could provide some relief, with one analyst saying, “Historically, Fed rate cuts have been used as a tool to stabilize markets, particularly rate cuts that saved the housing market in 2007.”

Speaking to Bloomberg, Sean Farrell, head of digital asset strategy at Fundstrat Global, stated that he is certain that the FED will cut interest rates in September and said, “The possibility of less restrictive monetary policy is a good thing for crypto.”

Khushboo Khullar of Lightning Ventures, which invests in Bitcoin-related companies, said: “The broad stock decline has created some panic, but the pullback in Bitcoin and cryptocurrencies presents a good buying opportunity for investors.” said.

An Extraordinary Meeting Was Held Before!

The FED had previously held extraordinary meetings and made interest rate reduction decisions.

At this point, the FED reduced the policy rate to the range of 0 – 0.25 percent at an extraordinary meeting in March 2020 due to the negative effects of the coronavirus epidemic on the economy. Again, the FED cut interest rates by 50 basis points after Lehman Brothers announced its bankruptcy in 2008.

*This is not investment advice.