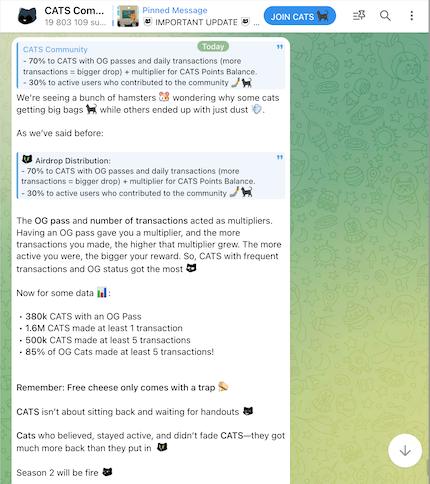

CATS on why some cats getting big bags while others ended up with just dust

We’re seeing a bunch of hamsters wondering why some cats getting big bags while others ended up with just dust.

As we’ve said before:

Airdrop Distribution:

- 70% to CATS with OG passes and daily transactions (more transactions = bigger drop) + multiplier for CATS Points Balance.

- 30% to active users who contributed to the community

The OG pass and number of transactions acted as multipliers. Having an OG pass gave you a multiplier, and the more transactions you made, the higher that multiplier grew. The more active you were, the bigger your reward. So, CATS with frequent transactions and OG status got the most

Now for some data :

• 380k CATS with an OG Pass

• 1.6M CATS made at least 1 transaction

• 500k CATS made at least 5 transactions

• 85% of OG Cats made at least 5 transactions!

Remember: Free cheese only comes with a trap

CATS isn’t about sitting back and waiting for handouts

Cats who believed, stayed active, and didn’t fade CATS—they got much more back than they put in

Season 2 will be fire

P.S. We know that a small group of CATS still has issues with uncounted OG passes or transactions, even though most of the problems were handled and solved before the airdrop. We want to ensure that no cat receives fewer CATS than they deserve

Soon, we’ll be opening a CATS hotline for airdrop/balance issues to make sure every cat is taken care of

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Rise of Dynamic Clean Energy Markets

- CleanTrade, CFTC-approved as a Swap Execution Facility (SEF), transformed clean energy markets into institutional-grade assets by standardizing VPPAs, PPAs, and RECs. - The platform addressed fragmented pricing and opaque risks, enabling $16B in transactions within two months and bridging renewable assets with institutional capital. - Institutional investors now use CleanTrade’s tools to hedge fossil fuel volatility and lock in renewable energy prices, mirroring traditional energy strategies. - Global cl

COAI Token Fraud: Insights for Cryptocurrency Investors During Times of Regulatory Ambiguity

- COAI token's 88% collapse in late 2025 exposed systemic risks in AI-driven DeFi ecosystems, with $116.8M investor losses. - Governance flaws included 87.9% token concentration in ten wallets, untested AI stablecoins, and lack of open-source audits. - Panic selling accelerated by AI-generated misinformation and CEO resignation, amid conflicting global crypto regulations. - Lessons emphasize scrutinizing token distribution, demanding transparent audits, and avoiding jurisdictions with regulatory ambiguity.

Renewable Energy Training as a Key Investment to Meet Future Workforce Needs

- Farmingdale State College's Wind Turbine Technology program aligns with surging demand for skilled labor in decarbonizing economies, driven by U.S. renewable energy targets. - Industry partnerships with Orsted, GE Renewable Energy, and $500K in offshore wind funding validate the program's role in addressing workforce shortages in expanding wind sectors. - Hands-on training with GWO certifications and VR simulations prepares graduates for high-demand, high-salary roles ($56K-$67K annually), reducing corpo

The Revival of STEM Learning as a Driving Force for Tomorrow’s Technology Investments

- Emerging STEM universities are driving tech innovation through interdisciplinary curricula and industry partnerships, focusing on AI, biotech , and advanced manufacturing. - U.S. programs like STEM Talent Challenge and NSF Future Manufacturing allocate $500K-$25.5M to bridge skills gaps and fund projects in quantum tech and biomanufacturing. - Leadership-focused STEM programs at institutions like Florida State and Purdue boost startup success rates (75-80%) and align with venture capital trends favoring