$16 million worth of ether from PlusToken ponzi moves to exchanges, analyst expects full $1.3 billion sale to follow

Around 7,000 ether tokens seized from the crypto ponzi scheme PlusToken were moved to exchanges earlier this week.Over $14 billion worth of different cryptocurrencies were seized from PlusToken, which defrauded over 2.6 million in 2018 and 2019.OXT analyst ErgoBTC said the recent sale of ether likely precedes a full sale of the cryptocurrency, which is worth $1.3 billion.

This comes around two months after wallets linked to the crypto scheme were seen moving large amounts of ether after being dormant since 2021.

“Current ETH distribution follows the same attempted obfuscation pattern as that of the BTC in 2019, with a likelihood of full sale of the $1.3b of ETH in the future,” said the OXT analyst ErgoBTC.

PlusToken was a Chinese crypto pyramid scheme that defrauded over 2.6 million people in 2018 and 2019. A local police crackdown confiscated over $14 billion worth of bitcoin, ether and seven other cryptocurrencies.

A court document seen by analyst ErgoBTC said that the seized crypto was turned over to Beijing Zhifan Technology Co to sell and convert the assets into cash for restitution.

According to the OXT analyst, an “overwhelming majority” of bitcoin, roughly worth $1.3 billion, was sold between 2019 and 2020. Meanwhile, around 542,000 ETH ($1.29 billion) remained untouched in thousands of mixing addresses until this August, when the assets were redistributed to 294 fresh addresses.

On Tuesday, about 15,700 ETH were moved out of the addresses in a mixing process similar to those in 2020 and 2021. According to ErgoBTC, around 7,000 ETH were sent to a "handful" of exchanges, including BitGet, Binance and OKX.

“Given the recent effort to re-obfuscate the ETH, it is unlikely that the active distribution of the 15.7k ETH moved yesterday is the last of the 540k ETH supply distribution,” said ErgoBTC. “This recently observed behavior introduces a new, unexpected supply overhang to Ethereum.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Morning Brief | The US Senate has passed a procedural vote on the "end government shutdown plan"; About 4.64 million bitcoins have been moved out of dormant wallets this year; Monad token public sale will start on November 17

Overview of major market events on November 10.

【Calm Order King】Trader achieves 20 consecutive wins: Who can stay calm after watching this?

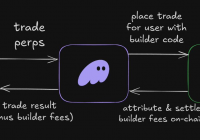

ERC-8021: Ethereum’s ‘copy Hyperliquid’ moment, a new way for developers to make a fortune?

Morgan Stanley: The End of Fed QT ≠ Restart of QE, Treasury's Issuance Strategy Is the Key

Morgan Stanley believes that the end of the Federal Reserve's quantitative tightening does not mean a restart of quantitative easing.

Trending news

MoreMorning Brief | The US Senate has passed a procedural vote on the "end government shutdown plan"; About 4.64 million bitcoins have been moved out of dormant wallets this year; Monad token public sale will start on November 17

【Calm Order King】Trader achieves 20 consecutive wins: Who can stay calm after watching this?