Bitcoin To Hit New All-Time High With Ease, Predicts Glassnode Co-Founders – Here’s Why

The founders of analytics firm Glassnode are predicting that Bitcoin ( BTC ) will soon print fresh all-time highs for one key reason.

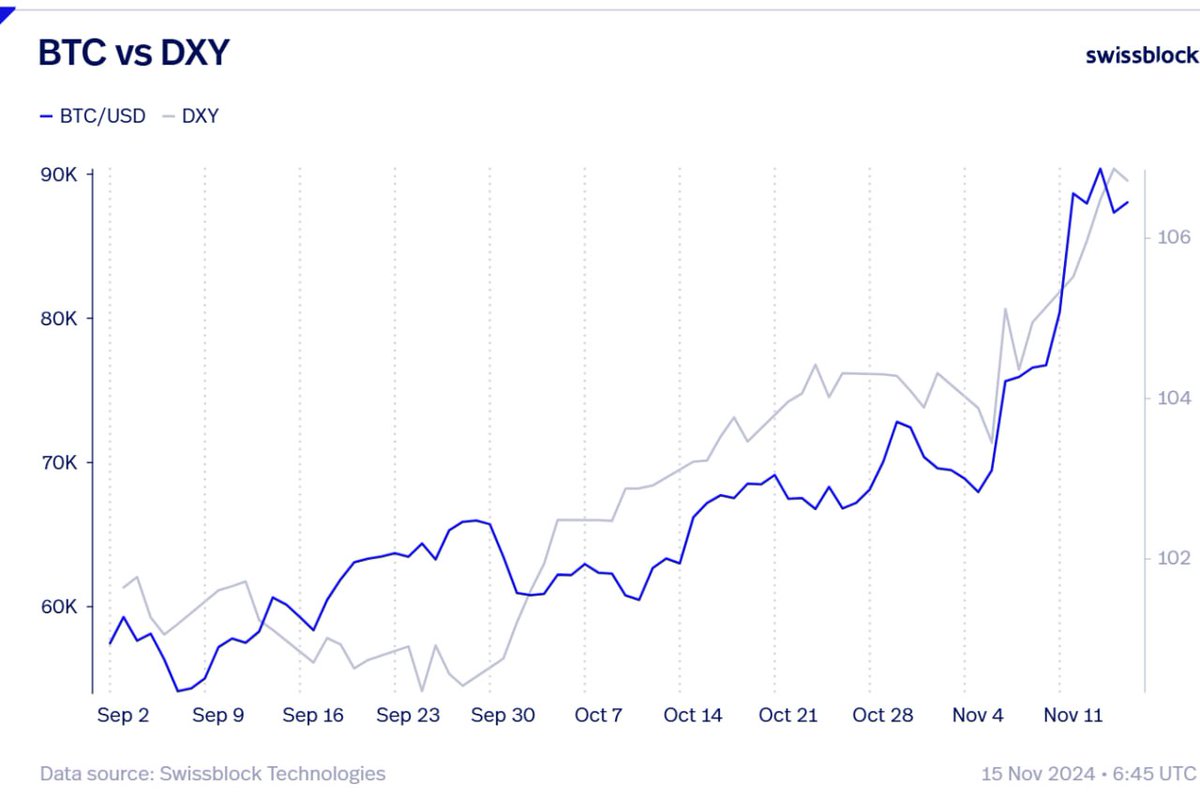

Jan Happel and Yann Allemann, who go by the handle Negentropic, tell their 63,200 followers on the social media platform X that Bitcoin may surge if the US Dollar Index (DXY) starts to decline due to the Fed’s rate-cutting cycle and quantitative easing (QE).

The DXY is a measure of the value of the US dollar against a basket of six major currencies. Traders keep a close watch on the DXY as a weak index suggests that investors are favoring risk assets like stocks and crypto over the dollar.

“Bitcoin and DXY: a tight dance. Bitcoin has closely tracked the DXY for weeks, especially post-US elections, as the dollar hit new yearly highs. But with easing policies in play, what happens when the DXY weakens and decoupling starts? Signs point to Bitcoin smashing new all-time highs with ease.”

Source: Negentropic/X

Source: Negentropic/X

Bitcoin is trading for $89,200 at time of writing, down nearly 5% from its all-time high of about $93,500.

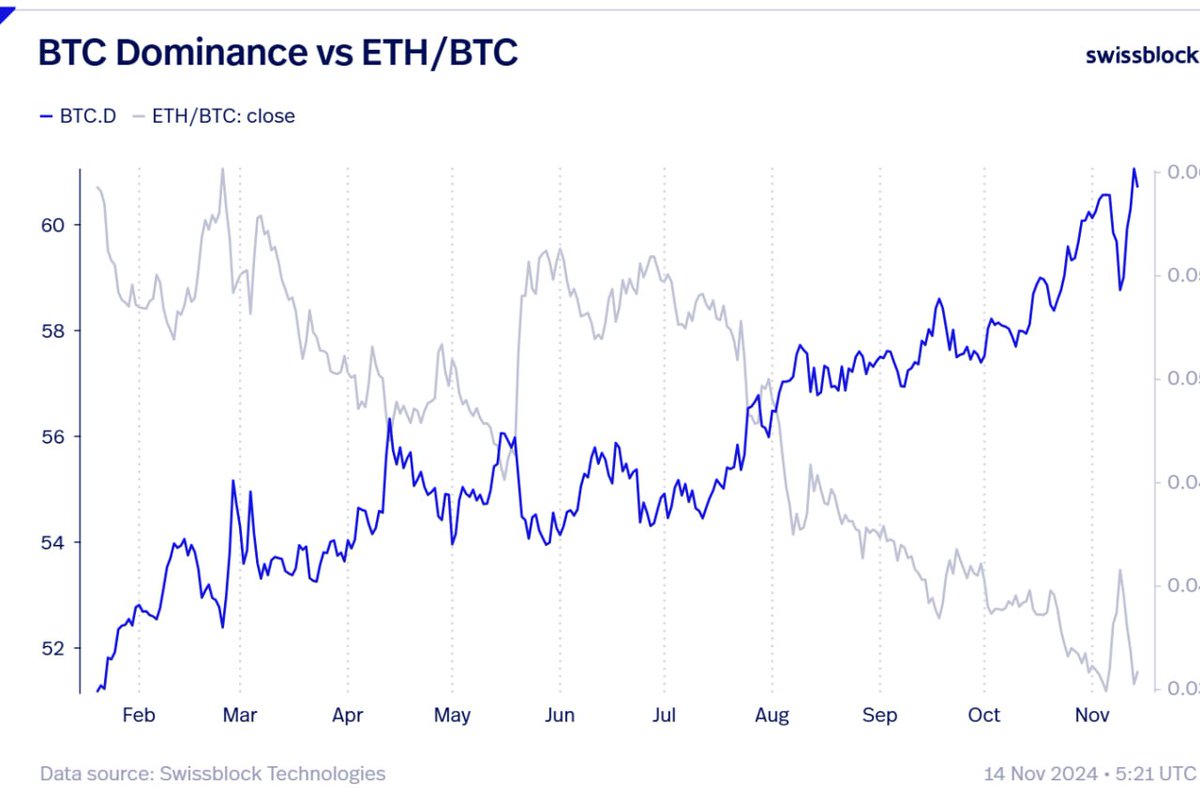

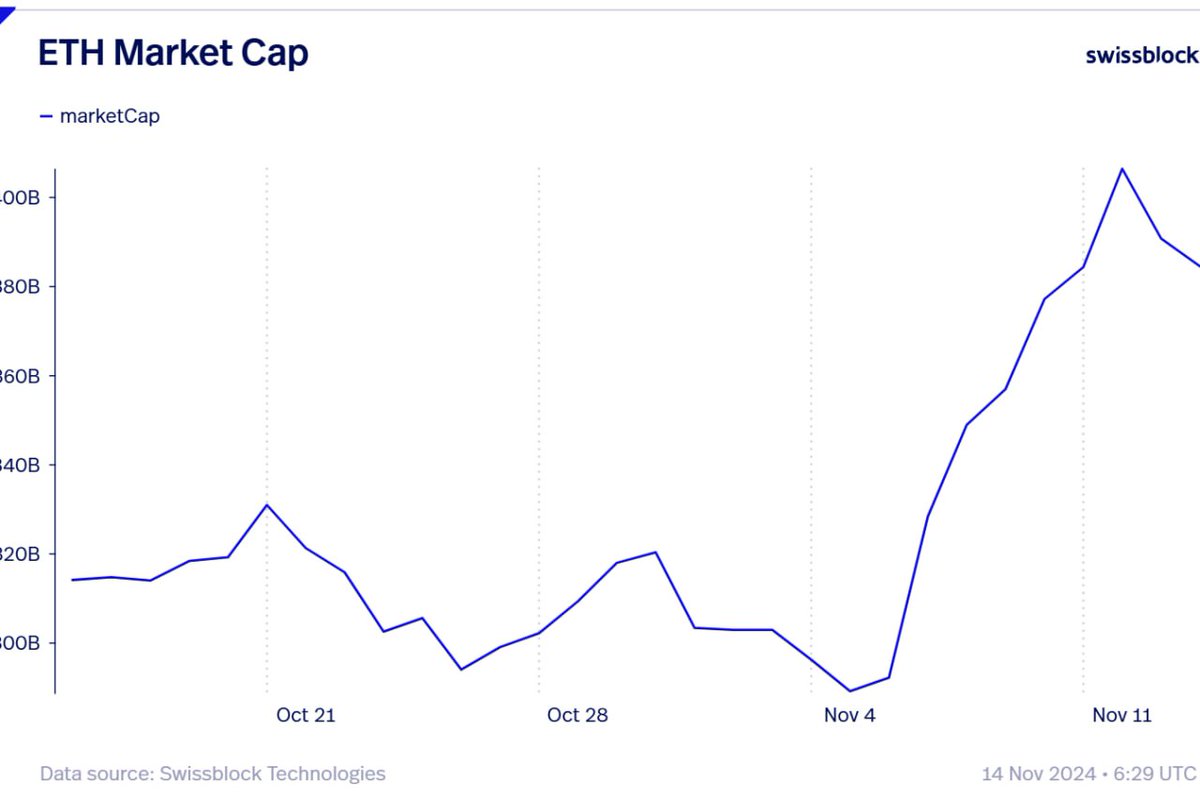

Next up, the analysts say Ethereum ( ETH ) is showing market strength despite declining against Bitcoin (ETH/BTC).

“During this Bitcoin rally, Ethereum took off, and as BTC hit $74,000 with a drop in dominance, the ETH/BTC pair eased its pressure. But after Bitcoin’s weekend pump, pushing it to $93,000, BTC dominance has surged, while the ETH/BTC pair slumped – without Ethereum’s price dropping significantly. What does this signal? A Bitcoin dominance rebound or ETH holders dumping on the pump? Taking a look at Ethereum’s market cap: after ‘Super Tuesday,’ it rose from $290 billion to just over $400 billion, During this ETH/BTC pullback and BTC dominance surge, ETH’s market cap only dipped to $380 billion. This suggests no dumping, just Bitcoin’s strength outshining other market forces.”

Source: Negentropic/X

Source: Negentropic/X

Bitcoin’s dominance level (BTC.D) is the ratio between the market cap of BTC versus the market cap of all crypto assets combined. At time of writing, BTC.D is at 61%.

Source: Negentropic/X

Source: Negentropic/X

ETH/BTC is trading for 0.03398 BTC ($3,035) at time of writing, down 4.39% in the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Sol Invictus/IvaFoto

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polymarket: The Rise of Cryptocurrency Prediction Markets

Can Bitcoin start a Christmas rally after returning to $90,000?

Vitalik's 256 ETH Donation: A Strategic Turning Point for the Privacy Communication Sector