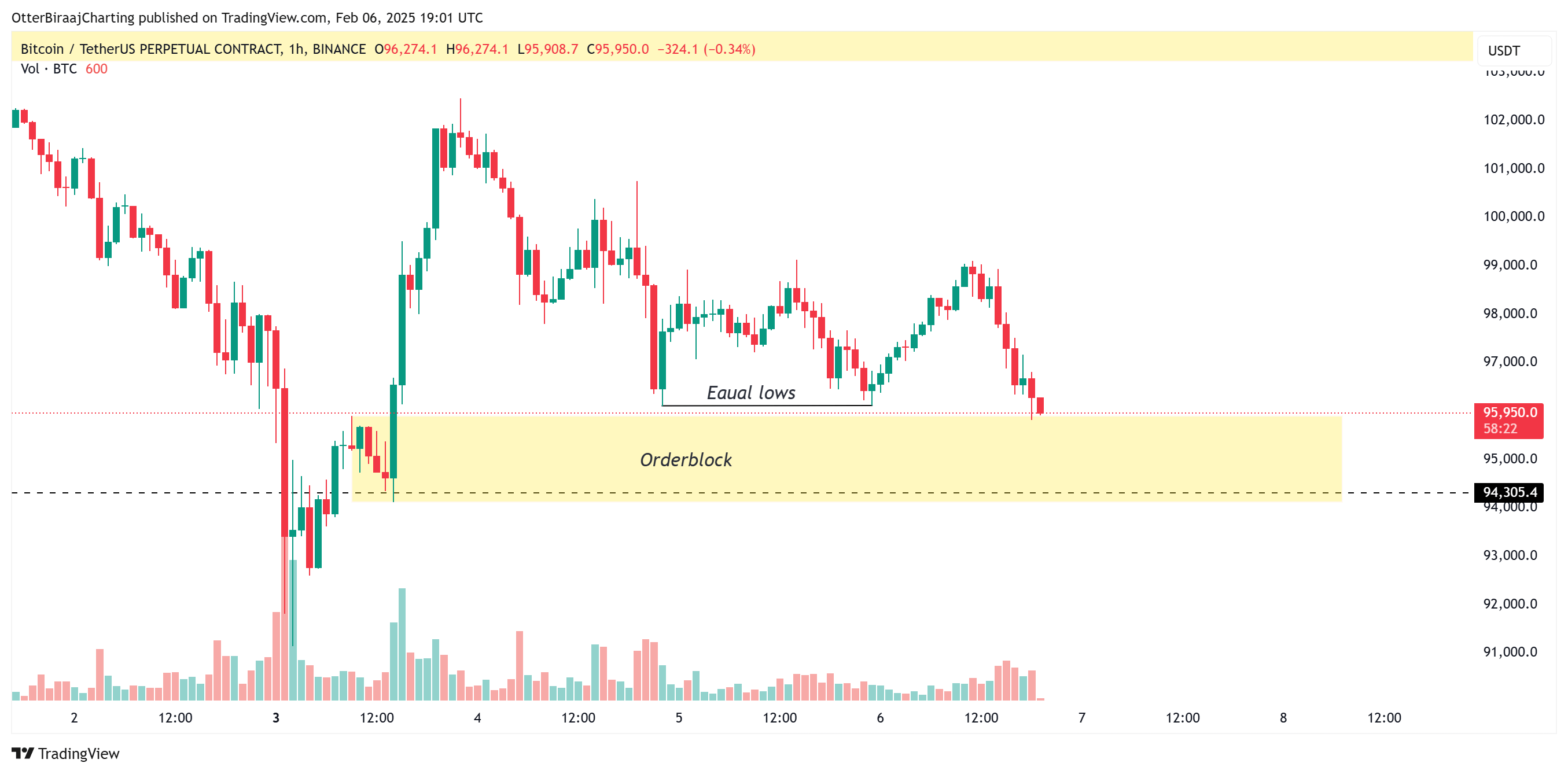

Bitcoin (BTC) continued its downtrend this week, dropping briefly below $95,600 during the trading day. With a demand zone between $94,300 and $95,800, the crypto asset has exhibited a liquidity sweep of equal lows around $96,200, but a clear bullish reversal has yet to take place in the short term.

Bitcoin price seasonality data calls for $120K in Q1, but leverage remains BTC’s ‘biggest risk’

Bitcoin’s historical price data favors new all-time highs in Q1, but liquidity gaps below $80,000 could pull the price lower in the short term.

Bitcoin on track to topple $120,000, says analyst

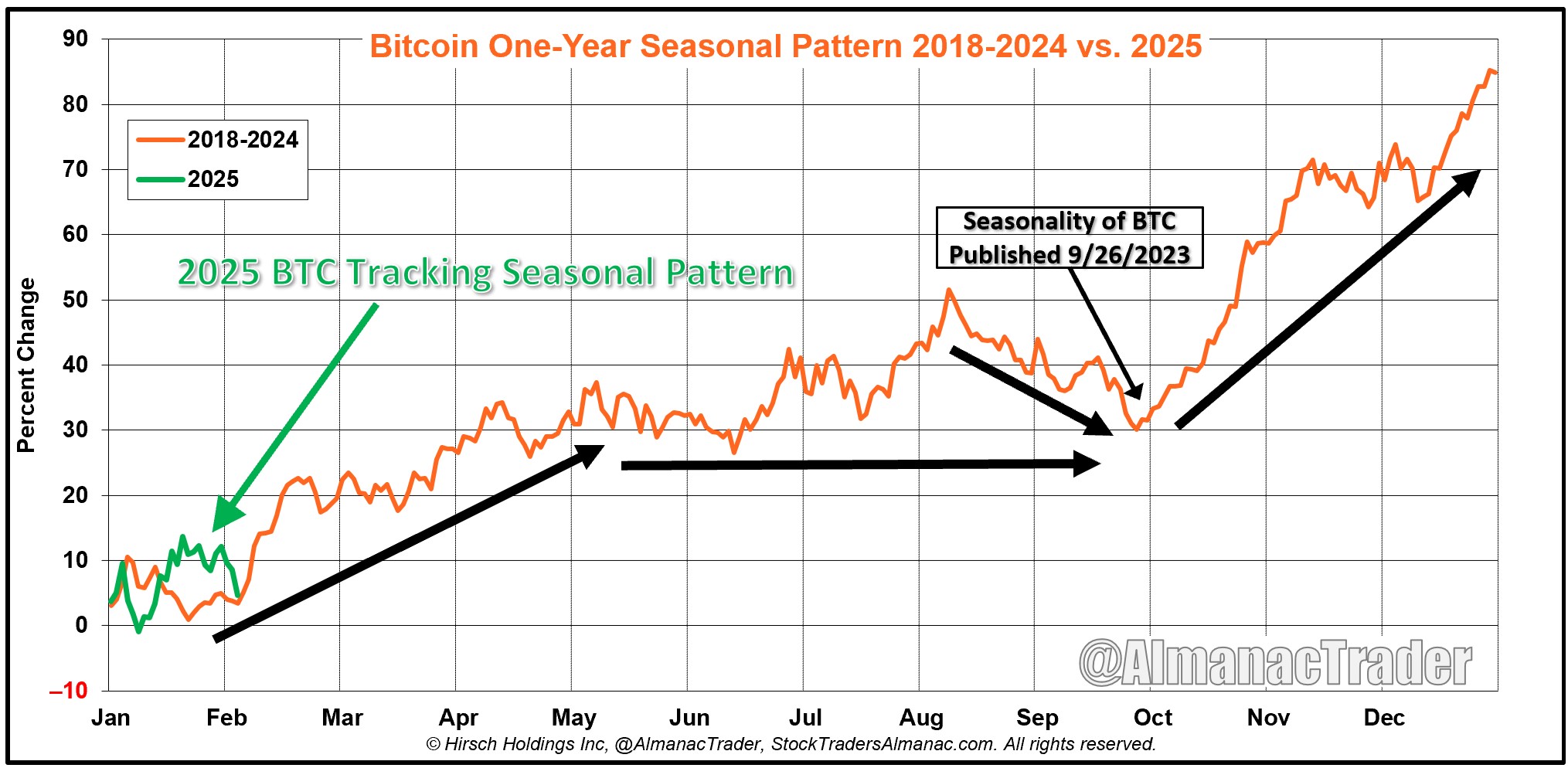

Mikybull, a crypto analyst, pointed out that despite BTC’s current consolidation phase, the crypto asset could potentially reach a new all-time high of $120,000 if it follows its seasonal pattern from 2018 to 2014.

As illustrated in the chart, Bitcoin has witnessed an uptrend on average during February, and with respect to the seasonality data, it is currently on track to trend higher in 2025 as well.

Since 2013, Bitcoin has delivered an average return of 14.08% in February, with the month ending in a decline only twice in the past decade. Its average Q1 returns also stand at 52.43%, behind Q4’s average returns of 84% since inception.

Similarly, Danny Marques, a markets researcher, also believed that BTC’s recent drop down to $91,000 was the local bottom. The analyst added ,

“Bitcoin will be going to $120k+ sooner than you think and it'll be quick This is how I see next few weeks/months for those that care about charts.”

BTC to $110,000 or $80,000 first?

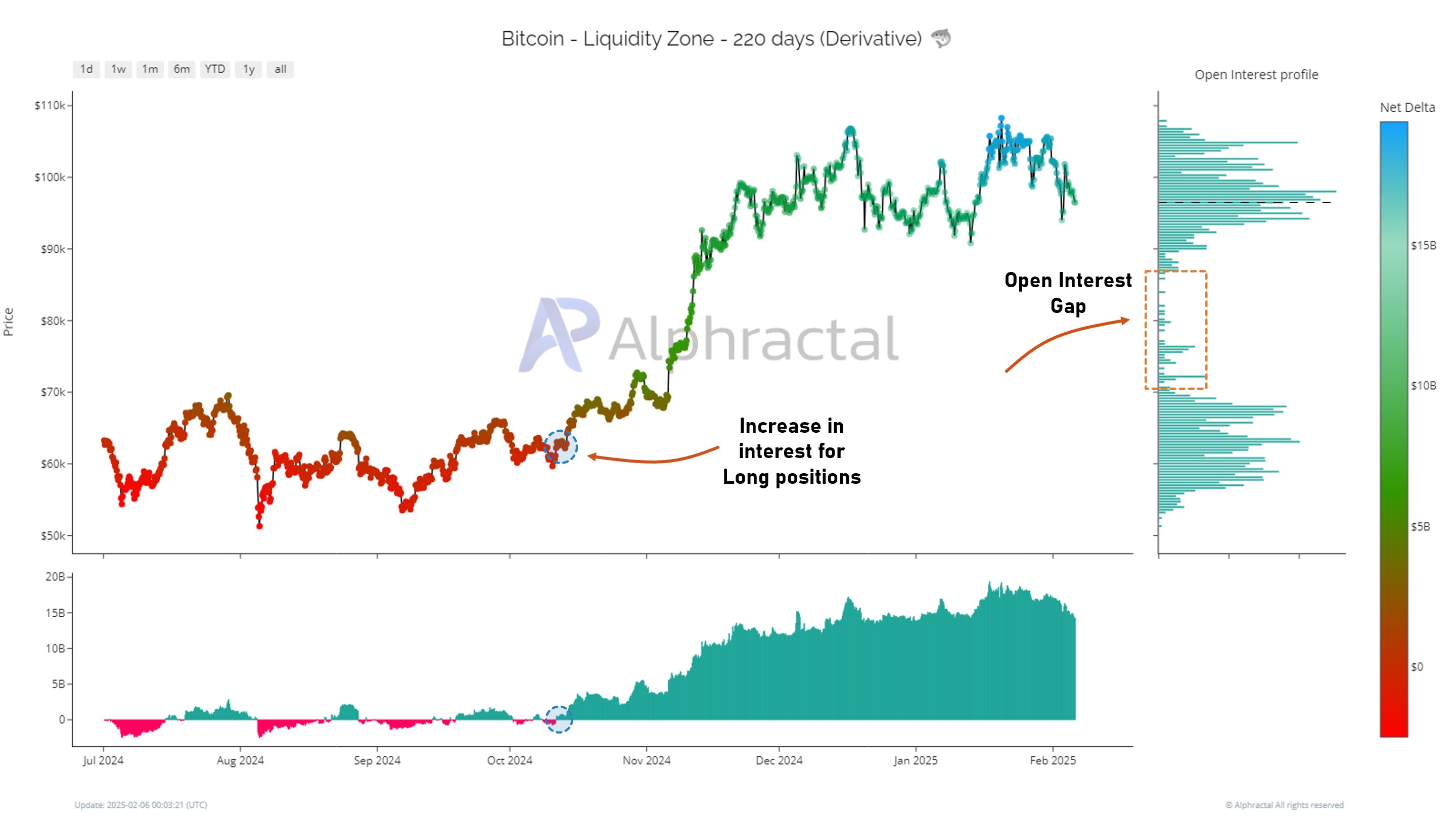

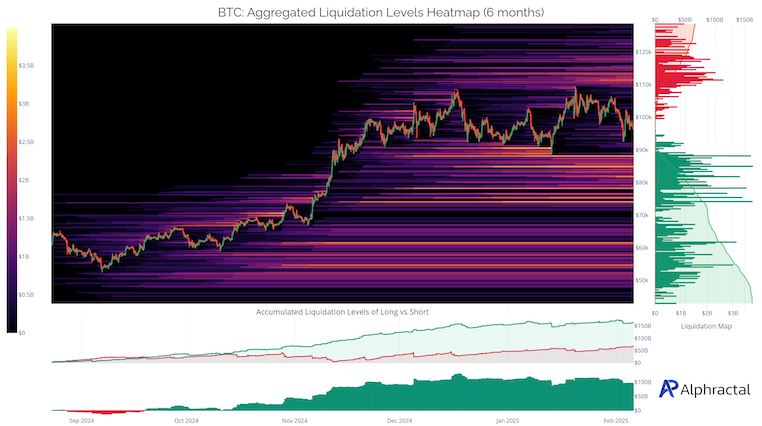

Despite arguments supporting a local bottom, Alphractal, a data analysis platform, highlighted leverage trading as Bitcoin’s “greatest risk” which may open the possibility of a $80,000 retest.

In an X post, the analytics platform said that there was a notable increase in long positions during October 2024, which created a significant liquidity gap between $72,000 and $86,000, where low trading activity took place.

Thus, a sharp drop below $80,000 remains a possibility to liquidate the long positions built since November 2024.

On the other hand, there is also a cluster of short positions just above $111,000, which were opened in December 2024, but it is important to note that there are twice as many longs compared to shorts.

Additionally, the decrease in open interest from $76 billion to $59 billion implied a reduction in the use of leverage in the market, which could signal less risk appetite among traders, potentially affecting Bitcoin's price stability over the next few weeks.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hopes for a December rate cut fade? Bitcoin erases its yearly gains

After the release of the delayed U.S. September non-farm payroll data, which was postponed by 43 days, the market has almost abandoned expectations for a rate cut in December.

Gold Rush Handbook | Circle Arc Early Interaction Step-by-Step Guide

Remain proactive even during a sluggish market.

Mars Morning News | Nvidia's impressive earnings boost market confidence, while growing divisions in the Fed minutes cast doubt on a December rate cut

Nvidia's earnings report exceeded expectations, boosting market confidence and fueling the ongoing AI investment boom. The Federal Reserve minutes revealed increased disagreement over a possible rate cut in December. The crypto market is seeing ETF expansion but faces liquidity challenges. Ethereum has proposed EIL to address L2 fragmentation. A Cloudflare outage has raised concerns about the risks of centralized services. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved during iteration.

Surviving a 97% Crash: Solana’s Eight-Year Struggle Revealed—True Strength Never Follows the Script

Solana co-founder Anatoly Yakovenko reviewed the origins, development process, challenges faced, and future vision of Solana, emphasizing the transaction efficiency of a high-performance blockchain and the comprehensive integration of financial services. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the iterative update stage.