Bitcoin Today 17/03/2025: BTC Trades at $83K as Tokens Explode 300%

- Bitcoin rises to $83K today.

- MAVIA and EPIC tokens explode.

- BTC stress rate reaches alarming level.

With a daily increase of over 1%, the price of Bitcoin today 17/03/2025 is holding above the $83 zone while cryptocurrencies ETH, XRP, BNB and DOGE are registering increases between 2% and 3%. The highlight in the last 24 hours are the Heroes of Mavia (MAVIA) and Epic Cash (EPIC) tokens, which exploded an impressive 300%. Currently, Mavia is trading at $0,56 with an increase of over 291% while EPIC exploded 352.1% today and is being quoted at $1,53.

BTC, in turn, began an upward trajectory recently, breaking the $84 barrier again yesterday. However, the asset did not sustain its movement and retracted to $82, managing to recover to its current level.

At the time of publication, the price of Bitcoin was quoted at US$ 82.748,56 with an increase of 1.3% in the last 24 hours, equivalent to approximately R$ 479,794.90 BRL and € 76,677.00 EUR. In one week, BTC appreciated 1.3%.

Source: TradingView

Source: TradingView

Following Bitcoin’s current development, major cryptocurrencies are witnessing significant recovery in the last 24 hours. Ethereum is trading at $1.911,83 with a 2.1% increase in its price. XRP is trading at $2,34 with a 1.9% increase. Cardano is priced at $0,7249 after registering a 2.7% increase. Solana is down 0.6% and is trading at $129,25. With a 3.5% increase, DOGE is trading at $0,1733. Leading gainers among major cryptocurrencies, BNB is up 6.3% to $631,38.

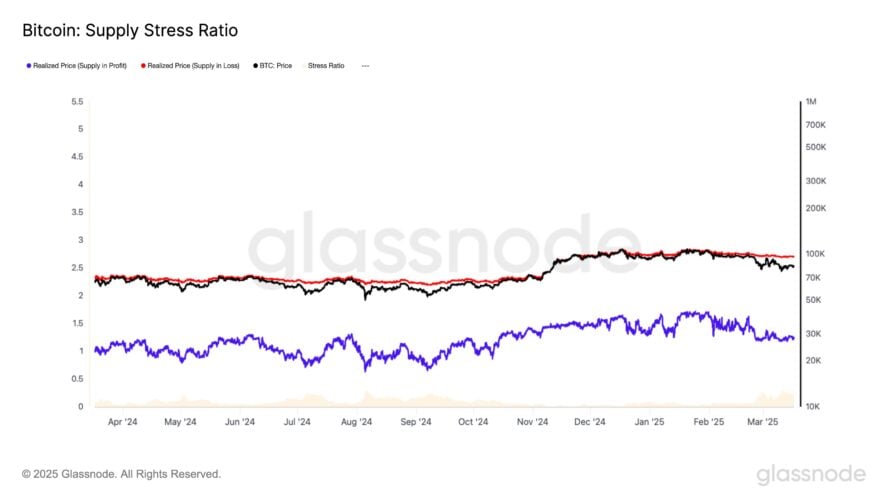

Bitcoin Stress Rate Reaches Alarming Level

In a scenario that has been worrying investors and cryptocurrency enthusiasts, a new indicator is raising alarm bells for Bitcoin investors. The cryptocurrency’s “profitability stress ratio,” which measures the ratio of supply to loss in the market, reached 0,23, the highest value since last September, according to data shared by the Glassnode analysis platform. This level historically precedes periods of market turbulence, generating concerns about the near future of Bitcoin.

Source: Glassnode

Source: Glassnode

Glassnode’s analysis highlights that the rising stress ratio indicates increasing pressure in the market. In simple terms, more investors are selling their Bitcoins at a loss, which could trigger a spiral of selling and price decline.

“Historically, values above 0,2 have marked periods of heightened market stress. If the value continues to rise, it could signal increasing market pressure, potentially reinforcing a broader shift in sentiment,” he said.

Bitcoin has seen significant corrections in recent months, with its price seeing a 14.6% drop in the last 30 days alone.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Avalanche Breaks Trendline Near $13.7, Solana Nears a Decision Point, But BlockDAG’s $0.001 Price Window Is Stealing the Spotlight

Zcash Faces Weekend Challenges with Price Pressures

Ethereum ETF cut as Defiance pulls products from market

Samson Mow Challenges Bitcoin Growth Projections with Bold Assertions