How High Will Helium Price Go After SEC Drops Case?

In a landmark victory for Helium and the broader DePIN (Decentralized Physical Infrastructure) movement, the U.S. SEC has officially dropped its unregistered securities claims against Helium with prejudice. That means the SEC can’t come back to pursue these charges again. With this cloud of regulatory uncertainty finally lifted, the Helium Network—and its tokens HNT, MOBILE, and IOT—can now move forward with full confidence.

Following the news, Helium (HNT) price surged over 6%, hitting levels not seen in months. But with the charts heating up and momentum picking up, one big question remains: How high can Helium price go from here?

Is This a Turning Point for Helium and the DePIN Sector?

Absolutely. This isn’t just good news for HNT holders—it’s a signal to the entire crypto industry that real-world infrastructure projects like Helium are gaining legitimacy in the eyes of regulators. With the SEC declaring that Helium Hotspots and its token distribution mechanisms are not securities, a key barrier to adoption has just been smashed.

This gives Helium the green light to scale globally, attract new partners, and explore integrations without the fear of legal ambiguity. The regulatory clarity has also revived investor sentiment, as reflected in the charts.

Helium Price Prediction: What Does the Daily Chart Say About HNT's Trend?

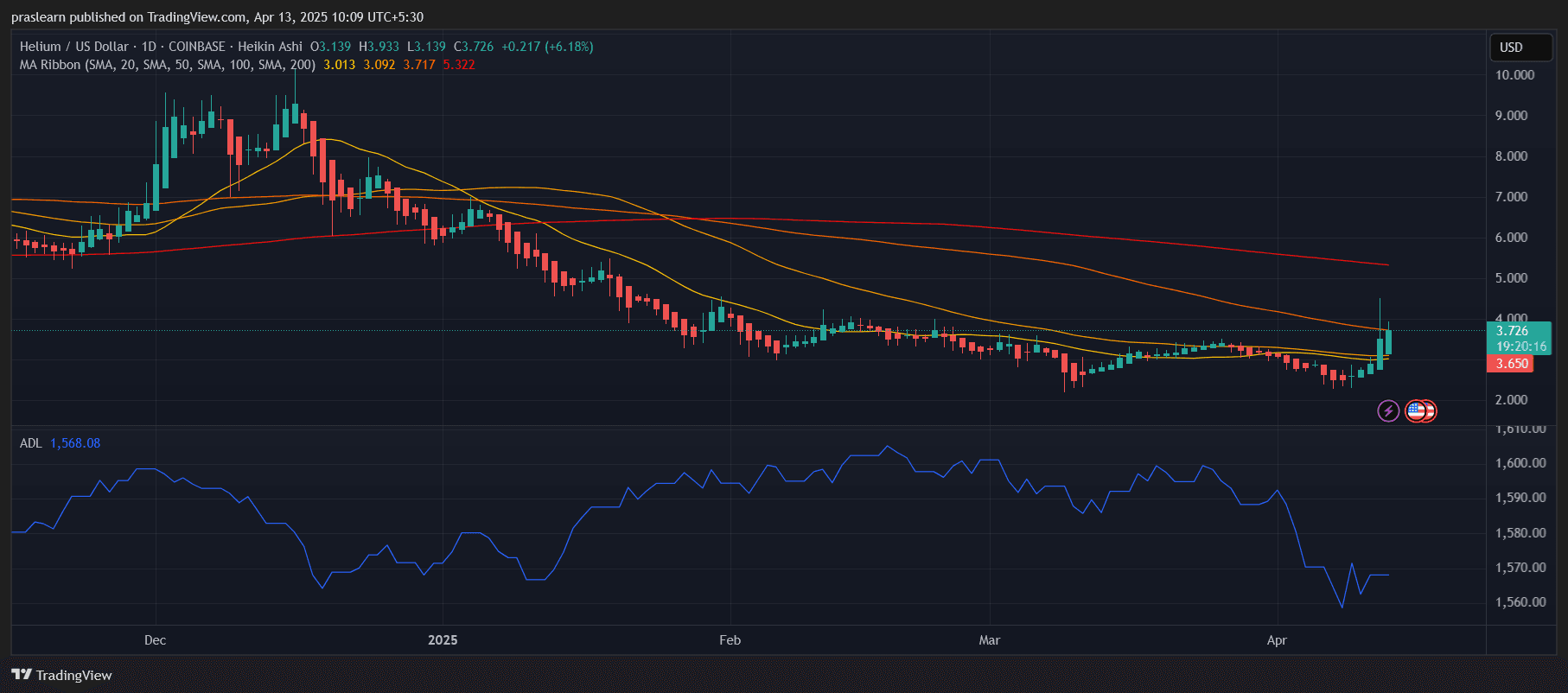

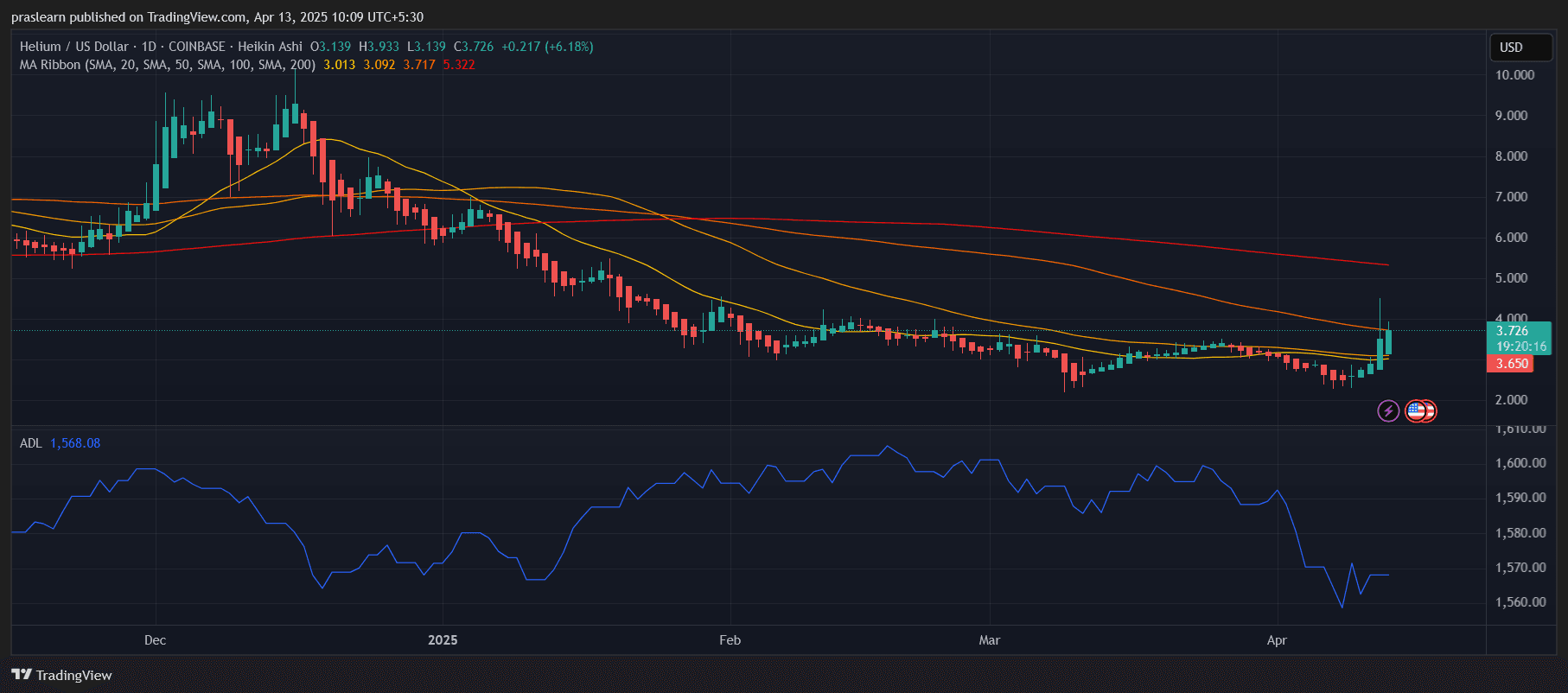

HNT/USD Daily Chart- TradingView

HNT/USD Daily Chart- TradingView

Helium’s daily chart looks like a technical breakout in motion. After weeks of tight consolidation, HNT exploded to $3.72, gaining more than 6% on the day. The price has successfully reclaimed the 20-day and 50-day SMAs, currently hovering around $3.01 and $3.09, showing bullish control.

More importantly, HNT pierced through the 100-day SMA at $3.71 , and if it holds above this level, the next key resistance is the 200-day SMA at $5.32. That would mark a nearly 40% upside from here, and if volume continues to rise, that target looks increasingly realistic.

The Accumulation/Distribution Line (ADL) is finally turning upward from 1,568.08, showing early signs that investors are buying into this rally—not just trading it.

Does the Hourly Chart Confirm Strength or Suggest a Cooldown?

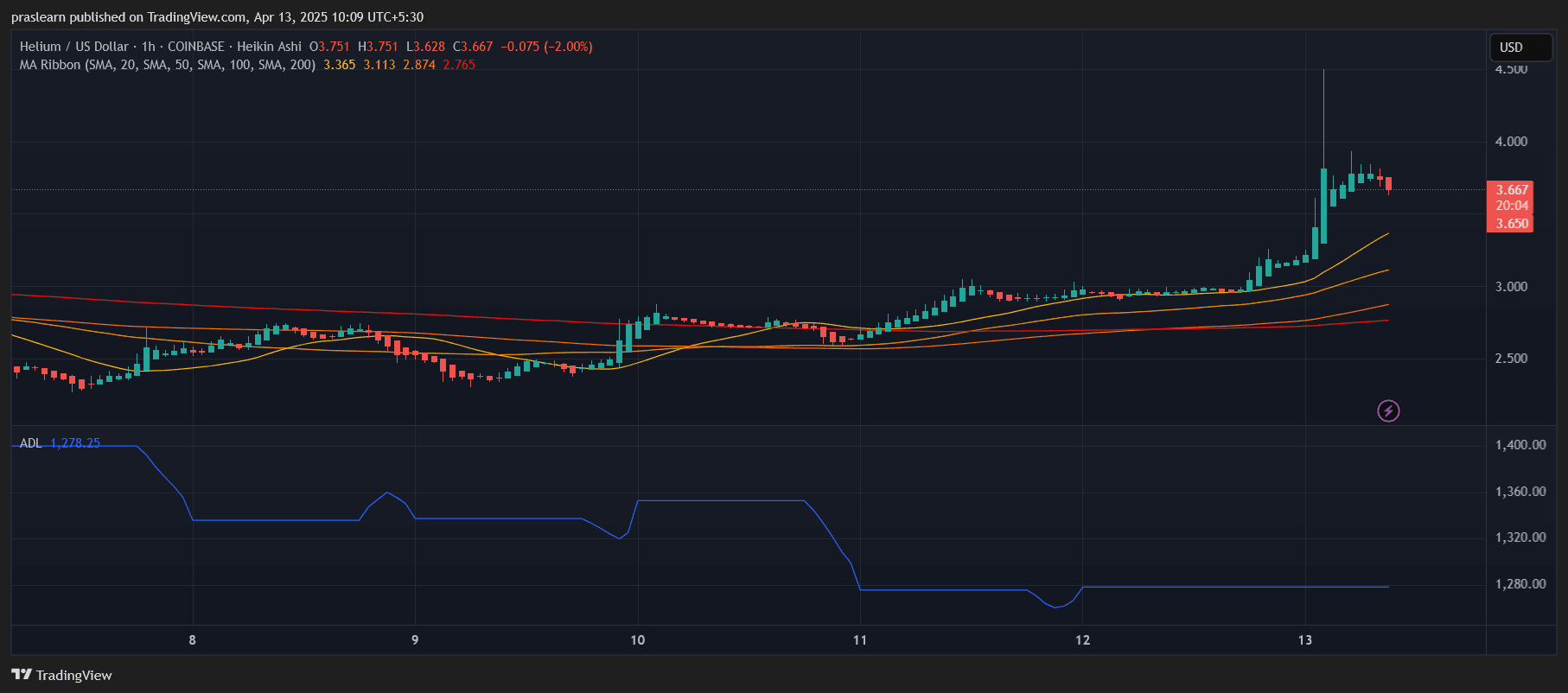

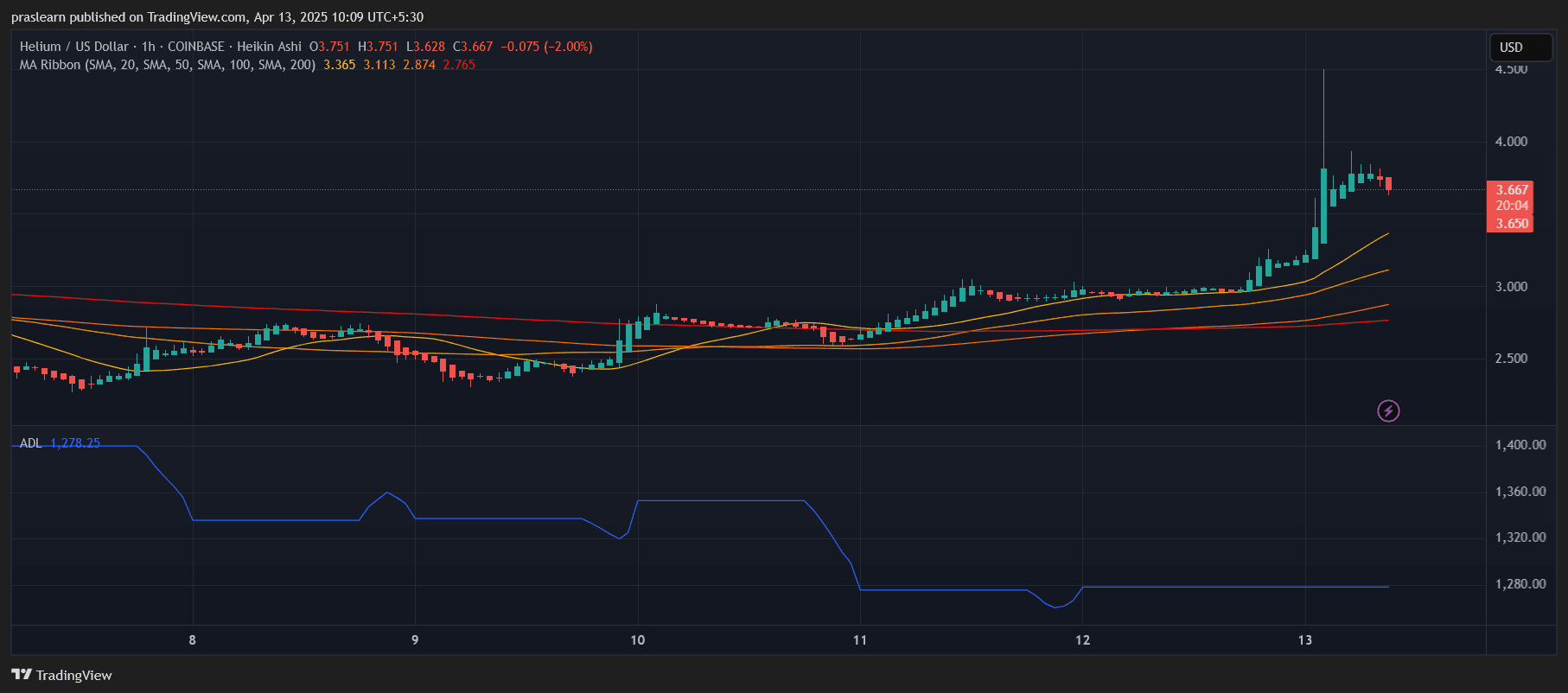

HNT/USD 1 Hr Chart- TradingView

HNT/USD 1 Hr Chart- TradingView

On the hourly chart, Helium price recently experienced a parabolic spike—a strong bullish signal that was followed by healthy consolidation. The price reached a high near $4.50, then pulled back slightly to the current level of $3.66, suggesting some profit-taking, but not full exhaustion.

HNT price is still well above all major short-term moving averages, with the 20-, 50-, 100-, and 200-hour SMAs clustering below $3.36, creating a strong base of support.

The Heikin Ashi candles are flattening, but remain mostly green, while the ADL on this chart has remained steady at 1,278.25, showing that long-term buyers aren’t fleeing.

If bulls maintain control, a retest of $4.20–$4.50 could happen quickly. However, if the rally loses steam short-term, support at $3.40 should act as a bounce zone before attempting a new leg higher.

Helium Price Prediction: How High Can Helium Price Go in 2025?

This legal win has removed a major ceiling on Helium’s long-term potential . Not only is HNT price cleared from the regulatory fog, but it also stands as a blueprint for how real-world crypto utility can coexist with legal frameworks. If the market momentum persists and DePIN adoption continues, $5.00–$6.00 is a realistic short-term target, with longer-term projections going even higher depending on adoption and broader market sentiment.

Is Helium the DePIN Leader Now?

With the SEC officially stepping aside, Helium price has secured a spot as the leading DePIN project in crypto. Its combination of regulatory clarity, growing ecosystem, and technical breakout makes it one of the most promising plays in the current market.

This isn’t just a rally—it’s a rebirth. And for Helium price, the sky might not even be the limit.

In a landmark victory for Helium and the broader DePIN (Decentralized Physical Infrastructure) movement, the U.S. SEC has officially dropped its unregistered securities claims against Helium with prejudice. That means the SEC can’t come back to pursue these charges again. With this cloud of regulatory uncertainty finally lifted, the Helium Network—and its tokens HNT, MOBILE, and IOT—can now move forward with full confidence.

Following the news, Helium (HNT) price surged over 6%, hitting levels not seen in months. But with the charts heating up and momentum picking up, one big question remains: How high can Helium price go from here?

Is This a Turning Point for Helium and the DePIN Sector?

Absolutely. This isn’t just good news for HNT holders—it’s a signal to the entire crypto industry that real-world infrastructure projects like Helium are gaining legitimacy in the eyes of regulators. With the SEC declaring that Helium Hotspots and its token distribution mechanisms are not securities, a key barrier to adoption has just been smashed.

This gives Helium the green light to scale globally, attract new partners, and explore integrations without the fear of legal ambiguity. The regulatory clarity has also revived investor sentiment, as reflected in the charts.

Helium Price Prediction: What Does the Daily Chart Say About HNT's Trend?

HNT/USD Daily Chart- TradingView

HNT/USD Daily Chart- TradingView

Helium’s daily chart looks like a technical breakout in motion. After weeks of tight consolidation, HNT exploded to $3.72, gaining more than 6% on the day. The price has successfully reclaimed the 20-day and 50-day SMAs, currently hovering around $3.01 and $3.09, showing bullish control.

More importantly, HNT pierced through the 100-day SMA at $3.71 , and if it holds above this level, the next key resistance is the 200-day SMA at $5.32. That would mark a nearly 40% upside from here, and if volume continues to rise, that target looks increasingly realistic.

The Accumulation/Distribution Line (ADL) is finally turning upward from 1,568.08, showing early signs that investors are buying into this rally—not just trading it.

Does the Hourly Chart Confirm Strength or Suggest a Cooldown?

HNT/USD 1 Hr Chart- TradingView

HNT/USD 1 Hr Chart- TradingView

On the hourly chart, Helium price recently experienced a parabolic spike—a strong bullish signal that was followed by healthy consolidation. The price reached a high near $4.50, then pulled back slightly to the current level of $3.66, suggesting some profit-taking, but not full exhaustion.

HNT price is still well above all major short-term moving averages, with the 20-, 50-, 100-, and 200-hour SMAs clustering below $3.36, creating a strong base of support.

The Heikin Ashi candles are flattening, but remain mostly green, while the ADL on this chart has remained steady at 1,278.25, showing that long-term buyers aren’t fleeing.

If bulls maintain control, a retest of $4.20–$4.50 could happen quickly. However, if the rally loses steam short-term, support at $3.40 should act as a bounce zone before attempting a new leg higher.

Helium Price Prediction: How High Can Helium Price Go in 2025?

This legal win has removed a major ceiling on Helium’s long-term potential . Not only is HNT price cleared from the regulatory fog, but it also stands as a blueprint for how real-world crypto utility can coexist with legal frameworks. If the market momentum persists and DePIN adoption continues, $5.00–$6.00 is a realistic short-term target, with longer-term projections going even higher depending on adoption and broader market sentiment.

Is Helium the DePIN Leader Now?

With the SEC officially stepping aside, Helium price has secured a spot as the leading DePIN project in crypto. Its combination of regulatory clarity, growing ecosystem, and technical breakout makes it one of the most promising plays in the current market.

This isn’t just a rally—it’s a rebirth. And for Helium price, the sky might not even be the limit.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hopes for a December rate cut fade? Bitcoin erases its yearly gains

After the release of the delayed U.S. September non-farm payroll data, which was postponed by 43 days, the market has almost abandoned expectations for a rate cut in December.

Gold Rush Handbook | Circle Arc Early Interaction Step-by-Step Guide

Remain proactive even during a sluggish market.

Mars Morning News | Nvidia's impressive earnings boost market confidence, while growing divisions in the Fed minutes cast doubt on a December rate cut

Nvidia's earnings report exceeded expectations, boosting market confidence and fueling the ongoing AI investment boom. The Federal Reserve minutes revealed increased disagreement over a possible rate cut in December. The crypto market is seeing ETF expansion but faces liquidity challenges. Ethereum has proposed EIL to address L2 fragmentation. A Cloudflare outage has raised concerns about the risks of centralized services. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved during iteration.

Surviving a 97% Crash: Solana’s Eight-Year Struggle Revealed—True Strength Never Follows the Script

Solana co-founder Anatoly Yakovenko reviewed the origins, development process, challenges faced, and future vision of Solana, emphasizing the transaction efficiency of a high-performance blockchain and the comprehensive integration of financial services. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the iterative update stage.