Zilliqa transitions to 2.0 with full EVM support and protocol overhaul

Zilliqa blockchain network has officially moved from version 1.0 to 2.0, a protocol upgrade that restructures the blockchain’s architecture.

According to a press release shared with crypto.news, the update introduces Ethereum Virtual Machine (EVM) compatibility, a new Proof-of-Stake consensus model, and infrastructure designed to support institutional use cases.

The roll out follows a six-month test phase involving 21 external validators. During this period, the proto-mainnet processed 7.5 million blocks and completed 15 client upgrades.

Key features of the upgrade include modular components that allow for greater network flexibility and future scalability. The update also introduces support for tokenized assets, verifiable smart contracts, and compliance-aligned DeFi infrastructure.

With EVM compatibility now in place, developers can deploy Ethereum-native applications on Zilliqa without significant changes. The platform also adds customizable shards, cross-chain communication, light client support, and updated staking mechanics.

The new staking system is designed to streamline validator onboarding and offers early incentives for users who migrate from Zilliqa 1.0. This is part of a broader shift intended to transition liquidity to the upgraded network while maintaining performance.

Zilliqa’s roadmap includes future additions such as smart accounts and zero-knowledge features, with aims to support digital identity, programmable assets, and privacy-preserving compliance tools.

Initial projects building on Zilliqa 2.0 span areas like tokenized assets, regulated DeFi, and fintech infrastructure. Early integrations include partnerships with LTIN and deBridge, which plans to bring native USDC to the network.

Under 1.0, the network experienced periods of instability, including validator bugs and service outages. According to the team, the upgraded version offers a more modular and fault-tolerant architecture to address technical limitations and improve overall network reliability.

Commenting on the upgrade, Zilliqa interim CEO Alexander Zahnd emphasized the importance of the transformation.

“We’re building the blockchain institutions can trust without compromising on the speed, flexibility, or openness that brought us here in the first place. The next era of blockchain won’t be built on hype. It’ll be built on trust, transparency, and technical excellence. That’s what Zilliqa 2.0 stands for”, he said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

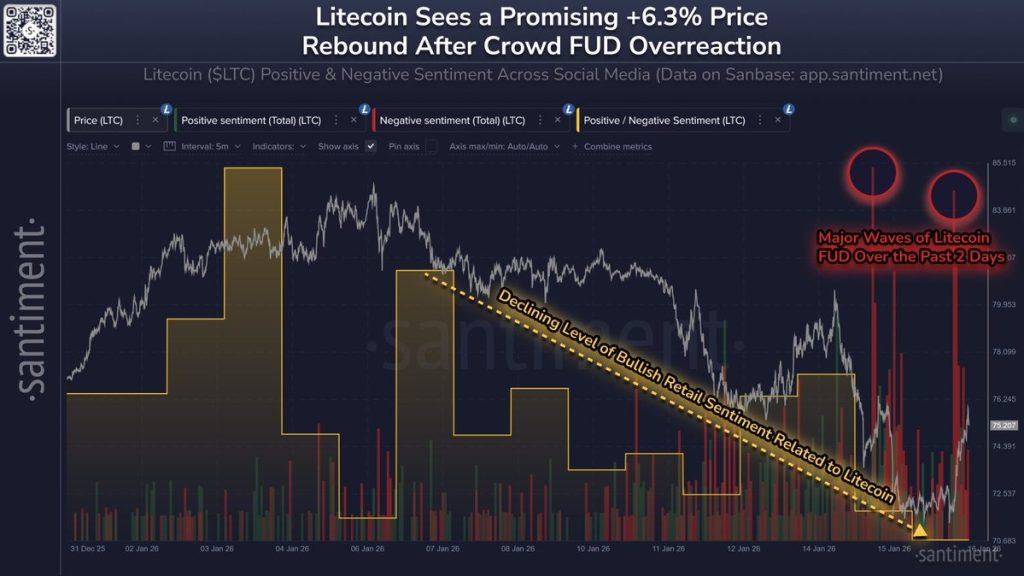

Are Traders Leaving Litecoin (LTC)? What It Means for This OG Crypto

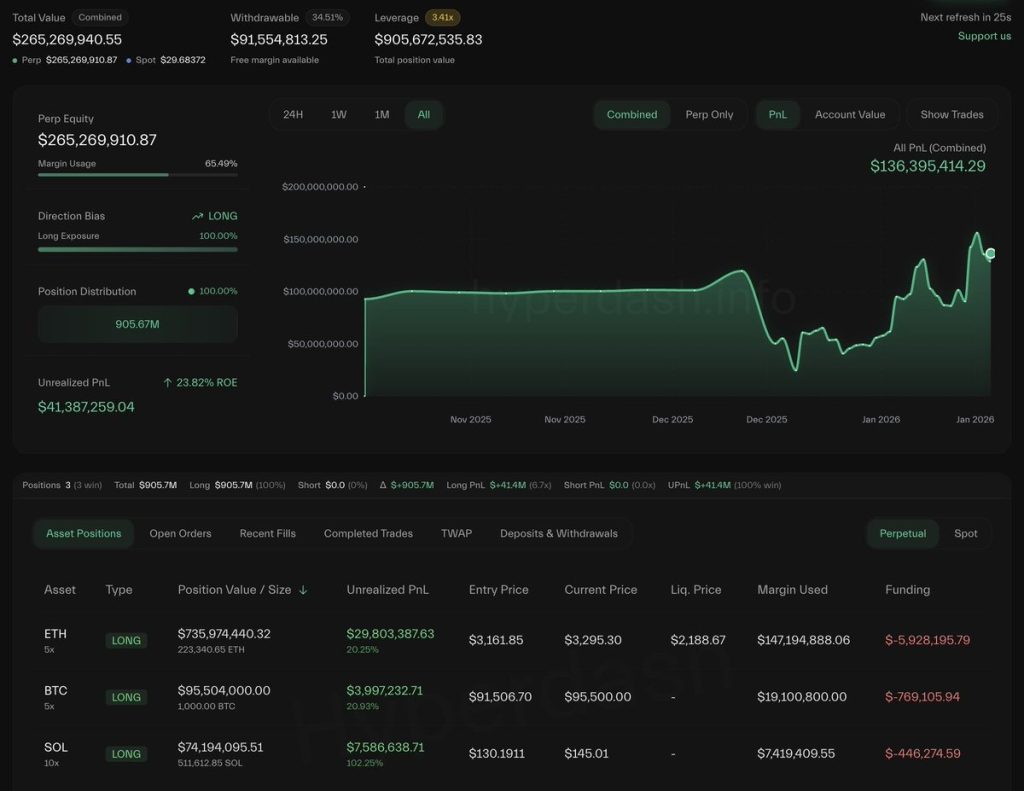

Solana (SOL) Price Eyes $150 as Active Addresses Rebound and ETF Volumes Hit $6B

Top Crypto to Watch This Weekend: BTC, ETH and SOL as Open Interest Rises

U.S. Treasury Scott Bessent Drops FED Chair Timeline: Trump’s Decision Coming Soon