UK crypto crackdown: Harsher fines incoming for non-compliant traders

Britain’s crypto traders may soon face more than just market volatility—starting in January, failure to share personal details with trading platforms could cost them £300 each.

The UK government is tightening its grip on the crypto economy with new tax compliance rules that require users to provide identifying information to exchanges and platforms. The Cryptoasset Reporting Framework, designed to close loopholes and capture unpaid capital gains, is expected to raise £315 million by April 2030. The fines—targeting both individual holders and non-compliant service providers—are part of a broader push to bring digital assets under traditional financial oversight and align UK regulations more closely with U.S. policy than the EU’s approach.

According to the Daily Mail , holders of Bitcoin ( BTC ), Ethereum ( ETH ), and other cryptocurrencies must supply accurate information to exchanges and platforms they use for trading.

Service providers that fail to report transaction details and tax reference numbers will also face penalties.

‘I’m not going to apologise’: Chancellor Reeves

Exchequer Secretary James Murray MP stated the rules will help “crack down on tax dodgers as we close the tax gap.”

The minister emphasized that comprehensive reporting will ensure “tax dodgers have nowhere to hide” while generating revenue for essential public services including healthcare and law enforcement.

The new framework forms part of broader government efforts to increase tax compliance across digital asset transactions. Current UK tax rules require cryptocurrency holders to pay capital gains tax on profits, but enforcement has been limited by reporting gaps.

The timing coincides with Chancellor Rachel Reeves’s refusal to rule out future tax increases following recent welfare reform reversals.

Reeves defended the government’s fiscal approach, stating, “I’m not going to apologise for making sure the numbers add up.”

The tax compliance measures complement the UK’s broader cryptocurrency regulatory framework, with draft legislation published in April 2025. This brings crypto exchanges, dealers, and stablecoin issuers under traditional financial services oversight.

The regulatory approach aligns more closely with the United States than the EU’s Markets in Cryptoassets Regulation. UK authorities are extending existing financial regulations to crypto firms through phased implementation expected to be complete by 2026.

The first phase focuses on stablecoins while the second phase will expand to broader cryptoasset categories and activities. Key rules and requirements are already being implemented throughout 2025.

Cryptocurrency service providers will need to implement customer data collection systems and regular reporting procedures to avoid penalties. The compliance burden may increase operational costs for smaller exchanges and trading platforms.

Users trading on non-compliant platforms or failing to provide required documentation face direct financial penalties. The £300 fine structure creates clear incentives for voluntary compliance while generating revenue from non-compliant actors.

Chancellor Reeves acknowledged that recent policy reversals have been “damaging” but maintained that fiscal responsibility requires comprehensive tax collection.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?

21Shares XRP ETF Set to Launch on 1 December as ETF Demand Surges

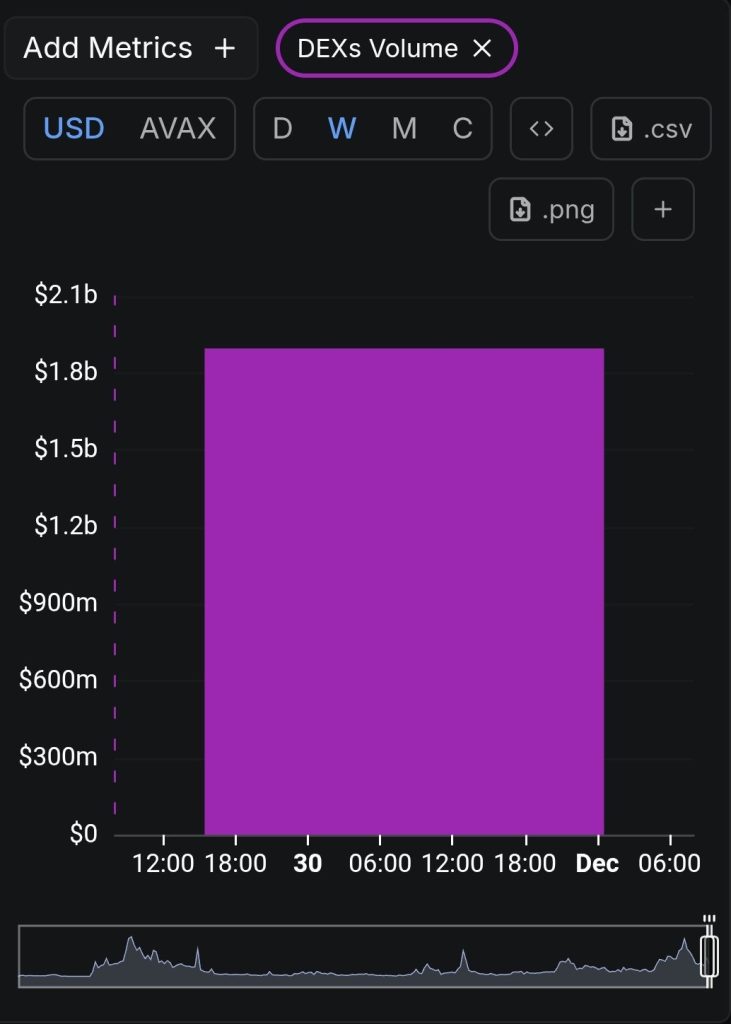

Avalanche (AVAX) Sees DEX Volume Surge as Price Rebounds From Key Support—Is a Major Breakout Near?

CZ Issues Market Warning as Crypto Exits Longest ‘Extreme Fear’ Streak