- Bitcoin holds above all major support levels, showing strong bullish structure.

- A dip to $113K may confirm the iHnS pattern and trigger upside momentum.

- $150K remains the target as the long-term trend stays intact and sentiment strengthens.

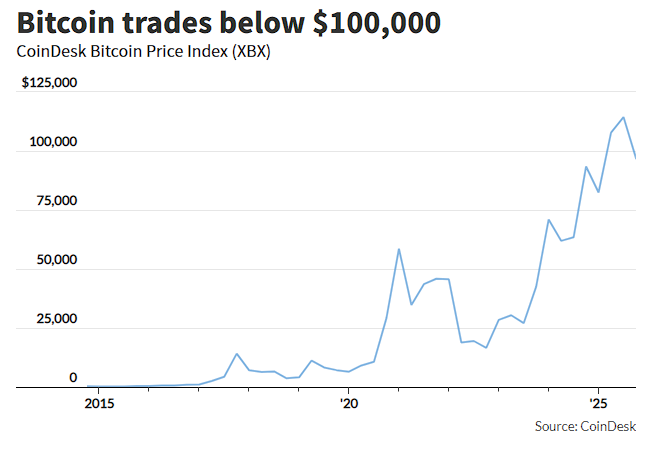

Bitcoin — BTC , isn’t breaking down—it’s building pressure like a coiled spring. While fear bubbles online, charts whisper a different story. The king of crypto still holds strong above all major support zones. What some call dips, others see as setups. Zooming out tells the truth: nothing has changed. $150,000 remains the prize. If prices wobble near $113,000, don’t panic. That move might strengthen Bitcoin’s foundation even more. The structure underneath this rally looks rock-solid and ready.

Healthy Markets Breathe—Bitcoin Is No Exception

Bitcoin hasn’t lost momentum; it’s simply inhaling before another sprint. Healthy uptrends need pauses. Those moments of doubt often fuel the next breakout. Think of it like a heartbeat—steady, rhythmic, and necessary for life. Pullbacks clear out weak hands and strengthen long-term trends. Right now, Bitcoin trades safely above all major support zones. The iHnS (inverse head and shoulders) pattern continues to hold firm. Each successful retest of that neckline adds muscle to the chart. This is not a fragile move—it’s a calculated build-up.

If the price of Bitcoin dips to the $112K–$113K range, it wouldn’t be a breakdown. That level marks the neckline of the iHnS structure. A retest there might feel nerve-racking, but it could be the last shakeout before liftoff. That green arrow pointing to support isn’t just a mark—it’s a warning to stay focused. Markets thrive on emotion. Fear always shows up before massive runs. That’s how sentiment flips. Bitcoin knows how to play this game. It fakes people out before real moves begin. The $113K region could act as a trampoline rather than a trapdoor.

$150K Still Looms—And Bitcoin Knows the Way

Traders must remain vigilant. A short-term drop wouldn’t destroy the trend—it would strengthen the pattern. The foundation still holds. Patterns like this don’t appear in weak trends. They develop in strength. They signal a deeper move is coming. Despite minor shakeouts, Bitcoin remains on course. The structure supports a continued push upward. Every time the neckline holds, confidence grows.

Traders return. Buyers step in. Momentum rebuilds. It’s not guesswork—it’s strategy. That $150K target still glows on the horizon. Bitcoin marches toward it one step at a time. Whether it climbs straight or zigzags, the destination hasn’t changed. Once the structure confirms fully, a powerful breakout could follow. History suggests that confirmed iHnS patterns trigger explosive upside. That’s no guarantee—but it’s a powerful clue.

Combine that with strong fundamentals, institutional interest, and reduced supply pressure, and you get a recipe for a major surge. For now, don’t let noise distract you. Stay focused on the chart. The supports haven’t cracked. The structure holds. Momentum hasn’t faded. All signs still point north. Let Bitcoin do what it does best—move in waves, trap the fearful, and reward the patient.