Today’s Preview

1、Sahara AI Data Services Platform Public Beta Launch: The public beta goes live on July 22, allowing anyone to participate in AI development and earn actual token rewards. The platform will also introduce new earning mechanisms and extra incentives from exclusive partners, open to global users.

2、zkLink Delays

Token

Unlock for Investors and Team: zkLink will postpone the token unlock for the core DAO team and advisors by 6 months, moving the schedule from January 22, 2024, to July 22, 2025.

3、Spark Ignition Airdrop Claim Deadline: Phase 1 airdrop claiming for Spark Ignition ends on July 22.

4、White House Digital Asset Policy Report: The White House Digital Asset Markets Working Group is expected to release its first report on crypto policy on July 22, including recommendations for regulation and legislation. Topics may include establishing a national digital asset reserve and ensuring fair access to banking services for crypto companies. Fed Chair Powell will deliver remarks at the regulatory capital framework discussion at 8:30pm Beijing time on July 22.

Macro & Hot Topics

1、Bit Origin Acquires 40.54 Million DOGE Worth $10 Million: NASDAQ-listed Bit Origin (BTOG) completed its first purchase of 40,543,745 DOGE at an average price of $0.2466, totaling around $10 million, less than a week after announcing the creation of a corporate DOGE treasury. Bit Origin has secured up to $500 million in equity and debt financing to support this strategy, believing that the current market environment favors DOGE's evolution towards DeFi. DOGE is recognized for its global liquidity and awareness.

2、Data: Over 90% of Ethereum Addresses in Profit, Highest Since Dec 2024: According to on-chain analytics platform Sentora (formerly IntoTheBlock), over 90% of ETH addresses are currently profitable, the highest since December 2024. Few addresses bought ETH above the current prices, indicating minimal on-chain resistance, with the main resistance zone near $4,000 where about 2.39 million addresses are still at a loss.

3、FTX Seeks Extension to Respond to Creditor Objections, $470M in Claims May Be Frozen: FTX's bankruptcy team is seeking a delay from the Delaware court to respond to over 90 objections to its proposal to pause payments to creditors in "restricted foreign jurisdictions," affecting $470 million in claims, with Chinese creditors accounting for 82% (~$380 million). FTX notes that repaying these creditors could trigger fines, personal liabilities, or criminal penalties, but many creditors oppose the proposal, fearing their claims may become worthless. There are still $1.4 billion in unresolved FTX claims.

4、Trump Media & Technology Group (DJT.O) Accumulates ~$2 Billion in Bitcoin-Related Assets: TMTG announced that it has accumulated about $2 billion in Bitcoin and Bitcoin-related securities, making up roughly two-thirds of its $3 billion liquid assets. The firm has also allocated $300 million for options strategies on Bitcoin-related securities and plans further acquisitions, with the intention to convert these options to spot Bitcoin as market conditions allow. The assets will generate income and may be used to acquire more crypto assets.

Market Updates

1、BTC Range-Bound, ETH Strong, Altcoins Rally, $429M in Liquidations Over 24H: Both longs and shorts saw significant liquidations.

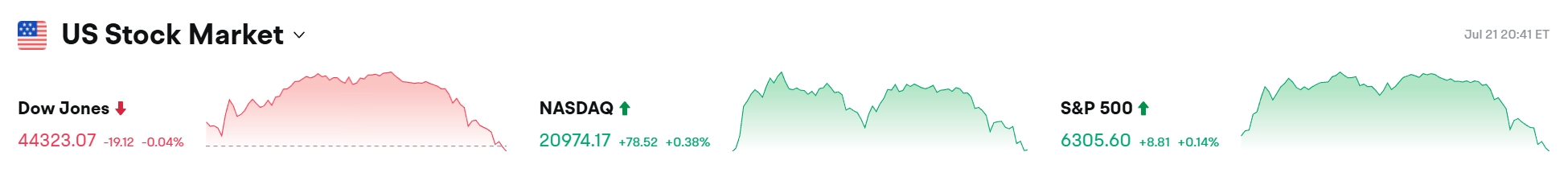

2、Investors Await Earnings Reports: NASDAQ and S&P 500 hit new highs. US Treasuries up, USD down, gold up ~1.5% to a monthly high.

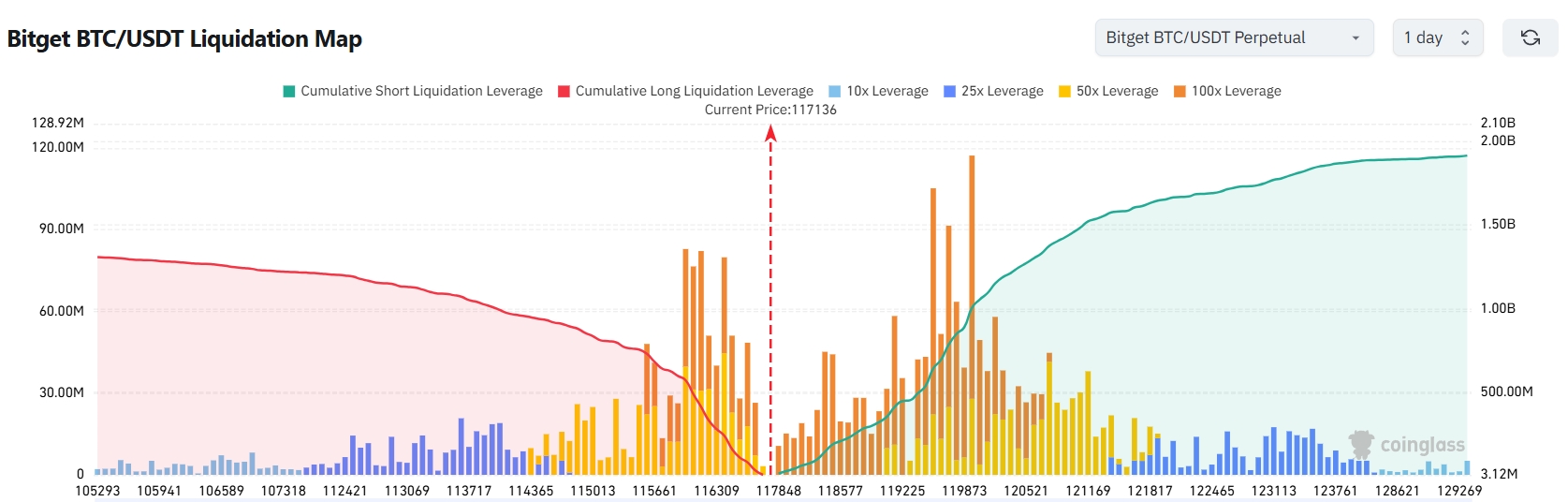

3、Bitget BTC/USDT Liquidation Map: If BTC drops 2k points to ~115,064 USDT, cumulative long liquidations could exceed $800 million; if BTC rallies 2k to ~119,064 USDT, cumulative short liquidation could exceed $450 million. Long liquidation exposure is much higher, so leverage control is advised to avoid mass liquidations.

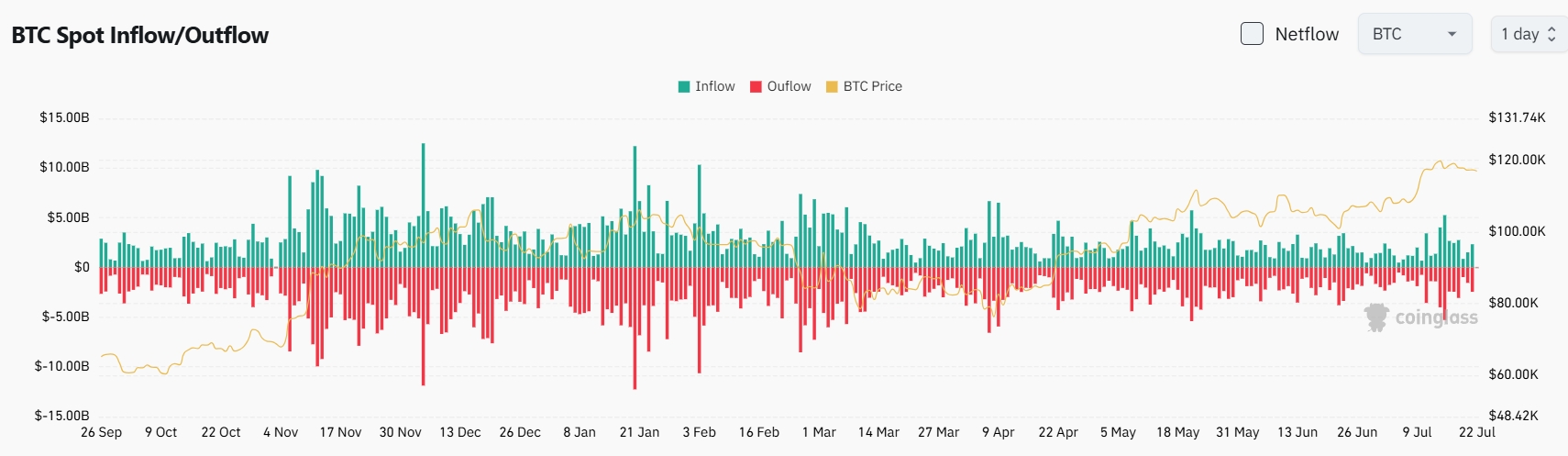

4、BTC Spot Net Outflow of $100 Million Over 24H: $2.3B inflows vs. $2.4B outflows.

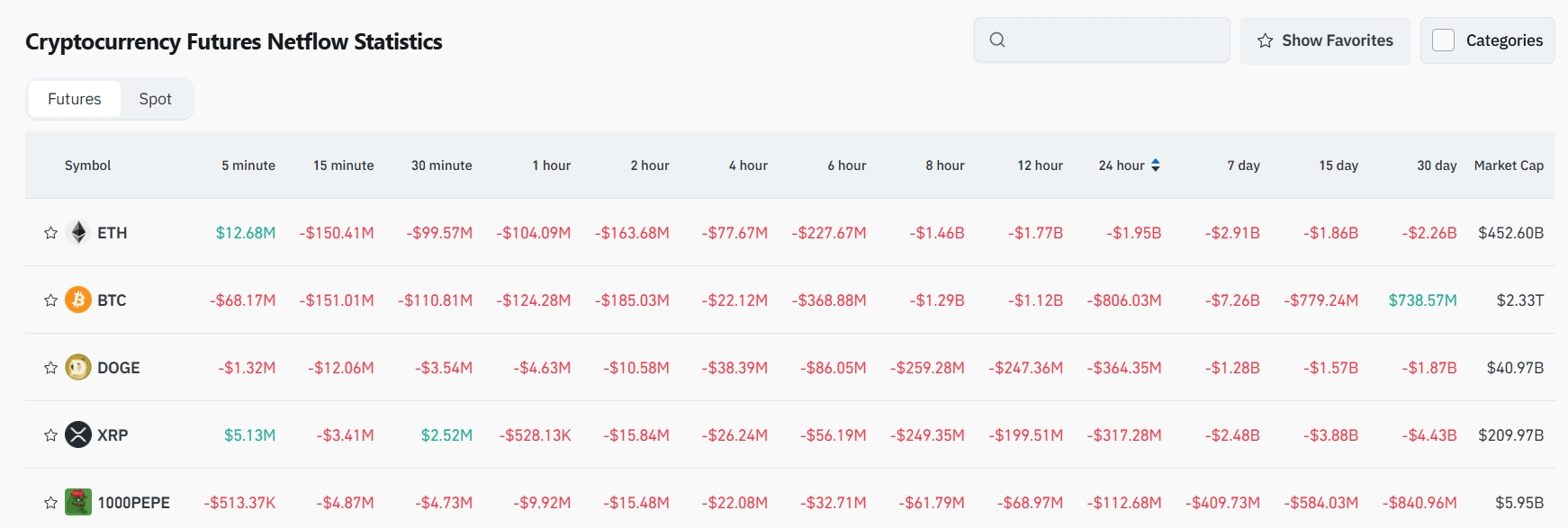

5、Perpetual Contracts Net Outflow Leads for $BTC, $SOL, $XRP, $ETH, $DOGE: Potential trading opportunities may emerge.

Institutional Views

1、QCP Capital: Altcoin season may have started; ETH staking spot ETF if approved will promote institutional ETH holdings.

Source

2、Fundstrat: Predicts Bitcoin could surpass $1 million in the next few years.

Source

3、CoinShares: Digital asset investment products saw $4.39 billion in net inflows last week — a new record.

Source

News Updates

1、White House official: The first White House report on crypto will be released by the end of this month.

2、US SEC Chair: ETH is not a security.

3、Morocco's Central Bank finalizes draft crypto asset bill.

4、Thailand SEC plans to ease crypto investor testing requirements.

Project Developments

1、XRP Market Cap Surpasses McDonald's, Rises to #83 Globally

2、Sophon: SOPH airdrop claiming ends July 28.

3、Data: Over 90% of ETH addresses in profit, a new high since December 2024.

4、ETHENA Announces $360M 'StablecoinX' PIPE Deal, $260M Foundation Buyback

5、Sonic Labs Co-Founder: All 1.866 million S tokens allocated for airdrop destroyed, worth ~$750,000.

6、Trump Media & Technology Group: Total Bitcoin reserves now $2B.

7、Mercurity Fintech (Nasdaq-listed): Received $200M strategic investment, launching Solana-focused treasury.

8、Two PUMP Institutions Dump 25.5B Tokens in a Week: Realized ~$40M in profits.

9、Dynamix (Listed Company): Plans to launch Ether Machine and hold over $1.5B in ETH.

10、Bit Origin Buys 40.54M DOGE for Corporate Treasury at ~$10M Cost

X Highlights

1、Guilin Chen: “Review of the ‘Atypical Bull Market’: Sentiment-led, BTC as template, alts tag along, balance is key”

This bull run is mainly a “capital-driven” BTC cycle led by US funds during monetary tightening. Altcoins merely follow in periodic oversold rebounds; the real potential still lies with BTC and ETH. BTC keeps breaking upwards despite negative news; ETH has mirrored BTC’s path, with fundamentals plus ETF flows ensuring smooth price action, while alts “just keep up.” In bull markets, small technical indicators often fail, with sentiment and liquidity driving moves. Over-waiting for pullbacks often leads to missing the trend. The best strategy is to balance offense and defense: ride major trends, book profits rationally, cut losses strictly, and avoid “moonshot” fantasies with small alts. Only make what you’re capable of — that's how to survive bulls and bears.

Original Post

2、Unipcs (aka 'Bonk Guy'): BonkFun Daily Tokens Minted Hit New Record, FOMO Loop Repeats On-chain

BonkFun hit a record of 28,316 tokens minted in 24 hours. Despite some predicting a cooling trend, BonkFun’s “token-machine” role is accelerating, and on-chain hype could surge more in the next season or mania. $BONK looks like a replay of the $HYPE FOMO story — both the on-chain cycle and platform influence are expanding, making it worth watching.

Original Post

3、Crypto_Painter: Full Breakdown of gKaito Logic: Real Contributions Over Bot Farming

gKaito’s core is using multidimensional data thresholds to eliminate low-quality, duplicate, and AI-generated accounts from the reward system. Only users with genuine on-chain activity, holdings, content influence, and real contributions can earn more gKaito and unlock higher-tier rewards — like X’s creator rewards that demand real engagement. The new model ensures rewards flow to loyal, genuine users, not to “farms” or bots, boosting fairness and efficiency. Everyone should ask: are you making valuable contributions, or just farming airdrops?

Original Post

4、Murphy: BTC Chip Structure Playbook Repeats, Rotation+Accumulation Drive New Highs

BTC’s current cycle is repeating the classic “pull-accumulate-pump-rotate” playbook. Each rise sees heavy accumulation in key zones, then after pullbacks, funds quickly lift BTC out of magnetic chip zones, with new buyers taking over at higher prices. Since mid-July, much low-price supply has rotated upwards, and consensus is building around $120,000. Despite local overheating and possible retracements, as long as big buyers continue to absorb high prices, BTC’s long-term uptrend remains intact. What’s different this time is strong hands keep stepping in at higher levels, supporting ever higher consensus ranges.

Original Post