Wall Street rallies as AI hype meets earnings reality

Stocks climbed toward record highs on Monday as investors looked past tariff tensions and focused on upcoming tech earnings.

The Dow rose 220 points (0.52%), while the S&P 500 and Nasdaq gained 0.58% and 0.75%, respectively.

Traders are piling into tech shares ahead of key results from Alphabet and Tesla, both set to report on Wednesday. Optimism is high—but so are valuations, drawing warnings from economists who see signs of a growing AI-fueled bubble. Apollo’s chief economist, Torsten Slok, said valuations for top S&P 500 firms, such as Nvidia, Microsoft, and Apple, now exceed their peaks from the dot-com era.

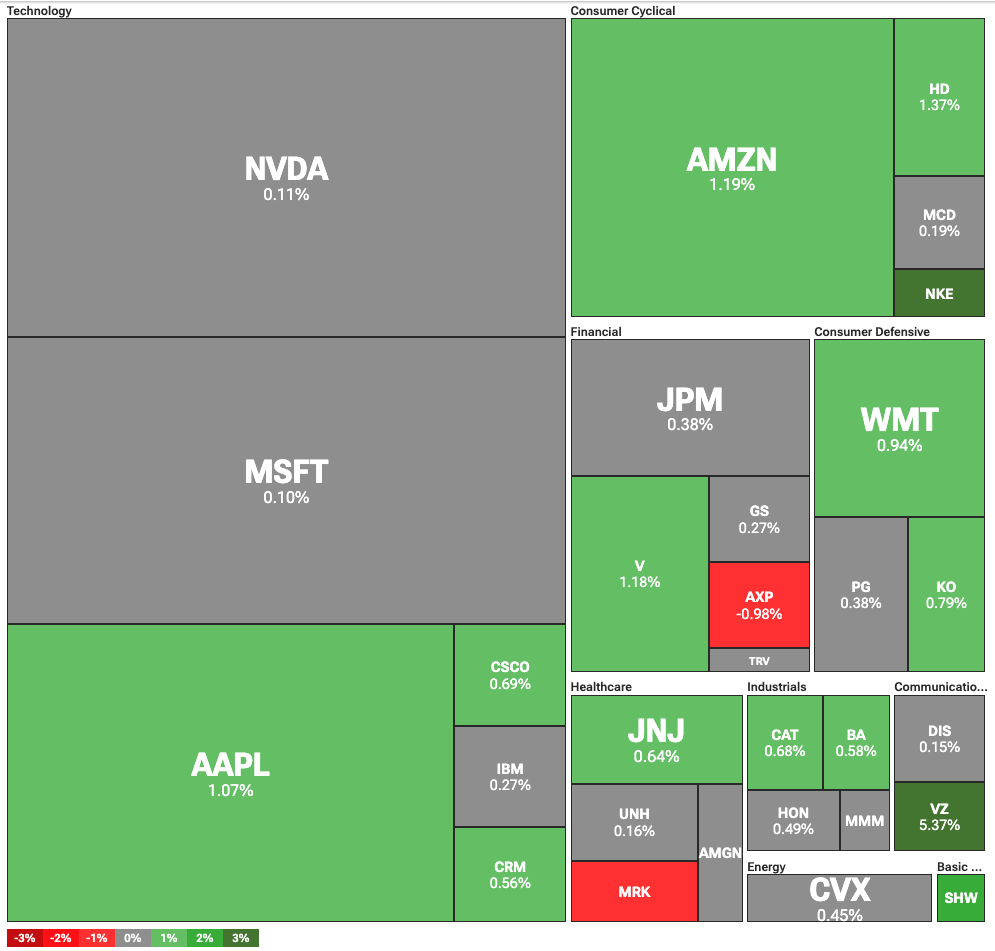

Dow Jones Industrial Average heatmap

Dow Jones Industrial Average heatmap

Traders are bidding up tech stocks ahead of key earnings reports. Notably, both Alphabet and Tesla will release their earnings on Wednesday, the first among the major tech giants this quarter. Strong results could validate the market’s optimism and high valuations.

Still, the market’s focus on the AI sector is increasingly drawing comparisons to the 1999 tech bubble. Torsten Slok, the chief economist at Apollo Global Management, stated that the AI bubble could be even worse than the dot-com bubble.

Slok explained that the top 10 companies in the S&P 500 are now more overvalued than they were in the 1990s. Specifically, he compared the P/E ratios of major firms such as Nvidia, Microsoft, and Apple, and found they were higher than at the absolute peak of the dot-com bubble.

EU readies response as trade war escalates

Moreover, traders remain concerned over U.S. trade policy, as tensions with the EU escalate. The European Union is preparing for a trade reprisal if it doesn’t get a deal with the U.S. “If they want war, they will get war,” WSJ quoted one German official referencing the trade negotiations.

This is a response to President Donald Trump’s escalating demands toward the EU and other trading partners. Earlier, Trump pushed for a 20% minimum tariff on EU goods, up from 15% proposed earlier. On the other hand, the EU aims to obtain a 10% baseline tariff, with special consideration for certain industries.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve officials divided on December rate cut, at least three dissenting votes, Bitcoin's expected decline may extend to $80,000

Bitcoin and Ethereum prices have experienced significant declines, with disagreements over Federal Reserve interest rate policies increasing market uncertainty. The mainstream crypto treasury company mNAV fell below 1, and traders are showing strong bearish sentiment. Vitalik criticized FTX for violating Ethereum’s decentralization principles. The supply of PYUSD has surged, with PayPal continuing to strengthen its presence in the stablecoin market. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

"Sell-off" countdown: 61,000 BTC about to be dumped—why is it much scarier than "Mt. Gox"?

The UK government plans to sell 61,000 seized bitcoins to fill its fiscal gap, which will result in long-term selling pressure on the market.

A $500,000 lesson: He made the right prediction but ended up in debt

The article discusses a trading incident on the prediction market Polymarket following the end of the U.S. government shutdown. Star trader YagsiTtocS lost $500,000 by ignoring market rules, while ordinary trader sargallot earned more than $100,000 by carefully reading the rules. The event highlights the importance of understanding market regulations. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Vitalik's "Can't Be Evil" Roadmap: The New Role of Privacy in the Ethereum Narrative

While the market is still chasing the ups and downs of "privacy coins," Vitalik has already placed privacy on the technical and governance roadmap for Ethereum over the next decade.