Research Report|Treehouse Project Overview & $TREE Token Valuation

I. Project Introduction

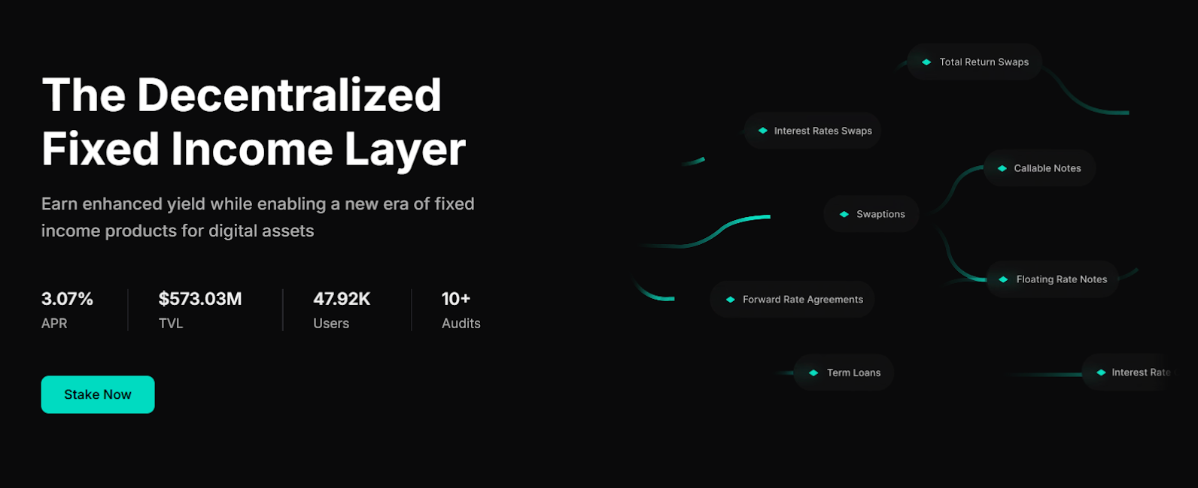

Treehouse is a DeFi protocol focused on the on-chain fixed-income market. Its core revolves around two innovative asset types: tAssets (e.g., tETH) and DOR (Decentralized Offered Rate). Users can supply ETH or major liquid staking tokens (LSTs) into the protocol and receive tAssets, while simultaneously providing liquidity to support the DOR consensus mechanism. The aim is to drive standardized on-chain interest rate benchmarks, increasing transparency and reference value in the Ethereum staking market.

Structurally, Treehouse draws inspiration from traditional finance's benchmark rate formation. DOR is not generated by a single oracle but by a panelist-submission process, with Delegators staking and voting on rates to build consensus. The agreed rates (such as TESR — Treehouse Ethereum Staking Rate) are published regularly on-chain. This system is naturally suited to support on-chain interest rate derivatives (such as FRAs, Forward Rate Agreements), giving DeFi an equivalent to LIBOR or SOFR as a reference benchmark.

For security, Treehouse has been audited by top firms (Trail of Bits, Sigma Prime, WatchPug, Fuzzland), is backed by an insurance fund, and has a TVL of over $573 million with nearly 50,000 active users—clear proof of market trust and protocol robustness.

On the token layer, TREE is used for incentives, governance, and utility burn. Panelists must stake TREE to report rates; contracts querying DOR pay TREE fees; DAO earnings cycle back as rewards based on reporting accuracy. TREE also underpins DAO ecosystem grants, developer rewards, and airdrops, forming a fairly robust value loop. Tokens vest over 48 months, with >45% directed to incentives and long-term ecosystem support.

Overall, Treehouse is building a foundational network for the DeFi fixed-income market—not just another staking optimizer, but one with "on-chain interest rate standards" and "native yield derivatives" at its core. Its potential for future expansion is strong, especially as RWA, on-chain treasuries, and rates markets evolve quickly.

II. Project Highlights

-

On-Chain Rate Benchmark — Filling DeFi's Fixed Income Gap

Treehouse introduces the first decentralized consensus rate (DOR), launching TESR (Treehouse Ethereum Staking Rate) as an on-chain equivalent to government yield curves or lending benchmarks. Its panelist-vote structure more accurately reflects real yield expectations on ETH staking, enabling construction of on-chain FRAs and other fixed-income products. -

LST 2.0 — Yield Stacking + Unified Liquidity + Enhanced Security

Unlike traditional single-yield staking, Treehouse’s LST 2.0 gives users triple-yield stacking: basic LST APY, Market Efficiency Yield via rate arbitrage, and incentive tokens via Restaking Points and Nuts. tETH also unifies liquidity across the rate market, increasing both protocol security and DOR's crypto-economic integrity. -

Complete TREE Token Design — Strong Incentive Governance Alignment

TREE is the protocol’s core functional and governance token, covering everything from panelist collateral to query fees to incentive rewards. Token rewards are distributed via a consensus/accuracy mechanism, introducing game theory to rate-setting. The linear four-year unlock schedule, with 20% community, 10% ecosystem fund, and nearly 6% set aside for future airdrops, is structured for long-term alignment. -

Security-First Setup: Multi-Audit + DAO Insurance Fund

Treehouse is audited by Trail of Bits, Sigma Prime, Fuzzland, WatchPug, and has a HackenProof bug bounty and dedicated insurance fund. Segregated roles for data sources (Panelists/Operators/Referencers) reduce manipulation and bias, supporting long-term, robust DOR operation.

III. Valuation Outlook

Treehouse is a pioneer in decentralized rate benchmarking, introducing on-chain interest rate curves (DOR) to enable widespread fixed-income and structured product deployment. With tETH and TESR live, $573M TVL, and ~50,000 users, TREE will launch its token via ICO after mainnet.

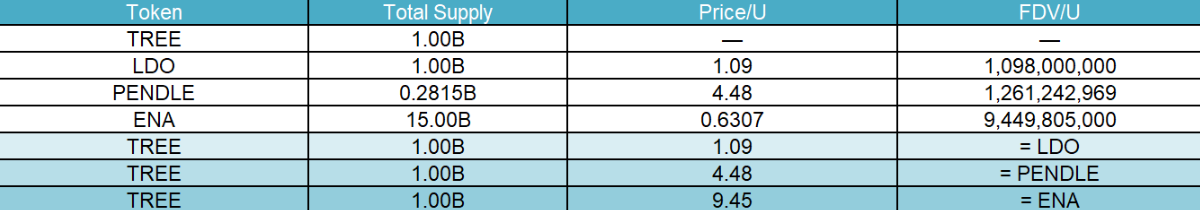

TREE’s total supply is 1 billion. Initial price and fully diluted valuation (FDV) remain undisclosed, but as a hybrid of Lido (LST ecosystem), Pendle (yield derivatives), and Ethena (structured yield), market comparables offer a basis for valuation mapping. Projects in peer ranges (FDV) set reference points for TREE’s potential.

IV. Tokenomics

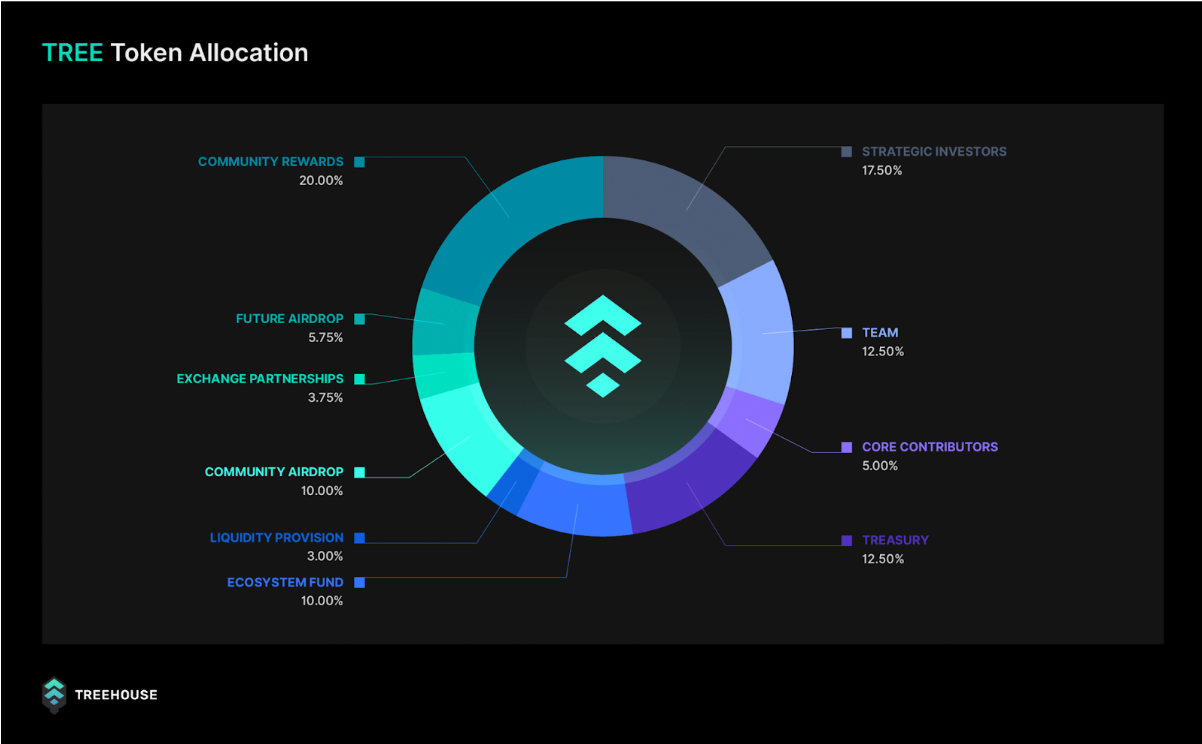

Total Supply: 1,000,000,000 TREE

Allocation:

- 20% Community Rewards (user incentives, governance, staking)

- 17.5% Strategic Investors (seed, series A, private rounds)

- 12.5% Core Team (multi-year vesting)

- 12.5% DAO Treasury (upgrades, partnerships, liquidity)

- 10% Initial Community Airdrop (early users, testers, contributors)

- 10% Ecosystem Fund (developer, hackathons, DOR integrations)

- 5% Core Contributors (research, protocol design, outside team)

- 5.75% Future Airdrops (adoption promotion)

- 3.75% Exchange Partnerships (listing rewards, liquidity)

- 3% Liquidity Pool Incentives

Utility:

- Participation Staking Rewards:

TREE is used for on-chain query fees, incentivizing Panelists/Delegators, and as the staked asset for reporting—guaranteeing consensus accuracy and Sybil resistance. - Governance:

TREE holders vote on DOR parameters, incentives, product updates, and DAO proposals. - Data Query Fees Buybacks:

Contracts referencing DOR/pay a TREE fee; ~25% of protocol revenue is committed to repurchasing $TREE, ensuring a value loop. - Ecosystem Growth Funding:

TREE is used for partnership grants, RWA onboarding, and new product launches, expanding Treehouse’s network effect.

V. Team Funding

Team:

Founded in 2021 by Brandon Goh (ex-Treehouse Finance CEO, digital asset analytics), Ben L. (chief growth strategist, market/ecosystem leader), Bryan Goh (ex-PE fund, TradFi and RWA expert), and tech head Thu Như Anh (built DOR and tAssets). The founding team spans finance, protocol design, and on-chain data engineering, pushing for rate-centric DeFi foundation.

Funding:

Latest: Series A (April 2025) at $400M valuation (amount undisclosed), Investors include MassMutual Ventures, Guy Young, Darius Sit, Jordi Alexander, Matthew Tan, Michael Ashby, and Rich Teo. Seed round (March 2022): $18M from Y2i Labs, Jump Capital, Mirana Ventures, Wintermute, Global Founders Capital, Do Kwon, etc. Backing spans L1/L2s, trading, analytics, and funds—ensuring broad strategic alignment.

VI. Risk Notices

- Adoption Uncertainty:

While Treehouse’s on-chain rate standards (e.g., TESR) are well-structured, the fixed-income DeFi market is early stage. There’s no guarantee major protocols will adopt DOR or a durable network effect will emerge quickly. - Ecosystem Participation:

Treehouse’s system relies on meaningful involvement from Operators, Referencers, devs, and integrated protocols. If incentive design lags or DeFi partners are slow to adopt, ecosystem growth may stall.

VII. Official Links

- Website: https://www.treehouse.finance/

- Twitter: https://x.com/TreehouseFi

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Truck transport employment remained unchanged in December, marking the lowest level since 2021

EUR/USD closes the week around 1.1640, recording a 0.7% decline as the Dollar remains strong

World’s biggest custodian bank BNY will provide tokenized deposit services to institutional clients

Insiders Say DeepSeek V4 Will Beat Claude and ChatGPT at Coding, Launch Within Weeks