- PROVE leads the market with a massive volume spike and sharp price gain, signaling strong momentum and chart dominance.

- ether.fi gains 5.59% while maintaining strong trading activity and a wide distribution of over 133,000 holders.

- MemeFi grabs attention with the biggest volume spike of the day, driving a 173.93% rise in market cap despite price pullback.

Succinct (PROVE), ether.fi (ETHFI), and MemeFi (MEMEFI) are among the top gainers today, driven by explosive trading volume and market momentum. These digital assets delivered strong price action, with sharp increases in volume and significant changes in market cap. Each token is responding to renewed buying activity, and PROVE is currently leading this surge in the DeFi landscape .

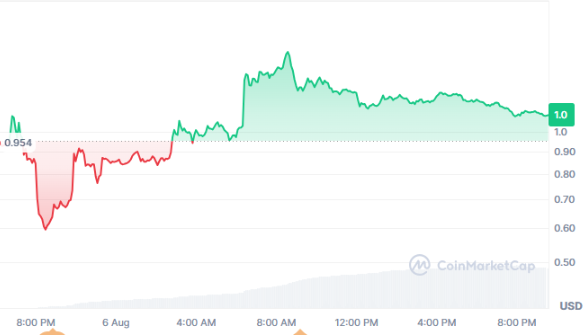

PROVE Leads the Surge with 17.68% Gain and Billion-Dollar Volume

PROVE is showing dominant momentum in the market, climbing 17.68% in a single session to trade at $1.09. The 24-hour trading volume spiked to $1.38 billion, a sharp 1192.07% increase compared to the previous session. As a result, its market cap rose over 61% to $213.05 million, pushing PROVE into top gainer territory.

With 195 million tokens circulating out of a 1 billion supply cap, PROVE maintains scarcity while supporting strong activity. The volume-to-market cap ratio surged past 652%, indicating rapid buying interest relative to market capitalization. This sharp increase suggests that liquidity remains healthy and continues to support price movements in favor of buyers.

The PROVE token has gained attention across exchanges due to its consistent upward trend. It maintained a price above key levels after its breakout and held firm through minor pullbacks. This behavior highlights sustained demand and further supports PROVE as one of the leading gainers in the current session.

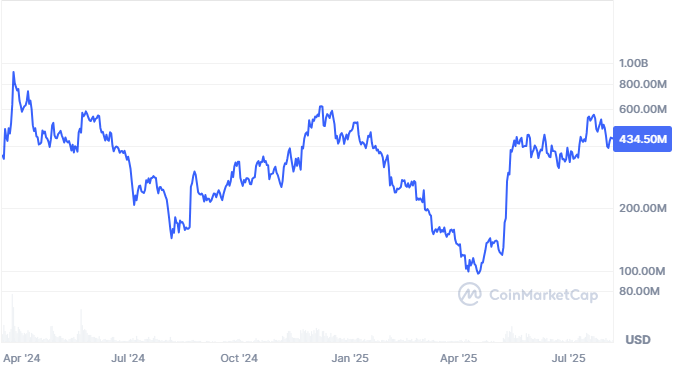

ETHFI Rebounds with Steady Gains and Strong Holder Base

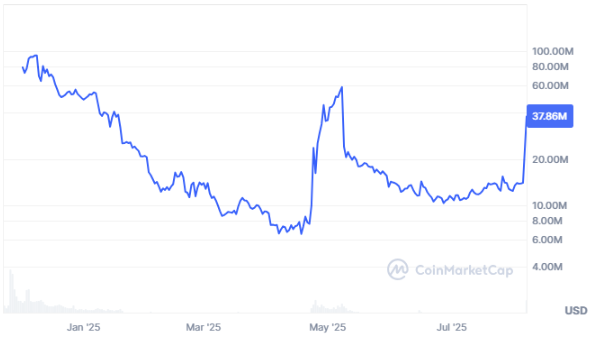

There was a huge increase in the daily volume, with MemeFi (MEMEFI) enjoying an overnight percentage increase of 3067 percent to $183.3 million. It is trading at $0.003766, a decrease of 35.94 percent of the all-time high price. Nevertheless, with a rise in the market cap by 173.93 percent to $37.66 million, it displayed robust market drive and effect.

The ETHFI token has 421.02 million coins in circulation, nearing its full 1 billion supply. It has maintained a wide distribution, with over 133,000 holders recorded across networks. This broad holder base contributes to consistent participation and trading engagement.

Market interest continues to grow as ETHFI’s fundamentals and protocol activity stay active within the DeFi sector. Its fully diluted valuation remains at $1.03 billion, reflecting investor confidence in long-term growth. The token’s recent rebound positions it to regain momentum and strengthen its market structure.

MEMEFI Posts Volume Explosion and Reclaims Market Cap

MemeFi (MEMEFI) experienced a massive surge in daily volume, reaching $183.3 million—a 3067% increase in 24 hours. Its price currently sits at $0.003766, reflecting a 35.94% decline from its all-time high. However, the market cap grew by 173.93% to $37.66 million, showing powerful market momentum and engagement.

MEMEFI’s entire 10 billion token supply is now circulating, which increases activity but removes any supply shock risk. The volume-to-market cap ratio stands at over 476%, indicating a surge in transactional interest. This spike aligns with broader trends in meme tokens regaining traction across the DeFi space.

Momentum-Driven Trading Pushes Top Tokens Forward

The top gainers today, PROVE, ETHFI, and MEMEFI, share a common pattern of increasing volume, surging market caps, and renewed interest. These movements reflect a wider shift in sentiment across the DeFi and meme token spaces. As PROVE maintains its breakout, it continues to set the pace for volume-led rallies.

Each token responded to different catalysts, but all benefited from rising liquidity and renewed activity. ETHFI leveraged its user base and steady platform presence to recover lost ground and regain upward movement. Meanwhile, MEMEFI’s volume explosion reinforced short-term interest, pushing it higher despite long-term drawdowns.