HBAR Price Consolidation May Continue As Outflows Reach 2-Month High

HBAR struggles within a range as outflows hit 2-month high; price could fall to $0.230 if selling pressure intensifies.

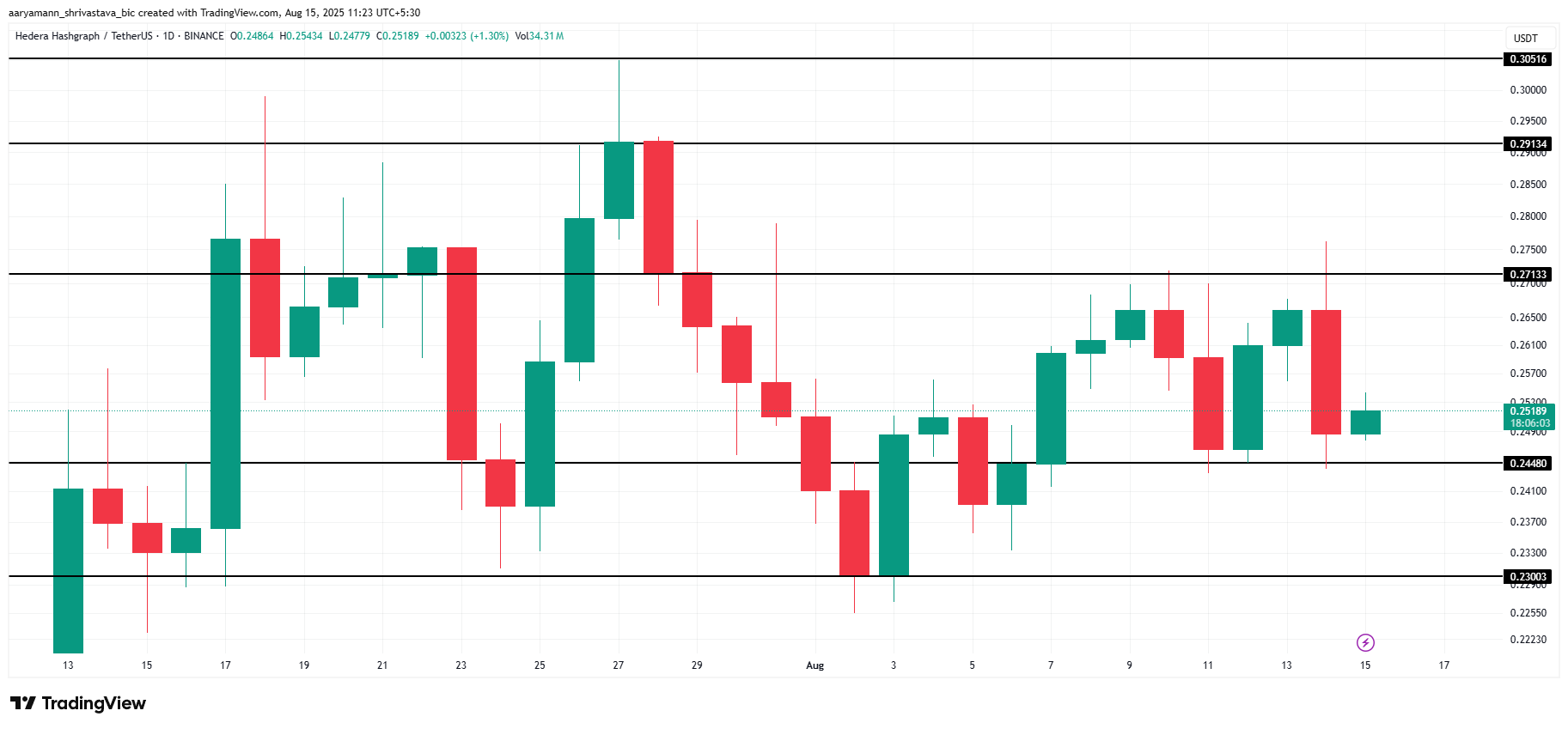

HBAR has been experiencing sideways movement recently, remaining rangebound between $0.244 and $0.271.

The price has struggled to break out, largely due to mixed cues coming from both the broader market and investor sentiment. The altcoin’s inability to show decisive price action reflects uncertainty among holders.

Hedera Investors Are Selling

The Chaikin Money Flow (CMF) indicator shows that investor sentiment toward HBAR is currently bearish. The CMF has reached a two-month low, signaling that outflows are dominating the asset. This decline in the CMF suggests that many HBAR holders are selling their positions as the price consolidates, pushing investors to secure their gains.

As the price continues to range, the selling pressure has intensified, causing concern among investors. With the outflows continuing to rise, it appears that the bearish sentiment is taking hold.

HBAR CMF. Source:

TradingView

HBAR CMF. Source:

TradingView

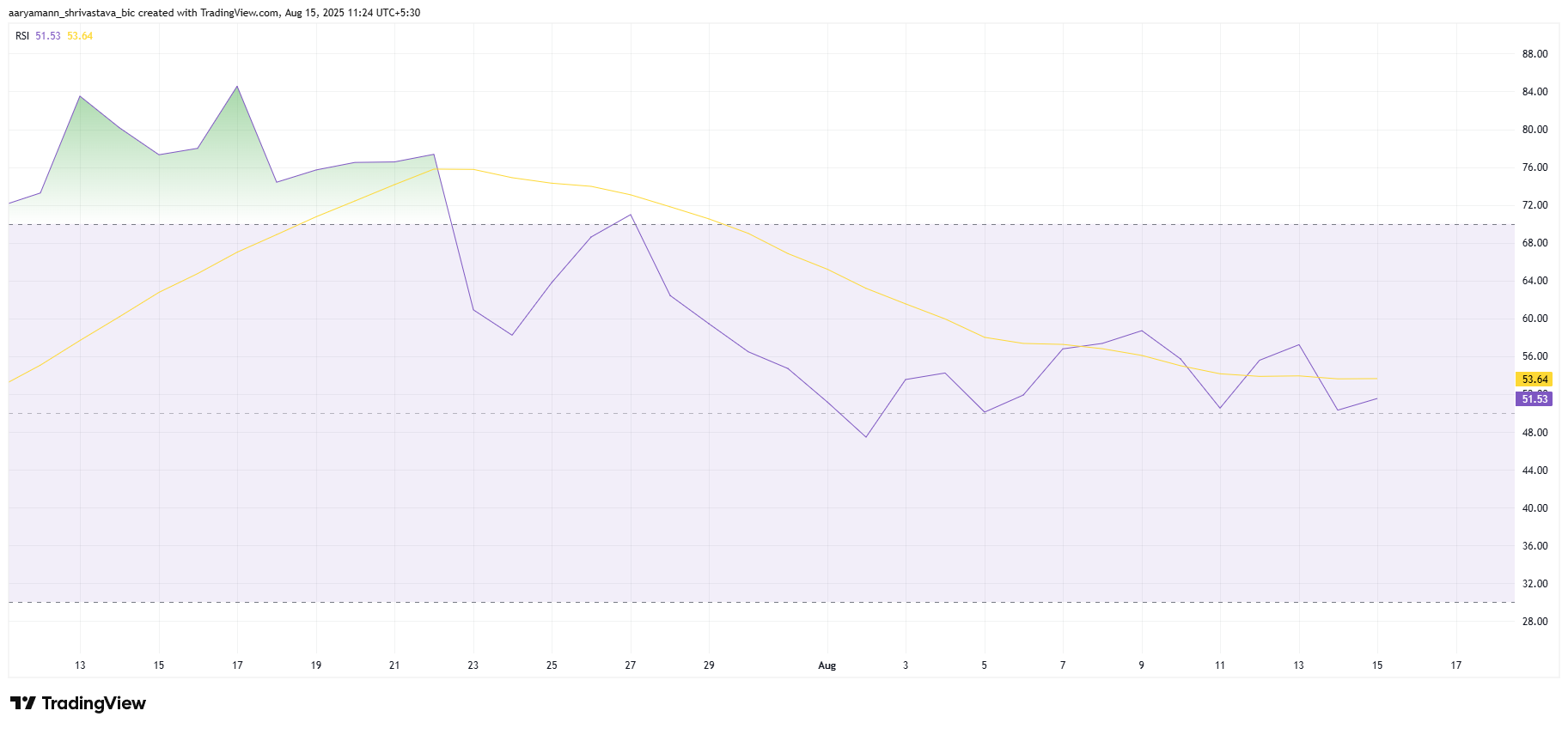

Despite the bearish trend in the CMF, the relative strength index (RSI) for HBAR remains above the neutral 50.0 mark. This indicates that, overall, the market sentiment is still somewhat bullish, with positive broader market cues supporting the altcoin. While investor behavior has been leaning toward selling, the RSI suggests there is still potential for upward movement.

The market momentum for HBAR is largely influenced by external factors, with the altcoin being supported by the overall trend in the cryptocurrency market. As long as the RSI remains above the neutral threshold, there is still a chance for HBAR to break out.

HBAR RSI. Source:

TradingView

HBAR RSI. Source:

TradingView

HBAR Price Is Stuck

HBAR’s price is currently at $0.251, trapped within the range of $0.244 to $0.271. The mixed market cues, including the bearish CMF and the relatively neutral RSI, suggest that HBAR could continue consolidating.

This sideways movement is expected to persist unless there is a major shift in investor sentiment or a market catalyst that could push the altcoin in either direction.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

If outflows intensify and HBAR falls below its $0.244 support level, the bearish case could become more likely. In such a scenario, the price may drop further to $0.230, invalidating the current bullish-neutral outlook and signaling a deeper correction for HBAR.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Institutional Buying Surges: 8-Day Bullish Streak Signals Major Market Shift

Cardano Price Prediction: ADA Recovery Continues but Confirmation Still Eludes Bulls

USDJPY Technical Analysis: Attention shifts to Japan's wage figures and US Non-Farm Payrolls