Top crypto protocols generate $1.2B in revenue after recording 9.3% monthly growth

The 10 highest-grossing crypto protocols generated $1.2 billion in revenue during the 30 days ending Aug. 28, representing a 9.3% increase from the previous month’s total of $1.1 billion per DefiLlama data.

Ethena led the percentage gains with a 243% revenue surge, jumping from $9.46 million to $32.48 million, as its synthetic dollar USDe captured market share from traditional stablecoins.

The protocol’s revenue expansion of $23 million represented the second-largest absolute increase among tracked applications.

Pump.fun posted the second-highest percentage growth at 79%, with revenue climbing from $22.55 million to $40.39 million.

The Solana-based memecoin launchpad benefited from continued speculation in newly created tokens, generating an additional $17.84 million in monthly fees.

Stablecoin dominance continues

Tether maintained market leadership despite modest 2.9% growth, with revenue rising from $614.79 million to $632.91 million.

The stablecoin issuer’s $18.12 million increase represented the largest absolute gain among protocols, reinforcing its position as the sector’s primary revenue generator.

Circle ranked second with revenue growing 4.5% from $197.59 million to $206.4 million, adding $8.81 million in monthly fees. Combined, the two stablecoin issuers accounted for 70% of total crypto protocol revenue during the tracking period.

Hyperliquid recorded substantial growth with revenue expanding 25.9% from $82.86 million to $104.3 million. The decentralized perpetual exchange captured an additional $21.43 million as trading volumes increased across its platform.

Mixed performance across sectors

Sky Protocol achieved 77.5% revenue growth, rising from $10.1 million to $17.93 million. Jupiter reported 23.5% growth, with revenue increasing from $21.95 million to $27.1 million, driven by activity in the Solana ecosystem.

Tron recorded moderate gains of 11.6%, with revenue climbing from $56.21 million to $62.73 million. Phantom wallet generated $22.82 million, up 9.5% from $20.84 million in the previous period.

Axiom provided the sole negative performance among top protocols, with revenue declining 13.9% from $62.11 million to $53.46 million. The cross-chain infrastructure provider lost $8.65 million in monthly fees, the only one in the group with a negative result.

Revenue growth occurs alongside the broader crypto market recovery, with protocols benefiting from increased user activity and higher fee generation across decentralized finance applications and trading platforms.

The post Top crypto protocols generate $1.2B in revenue after recording 9.3% monthly growth appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana DEX Jupiter Unveils JupUSD, Returning Native Treasury Yield to Users

ChatGPT suddenly announces ads, $8 subscription plan can't avoid them

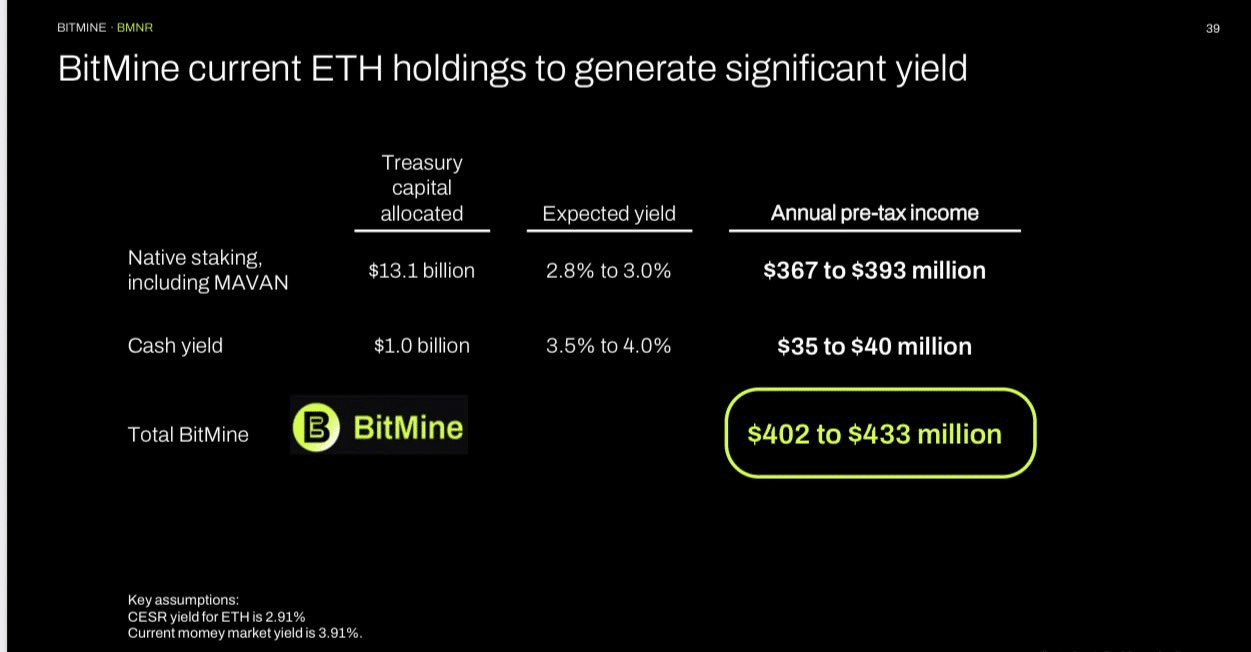

From $3.5K to $12K? Here’s why BMNR’s Ethereum forecast makes sense