Argentina's Milei LIBRA Scandal and the Risks of Politicized Crypto Markets

- Argentina's President Milei endorsed a Solana-based memecoin 23 minutes after its launch, triggering a $4.50 price surge before a $251M investor collapse. - Project founder Hayden Davis executed a $87M liquidity withdrawal hours later, admitting to "sniping" tactics typical of memecoin scams. - The scandal sparked impeachment calls, a 5% stock market drop, and highlights political risks in emerging market crypto ecosystems. - Argentina's crypto sector now faces reputational damage, with global investors

The $LIBRA cryptocurrency scandal, which erupted in February 2025, has exposed the volatile intersection of politics and emerging market crypto ecosystems. Argentine President Javier Milei’s endorsement of a Solana-based memecoin—a project launched just 23 minutes before his tweet—triggered a meteoric price surge from $0.000001 to over $4.50 within minutes [1]. However, the token’s collapse shortly thereafter, driven by liquidity withdrawals from wallets linked to its developers, left 86% of investors with losses totaling $251 million [3]. This episode underscores how political influence can distort crypto markets, amplifying risks for investors in emerging economies.

The scandal’s mechanics reveal a classic rug-pull scheme. Hayden Davis, CEO of Kelsier Ventures, who had previously met with Milei, controlled 70% of the token’s supply and executed a $87 million liquidity withdrawal within hours of the endorsement [3]. Davis later admitted to employing “sniping” strategies akin to other memecoin scams, netting $113 million in profits [2]. Milei, who deleted his promotional post hours later, claimed ignorance of the project’s details, but the incident has sparked impeachment calls and a 5% drop in Argentina’s stock market [3].

This crisis highlights a critical risk for emerging market crypto exposure: political instability. Milei’s endorsement, framed as a “private initiative” to stimulate Argentina’s economy, blurred the lines between public policy and speculative hype. Such actions erode investor trust and create regulatory ambiguity, particularly in economies already grappling with hyperinflation and currency controls [1]. The scandal has drawn international scrutiny, with investigations ongoing in both Argentina and the United States [2].

For investors, the $LIBRA affair serves as a cautionary tale. Emerging market crypto projects often lack the transparency and oversight of developed markets, making them fertile ground for exploitation. Political leaders’ endorsements can artificially inflate asset prices, creating bubbles that collapse when insider profits are realized. This dynamic is exacerbated in countries with weak institutional frameworks, where accountability mechanisms are either absent or easily circumvented [3].

The broader implications for emerging markets are profound. Argentina’s crypto sector, once seen as a potential lifeline for its struggling economy, now faces reputational damage and regulatory backlash. The scandal may deter foreign investment and delay much-needed reforms in Argentina’s financial system. For global investors, the lesson is clear: political instability is not just a macroeconomic risk—it is a systemic threat to crypto markets, where hype and power can combine to create catastrophic outcomes.

**Source:[1] $LIBRA: the timeline of a crypto scandal that's rocking the milei government [2] $Libra cryptocurrency scandal [3] LIBRA Meme Coin Scandal: Political Fallout, Investor Losses

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana DEX Jupiter Unveils JupUSD, Returning Native Treasury Yield to Users

ChatGPT suddenly announces ads, $8 subscription plan can't avoid them

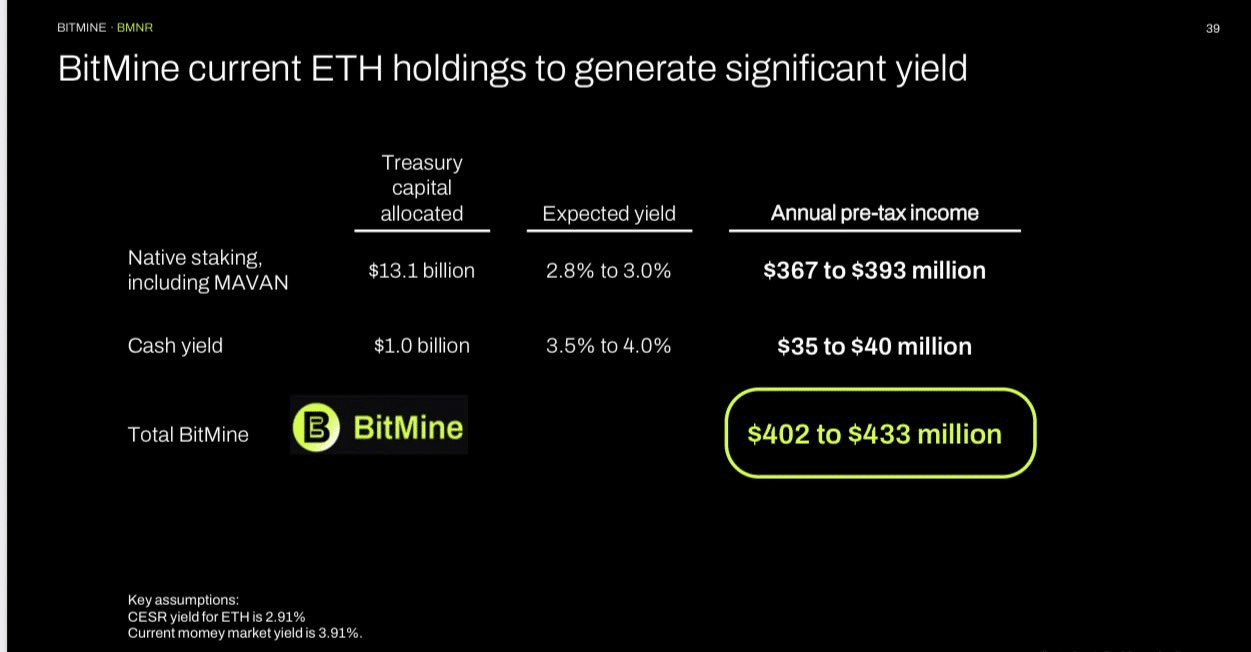

From $3.5K to $12K? Here’s why BMNR’s Ethereum forecast makes sense