Navigating the Fed's Dual Mandate in a Shifting Economic Landscape

- The Fed faces a 2025 dilemma: 2.7% inflation persists while unemployment stays near 4.2% historic lows. - Structural shifts show healthcare job growth (73,000 July jobs) and rising long-term unemployment (1.8M) threatening labor flexibility. - Investors must balance exposure to inflation-protected assets and growth sectors amid fragile labor markets and uncertain policy paths. - Shrinking labor participation (62.2%) forces consideration of wage-driven inflation risks and potential liquidity traps. - Stra

The Federal Reserve’s dual mandate—to achieve maximum employment and stable prices—has always been a balancing act. Yet, in mid-2025, the U.S. economy presents a paradox: inflation remains stubbornly above the 2% target, while unemployment hovers near historic lows. This tension demands a nuanced approach to asset allocation, one that accounts for both the Fed’s policy constraints and the structural shifts reshaping labor markets and price dynamics.

The Inflation-employment Tightrope

The 12-month U.S. inflation rate stood at 2.7% in July 2025, unchanged from June, with core CPI rising 0.3% month-on-month [1]. While this suggests a slight moderation compared to earlier in the year, the persistence of inflation—particularly in services and housing—indicates that price pressures are not yet fully under control. Meanwhile, the unemployment rate remains at 4.2%, a level consistent with the Fed’s estimate of full employment [1]. However, the labor market is showing signs of fragility: the three-month average job growth has fallen to 35,000, down from 258,000 in May and June after revisions [3].

This duality—modest inflation and low unemployment—creates a policy dilemma. A tightening bias risks exacerbating labor market weakness, while accommodative policies could prolong inflationary pressures. The Fed’s recent decision to pause rate hikes reflects this caution, but the path forward remains uncertain.

Structural Shifts and Asset Allocation

The evolving economic landscape requires investors to rethink traditional asset allocation strategies. Three key trends demand attention:

Sectoral Divergence in Employment: The health care and social assistance sectors added 73,000 jobs in July alone, accounting for nearly all net job growth [1]. This suggests a structural shift toward labor-intensive industries, which may benefit equities in these sectors but pose risks to bond markets if wage growth outpaces productivity.

Long-Term Unemployment: The number of long-term unemployed individuals rose to 1.8 million in July, representing 24.9% of the total unemployed [1]. This trend could signal a loss of labor market flexibility, potentially leading to wage inflation that outpaces productivity gains—a classic recipe for stagflation.

Labor Force Participation: The 62.2% participation rate reflects a decline over the past year, driven by demographic shifts and persistent underemployment [1]. A shrinking labor pool may force the Fed to tolerate higher inflation to avoid pushing the economy into a liquidity trap.

Strategic Implications for Investors

Given these dynamics, asset allocators should prioritize flexibility and hedging against macroeconomic uncertainty:

- Equities: Sectors with strong labor demand, such as health care and social services, may outperform. However, investors should remain cautious about valuations in growth stocks, which could be vulnerable to a sudden shift in monetary policy.

- Fixed Income: The Fed’s pause in rate hikes may support bond prices in the short term, but the risk of inflation persistence—particularly in services—suggests a tilt toward inflation-protected securities (TIPS) and shorter-duration bonds.

- Commodities and Alternatives: A prolonged period of low interest rates and wage-driven inflation could justify modest allocations to commodities, particularly energy and housing-related assets.

The Fed’s dual mandate is no longer a simple policy framework but a reflection of deeper structural challenges. Investors must navigate this complexity by balancing exposure to growth and inflation risks while maintaining liquidity to capitalize on emerging opportunities.

Source:

[1] Consumer Price Index Summary - 2025 M07 Results, [2] Current US Inflation Rates: 2000-2025, [3] Jobs and unemployment

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana DEX Jupiter Unveils JupUSD, Returning Native Treasury Yield to Users

ChatGPT suddenly announces ads, $8 subscription plan can't avoid them

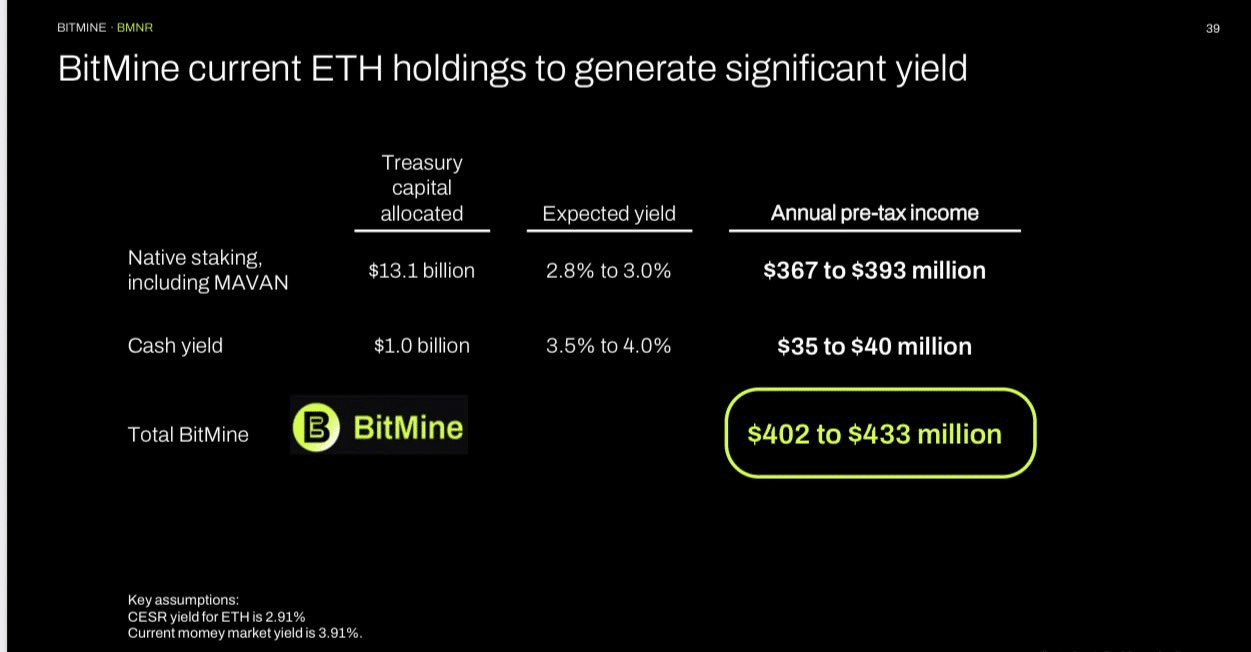

From $3.5K to $12K? Here’s why BMNR’s Ethereum forecast makes sense